Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

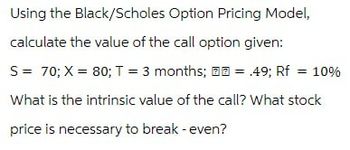

Transcribed Image Text:Using the Black/Scholes Option Pricing Model,

calculate the value of the call option given:

S = 70; X = 80; T = 3 months;

= .49; Rf = 10%

What is the intrinsic value of the call? What stock

price is necessary to break - even?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Suppose that the gamma of a delta-neutral portfolio of options on an asset is +11,000. What would be the impact on the portfolio of a sudden jump of +3 or -3 in the price of the asset (without any time passing). +49,500 and -20,000 +49,500 and +20,000 -49,500 and +49,500 +49,500 and +49,500 -20,000 and +20,000 EO O O O Oarrow_forwardi need the answer quicklyarrow_forwardplease give me answerarrow_forward

- What does it mean to assert that the delta of a call option is 0.7? How can a short position in 1,000 options be made delta neutral when the delta of each option is 0.7?arrow_forwardBlack-Scholes Model Use the Black-Scholes model to find the price for a call option with the following inputs: (1) current stock price is $32, (2) strike price is $37, (3) time to expiration is 3 months, (4) annualized risk-free rate is 7%, and (5) variance of stock return is 0.16. Do not round intermediate calculations. Round your answer to the nearest cent.arrow_forwardWhat is the put option premium given the following information? What would happen to the Put option premium if the risk-free rate significantly declined from its current level? Stock price $28.00 Strike price $35.00 Volatility 50% Dividend Yield 0.00 Time 0.50 Riskfree Rate 3.50%arrow_forward

- A call option will cost more today if I. the underlying asset's value in today's market is lower. II. its exercise price is higher. III. the stock's current value goes up. IV. its strike price goes down.arrow_forwardTopic: Option Pricing When computing, please do not round off. Only final answers must be rounded off to two decimal places Based on the Black-Scholes model, the price of a put option should be P2,800. If the underlying asset has a strike price of P60,000 and a market price of P58,500, how much is the extrinsic value of the option?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education