Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

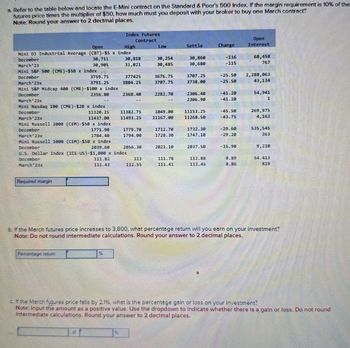

Transcribed Image Text:a. Refer to the table below and locate the E-Mini contract on the Standard & Poor's 500 Index. If the margin requirement is 10% of the

futures price times the multiplier of $50, how much must you deposit with your broker to buy one March contract?

Note: Round your answer to 2 decimal places.

Index Futures

Contract

Open

High

Low

Settle

Change

Open

Interest

Mini DJ Industrial Average (CBT)-$5 x index

December

30,711

38,818

30,254

30,860

March 23

30,905

31,821

30,485

30,680

-116

-115

68,458

767

Mini S&P see (CME)-$se x index

December

3759.75

SZOLLE

3676.75

3707.25

-25.50

March 23x

3791.25

3804-25

3707.75

3738.00

-25.50

2,288,063

43,134

Mini S&P Midcap 400 (CME)-$100 x index

December

2356.80

2368.40

2282.70

2306.40

-41-20

54.941

March 23x

2306.90

-41-20

Mini Nasdaq 100 (CME)-$20 x index

December

11328.25

11382.75

1049.00

11153.25

-45-50

269.975

March 23x

11437.00

11493.25

11167.00

11268.50

43.75

Mini Russell 2000 (CEM)-$50 x index

December

1771.90

1779.70

1712.70

1732.30

-29.60

March 23x

1784.40

1794.00

1728.30

-29-20

535.545

263

Mini Russell 1800 (CEM) $50 x index

December

2039.60

2056.30

2021.10

2837.50

16.90

9.210

U.S. Dollar Index (ICE US)-$1,000 x index

December

March 23x

111.82

111.43

111.78

111.41

54.413

819

Required margin

b. If the March futures price increases to 3,800, what percentage return will you earn on your investment?

Note: Do not round intermediate calculations. Round your answer to 2 decimal places.

Percentage return

c. If the March futures price falls by 2.1%, what is the percentage gain or loss on your investment?

Note: Input the amount as a positive value. Use the dropdown to Indicate whether there is a gain or loss. Do not round

Intermediate calculations. Round your answer to 2 decimal places.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Refer to the Mini-S&P contract in Figure 22.1. Assume the closing price for this day.a. If the margin requirement is 23% of the futures price times the contract multiplier of $50, how much must you deposit with your broker to trade the March maturity contract? (Round your answer to the nearest whole dollar.)Required margin depositb. If the March futures price increases to 2594.70, what percentage return will you earn on your investment if you entered the long side of the contract at the price shown in the figure? (Do not round intermediate calculations. Round your answer to 2 decimal places.)Percentage return on net investment%c. If the March futures price falls by 1%, what is your percentage return? (Negative amount should be indicated by a minus sign. Do not round intermediate calculations. Round your answer to 2 decimal places.)Percentage return on net investment%arrow_forwardThe margin requirement on the S&P 500 futures contract is 16%, and the stock index is currently 2,100. Each contract has a multiplier of $50 a. How much margin must be put up for each contract sold? Margin b. If the futures price falls by 1% to 2,079, what will happen to the margin account of an investor who holds one contract? (Input the amount as a positive value.) Margin account by c-1. What will be the investor's percentage return based on the amount put up as margin? (Negative value should be indicated by a minus sign. Round your answer to 2 decimal places.) Percentage return ed ok at rices c-2. What would be the current cash balance in the margin account? Cash balancearrow_forwardSuppose you buy one SPX call option contract with a strike of 2200. At maturity, the S&P 500 index is at 2218. What is your net gain or loss if the premium you paid was $14? (Input the amount as a positive value.)arrow_forward

- H3. Show proper step by step calculationarrow_forwardFutures Contracts | WSJ.com/commodities Metal & Petroleum Futures Contract Open High hi lo low Copper-High (CMX)-25,000 lbs.; $ per lb. Contract Open Open High hi lo low Settle Chg interest Open Coffee (ICE-US)-37,500 lbs.; cents per lb. Settle Chg interest Dec 194.00 205.55 192.95 204.05 10.05 129,6% March 22 196.95 208.35 195.80 206.90 10.10 70,796 Sugar-World (ICE-US)-112,000 lbs.; cents per lb. Oct 4.1500 4.2030 4.1500 Dec 4.1065 4.2030 4.0585 4.1885 40.1935 0.1035 0.0995 2,734 109,717 March 20.31 20.35 20.02 20.06 -.28 420,744 May 19.72 19.75 19.48 19.53 .23 156,809 Oct Gold (CMX)-100 troy oz.; $ per troy oz. 1754.30 1762.60 1748.50 Sugar-Domestic (ICE-US)-112,000 lbs.; cents per lb. 1757.00 1.70 Nov 1755.90 1764.30 1750.00 1757.70 1.40 4,163 1,093 Nov 37.00 37.01 37.00 37.00 -.05 1,265 March'22 36.00 36.01 36.00 36.00 -.10 2,819 Dec 1757.20 1765.20 1749.90 1758.40 1.40 407,321 Feb 22 1759.10 1766.40 1751.60 1760.10 1.60 46,135 Cotton (ICE-US)-50,000 lbs.; cents per lb. Oct Oct…arrow_forwardA trader creates a LONG STRADDLE for GBP/USD with a strike price of 1.2457. The call option premium on GBP is 0.017 USD. The put option premium is 0.022 USD. One option contract represents GBP 125,000. What is the net profit of the trader if GBP/USD = 1.2427 at expiry?arrow_forward

- Please show how to solve this CPT is currently trading at $120/share. You bought 3 CALL-option contracts on CPT with a strike price of $110 for $16 each. a. What will be your total $ and % gain/loss if CPT price is $120 at the expiration date?b. What will be your total $ and % gain/loss if CPT price is $140 at the expiration date?c. What will be your total $ and % gain/loss if CPT price is $125 at the expiration date?arrow_forwardConsider a hypothetical futures contract where the current price is $ 212. The initial margin requirement is $ 10 and the maintenance margin requirement is $ 8. You enter into long 20 contracts and meet all margin requirements, but do not withdraw any excess margin. B. Complete the table below and explain all deposited funds. Suppose the contract was purchased at the settlement price of that day, so there is no gain or loss at current market prices on the day of purchase. C. What is your total profit or loss by the end of Day 6?arrow_forwardanswer these questionsarrow_forward

- Using put-call parity, if the price of an At-the-Money Call option maturing in 1 day is $3.14, what is the price of an of an At-the-Money Put option maturing in 1 day (give an approximation)? A. $0.95 B. $2.86 C. $3.14 D.$3.26arrow_forwardPlease show step by step how to solve this CBE is currently trading at $120/share. You sold 8 PUT-option contracts on CBE with a strike price of $110 for $8 each. a. What will be your total $ and % gain/loss if WRE price is $130 at the expiration date?b. What will be your total $ and % gain/loss if WRE price is $115 at the expiration date?c. What will be your total $ and % gain/loss if WRE price is $100 at the expiration date?arrow_forwardThe stock index future contract involves buying and selling the stock index for a specified price at a specified date. How much will a contract price be if it involves the S&P SmallCap index with a current value of P200 times the index for 1700 points?* a. P340,000 b. P314,000 c. P8,500 d. P342,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education