Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN: 9781285595047

Author: Weil

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

7

10

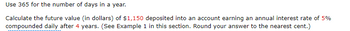

Transcribed Image Text:Use 365 for the number of days in a year.

Calculate the future value (in dollars) of $1,150 deposited into an account earning an annual interest rate of 5%

compounded daily after 4 years. (See Example 1 in this section. Round your answer to the nearest cent.)

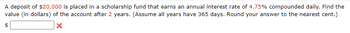

Transcribed Image Text:A deposit of $20,000 is placed in a scholarship fund that earns an annual interest rate of 4.75% compounded daily. Find the

value (in dollars) of the account after 2 years. (Assume all years have 365 days. Round your answer to the nearest cent.)

×

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- A deposit of $20,000 is placed in his scholarship fond that earns an annual interest rate of four. 75% compounded daily find the value (in dollars) of the account after 3 years. (Assume all years of 365 days. Round your answer to the nearest cent.)arrow_forwardA scholarship fund is to be set up to provide monthly scholarships of $600. If the first payment is due in 3.0 years and interest is 6.0% compounded quarterly, what sum of money must be deposited in the scholarship fund today?arrow_forwardA fund is to be set up for an annual scholarship of $5000. If the first payment is due in three years and interest is 6.2% compounded quarterly, what amount mis be deposited in the scholarship fund today?arrow_forward

- Find the periodic payments PMT necessary to accumulate the given amount in an annuity account. (Assume end-of-period deposits and compounding at the same intervals as deposits. Round your answer to the nearest cent.) $90,000 in a fund paying 4% per year, with monthly payments for 10 years PMT = $______arrow_forwardFind the amount of each payment to be made into a sinking fund earning 8% compounded monthly to accumulate $51,000 over 8 years. Payments are made at the end of each period The payment size is s (Do not round until the final answer. Then round to the nearest cent.) TEarrow_forwardFind the periodic payments PMT necessary to accumulate the given amount in an annuity account. (Assume end-of-period deposits and compounding at the same intervals as deposits. Round your answer to the nearest cent.) $10,000 in a fund paying 6% per year, with monthly payments for 10 yearsarrow_forward

- Find the amount of each payment to be made into a sinking fund earning 7 % compounded monthly to accumulate $33,000 over 9 years. Payments are made at the end of each period. The payment size is $ (Do not round until the final answer. Then round to the nearest cent.)arrow_forwardListen How much money must be deposited into an account paying interest at 5% compounded annually in order to fund a yearly scholarship of $2,000 with the first payment in one year and continuing forever? Your Answer: Answerarrow_forwardA college savings fund is opened with a $12,000 deposit. The account earns 6.55% annual interest compounded continuously. What will the value of the account be in 18 years? $26,704.29 $38,704.29 $27,013.46 $39,013.46 . By formula only please correct ansarrow_forward

- Find the amount of each payment to be made into a sinking fund earning 9% compounded monthly to accumulate $86,000 over 5 years. Payments are made at the end of each period. The payment size is $. (Round to the nearest cent.)arrow_forwardYou deposit $600 today into a fund that you intend to leave invested for 6 years. The fund earns 6% interest compounded annually. Indicate the inputs to be entered into the financial calculator keys. What is the value of the fund to be accumulated at the end of year 6? (Round future value answer to two decimal places (e.g., 52.75) and interest rate to one decimal place (e.g., 527.5).) Inputs Calculator N Keys Future value $ 6 I 6 PV 600arrow_forwardFind the periodic payments PMT necessary to accomulate the given account in an annuity account. (Assume end-of-period deposits and compounding at the same intervals as deposits. Round your answer to the nearest cent.) $20,000 in a fund paying 2% per year, with quarterly payments for 20 years. PMT = $arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you