Entrepreneurial Finance

6th Edition

ISBN: 9781337635653

Author: Leach

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

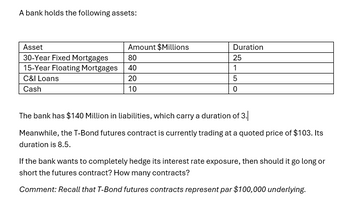

Transcribed Image Text:A bank holds the following assets:

Asset

Amount $Millions

Duration

30-Year Fixed Mortgages

80

25

15-Year Floating Mortgages

40

1

C&I Loans

20

5

Cash

10

0

The bank has $140 Million in liabilities, which carry a duration of 3.

Meanwhile, the T-Bond futures contract is currently trading at a quoted price of $103. Its

duration is 8.5.

If the bank wants to completely hedge its interest rate exposure, then should it go long or

short the futures contract? How many contracts?

Comment: Recall that T-Bond futures contracts represent par $100,000 underlying.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- A bank today makes $100 in 3-year loans with a 16% fixed annual interest rate. It funds the loans today with $100 in 1-year CDs that currently have a 7% annual interest rate. It has the option of entering an interest rate swap contract. The contract includes a variable rate of 4.5% and a fixed rate of 7.5%. If the bank chooses to hedge its interest rate risk using a $100 notional value swap contract, what is the bank's expected net interest income in the first year if all interest rates remain the same throughout the year? A) $9 OB) 12 OC) $7 OD) $16 O E) $6arrow_forwardA bank today makes $100 in 3-year loans with a 16 % fixed annual interest rate. It funds the loans today with $100 in 1-year CDs that currently have a 7% annual interest rate. It has the option of entering an interest rate swap contract. The contract includes a variable rate of 4.5% and a fixed rate of 7.5%. If the bank chooses to hedge its interest rate risk using a $100 notional value swap contract, what is the bank's expected net interest income in the first year if all interest rates remain the same throughout the year? A) $9 OB) 12 OC) $7 OD) $16 OE) $6arrow_forwardDesert Trading Company has issued $100 million worth of long-term bonds at a fixed rate of 10%. The firm then enters into an interest rate swap where it pays SOFR and receives a fixed 5% on notional principal of $100 million. What is the firm's effective interest rate on its borrowing? Only typing answer Please answer explaining in detail step by step without table and graph thankyouarrow_forward

- Suppose a bank enters a repurchase agreerment in which it agrees to sell Treasury securities to a correspondent bank at a price of $9.99,838 with the promise to buy them back at a price of $10.000,073. Calculate the yield on the repo if it has a 6-day maturity. (write your answer in percentage and round it to 2 decimal places)arrow_forwardA commercial bank invests in a loan with a current market value of $600,000 and a maturity of 3 years. The bank partially funds the loan by issuing a zero coupon bond with a maturity (principal) value of $450,000 and a duration of 3 years. The current market rate is 7% and interest rates are expected to increase by 1%. Which of the following statements is true? (a) The current equity value of the position is $150,000 and if interest rates increase the equity value will increase. (b) The current equity value of the position is $232,666 and if interest rates increase the equity value will increase. (c) The current equity value of the position is $232,666 and if interest rates increase the equity value will decrease. (d) The current equity value of the position is $150,000 and if interest rates increase the equity value will remain the same. (e) None of the given answers. The current equity value of the position is $232,666 and if interest rates increase the equity value will remain the…arrow_forwardThe answer is given, I want to receive the work on how to get the correct answer.arrow_forward

- Assume a bank has a $25 million mortgage bond risk position which it hedges in the Treasury bond futures market. Approximately how many futures contracts would be needed for this hedge if you assumed mortgage bonds and Treasury bonds were perfectly correlated? 2500 5 250 25 500arrow_forwardc. A bank enters a reverse repurchase agreement in which it agrees to buy treasury security from one of its correspondent bank at a price of 10 million with the promise to sell the securities back at a price of kshs. 10,008,548 after 5 days. Calculate bond the discount yield for the investing banks.arrow_forwardIf the interest rates go up by 1%, using the duration and convexity rule to determine the net worth of the bank and the equity to asset ratioarrow_forward

- An investment bank sells securities under a repurchase agreement for $800.438 million and buys them back in 7 days for $800.568 million. What is the repo's single payment yield?Report your answer in % to the nearest 0.01%;arrow_forwardA Bank offers both loans and deposits at a nominal interest rate of 4% that is continuously compounded A) What is the effective rate offered by the bank? B) The bank also offers a 3-year bond with face value £10000, redeemable at par, with 10% annual coupons. What is the final payment of that bond? C) Assuming there are no arbitrage opportunities, what is the price of the above bond?arrow_forwardDesert Trading Company has issued $100 million worth of long-term bonds at a fixed rate of 10%. The firm then enters into an interest rate swap where it pays SOFR and receives a fixed 5.2% on notional principal of $100 million. What is the firm's effective interest rate on its borrowing? Note: Enter value as positive amount. Round your answer to 1 decimal place. Effective interest rate %arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT