Survey of Accounting (Accounting I)

8th Edition

ISBN: 9781305961883

Author: Carl Warren

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

If now the question companies like Lazada, shopee, tik tok how answer?

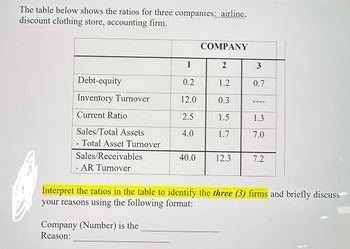

Transcribed Image Text:The table below shows the ratios for three companies: airline,

discount clothing store, accounting firm.

COMPANY

1

2

3

Debt-equity

0.2

1.2

0.7

Inventory Turnover

12.0

0.3

Current Ratio

2.5

1.5

1.3

Sales/Total Assets

4.0

1.7

7.0

- Total Asset Turnover

Sales/Receivables

40.0

12.3

7.2

AR Turnover

Interpret the ratios in the table to identify the three (3) firms and briefly discuss

your reasons using the following format:

Company (Number) is the

Reason:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- find one financial report for a company listed in bursa malaysia and find CURRENT RATIO,QUICK RATIO ,NET PROFIT MARGIN,RETURN ON ASSSET,INVENTORY TURNOVER,RECIEVABLE TURNOVER,DEBT RATIO,DEBT TO EQUITYarrow_forwardThe table below shows the ratios for three companies: airline, discount clothing store, accounting firm. COMPANY 1 2 3 Debt-equity 0.2 1.2 0.7 Inventory Turnover 12.0 0.3 Current Ratio 2.5 1.5 1.3 Sales/Total Assets 4.0 1.7 7.0 Sales/Receivables 40.0 12.3 7.2 Interpret the ratios in the table to identify the three (3) firms and briefly discuss your reasons using the following format: Company (Number) is the Reason: Briefly discuss two (2) reasons why it is difficult to use ratios to compare firms from different countries. Briefly discuss the basis for Mogdiliani and Miller (MM) to claim in their Proposition 1 that capital structure does not matter.arrow_forwardQuestions: 1. Make a comparison for each company based on computed ratio. 2. What is your financial analysis on their overall performance?arrow_forward

- Definitional problems: Listed are 11 terms that relate to ratio analysis:1. Book value per share2.Inventoryturnover3. Debt-to-equity ratio4. Average collection period5. Average sales period6. Return on common equity7. Earnings per share8. Price/earnings ratio9. Return on total assets10. Current ratio11. Accounts-receivable turnoverChoose the financial ratio or term from the list that most appropriately completes each of the following statements:1. The__________ tends to have an effect on the market price per share asreflected in the price/earnings ratio.2. The__________ indicates whether a stock is relatively cheap or relativelyexpensive in relation to current earnings. 3. The________ measures the amount that would be distributed to holders of common stock if all assets were sold at their balance-sheet carrying amount and if all creditors were paid off.4. The_____________ is a rough measure of how many times a company'saccounts…arrow_forwardCalculate all from 1 to 15 the following ratios 1-Current Ratio 2-Quick Ratio 3-Cash Ratio 4-Receivables Turnover 5-Inventory Turnover 6-Payables Turnover 7-Debt-Equity Ratio 8-Debt Ratio 9-Total Asset Turnover 10-Fixed Asset Turnover 11-Equity Turnover 12-Gross Profit Margin 13-Operating Profit Margin 14-Net Profit Margin 15-ROA 16- ROE Balance sheet Group Parent Company 31 December 2018 31 March 2018 31 December 2018 31 March 2018 Notes RO RO RO RO ASSETS Non-current Property, plant and equipment 5 6,406,433 7,113,759 3,683,610 4,182,275 Investment in subsidiaries - - 515,750 515,750 Fixed deposit 9.1 1,048,399 - 1,048,399 - Deferred tax assets 27 675,393 537,722 727,632 602,078 Non-current assets 8,130,225 7,651,481 5,975,391 5,300,103 Current Inventories 6 4,481,209 3,832,010…arrow_forwardBelow are the two basic financial statements of Chiz Trading Company. You are tasked to prepare an analysis using Horizontal and Vertical Analysis of their two-dated financial statements. In addition to this you have been tasked to prepare financial ratios measuring the company’s: Liquidity Status Current Ratios Quick Asset Ratios Efficiency Status Asset Turnover Fixed Asset Turnover Inventory Turnover Days in Inventory Accounts Receivable Turnover Days in Receivable Profitability Status: Gross Profit margin Ratio Operating Income Ratio Net Profit Ratio Return on Assets Return on Equityarrow_forward

- Compare the Solvency, Liquidity and Profitability for the two companiesarrow_forwardCompare the resulting ratios of P and P Manufacturing Company for 2018 (per your computation) with its competitors in the table given below.arrow_forwardCalculate the following Ratios: d) Quick Acid Ratio e) Inventory Turnover Ratio (Days) f) Accounts Receivable Turnover Ratioarrow_forward

- For the highlighted in yellow portions what are the Excel formulaes used to calculate ratios?arrow_forward1. Provide the equation for each ratio listed. 2. What does each ratio listed tell you about the company? 3. Compare the company ratios to the standard ratios, and give an overall analysis of the company.arrow_forwardThe following financial ratios have been calculated for Nova Ltd for the year ended 30 June 2008:Ratio ActualresultsBudgetedresultsPreviousyearIndustry AverageCurrent ratio 1.97 1.92 1.87 1.92Quick asset ratio 1.06 1.06 1.06 1.11Inventory turnover 4.21 4.91 4.86 4.76Net profit ratio 0.05 0.03 0.03 0.03Gross margin 0.65 0.59 0.61 0.61Required:Provide four (4) possible explanations for the results of the various ratios for Nova Ltd and explaintheir implications for the audit.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning