Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

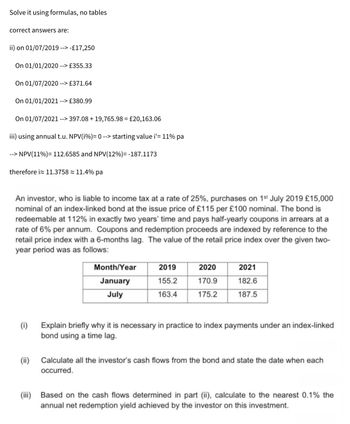

Transcribed Image Text:Solve it using formulas, no tables

correct answers are:

ii) on 01/07/2019 --> -£17,250

On 01/01/2020 --> £355.33

On 01/07/2020 --> £371.64

On 01/01/2021 --> £380.99

On 01/07/2021 --> 397.08+ 19,765.98 = £20,163.06

iii) using annual t.u. NPV(i%) = 0 --> starting value i'= 11% pa

--> NPV(11%)= 112.6585 and NPV(12%)=-187.1173

therefore i≈ 11.3758≈ 11.4% pa

An investor, who is liable to income tax at a rate of 25%, purchases on 1st July 2019 £15,000

nominal of an index-linked bond at the issue price of £115 per £100 nominal. The bond is

redeemable at 112% in exactly two years' time and pays half-yearly coupons in arrears at a

rate of 6% per annum. Coupons and redemption proceeds are indexed by reference to the

retail price index with a 6-months lag. The value of the retail price index over the given two-

year period was as follows:

(i)

(ii)

Month/Year

2019

2020

2021

January

155.2

170.9

182.6

July

163.4

175.2

187.5

Explain briefly why it is necessary in practice to index payments under an index-linked

bond using a time lag.

Calculate all the investor's cash flows from the bond and state the date when each

occurred.

(iii) Based on the cash flows determined in part (ii), calculate to the nearest 0.1% the

annual net redemption yield achieved by the investor on this investment.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- Please solve using Excel and show formulas. You have decided to buy a car with price tag of $60,000 but you are able to negotiate the price down to $58,000. You have $5,000 saved, so you need to borrow $53,000 in a 5-year loan from your bank (your bank offers lower rates than the auto-dealer) at a 4.5% APR (annual rate). How much will you owe to the bank after 3 years?arrow_forwardAm. 355.arrow_forwardusing formulas, no tables, correct answers are a) = 0.275454% pa, b) i^12 = 3.310009% pa. C)d^12 = 3.3009% Paarrow_forward

- A4 Please solve branch B by hand on a piece of paper, pleasearrow_forwardSolve the following exercise by using the present value formula. Do not round intermediate calculations. Round your answers to the nearest cent. Compound Amount Term ofInvestment NominalRate (%) InterestCompounded PresentValue CompoundInterest $13,000 7 years 8.5 semiannually $ $arrow_forwardFINAL EXAM. Fa 2023 0 4 in ach of the following cases, calculate the accounting break-even and the cash break- even ports Ignore any tax effects in calculating the cash break even (Do not round intermediate calculations and round your answers to 2 decimal places g. 32.16) CHE 22 Case 7 Unt Price $2000 44 Unt Variable Cell $1640 39 3 Accounting break even Foed Costs $7,200,000 $2.000.000 Depreciation 275.000 5.800 182.000 1100 Cash break evenarrow_forward

- Helparrow_forwardSolve for the unknown interest rate in each of the following: (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) Present Value $ 290 410 44,000 43,261 Years 3 18 20 Interest Rate % % % % Future Value $ 345 1,253 209,290 388,485arrow_forwardPlease do not give solution in image format thankuarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education