Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

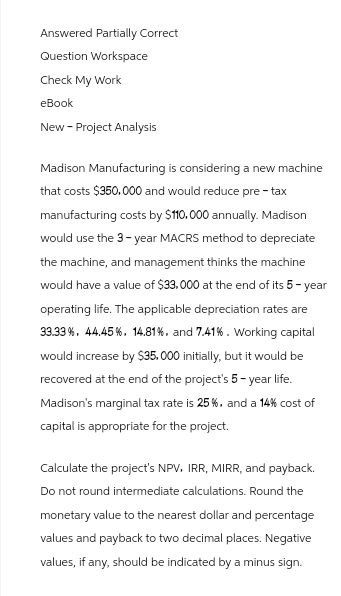

Transcribed Image Text:Answered Partially Correct

Question Workspace

Check My Work

eBook

New - Project Analysis

Madison Manufacturing is considering a new machine

that costs $350.000 and would reduce pre-tax

manufacturing costs by $110.000 annually. Madison

would use the 3-year MACRS method to depreciate

the machine, and management thinks the machine

would have a value of $33,000 at the end of its 5-year

operating life. The applicable depreciation rates are

33.33%. 44.45%. 14.81%. and 7.41%. Working capital

would increase by $35,000 initially, but it would be

recovered at the end of the project's 5-year life.

Madison's marginal tax rate is 25%, and a 14% cost of

capital is appropriate for the project.

Calculate the project's NPV, IRR, MIRR, and payback.

Do not round intermediate calculations. Round the

monetary value to the nearest dollar and percentage

values and payback to two decimal places. Negative

values, if any, should be indicated by a minus sign.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 4 images

Knowledge Booster

Similar questions

- Please do not give solution in image format thankuarrow_forwardAnswered Partially Correct Question Workspace Check My Work eBook New-Project Analysis Madison Manufacturing is considering a new machine that costs $350,000 and would reduce pre-tax manufacturing costs by $110,000 annually. Madison would use the 3-year MACRS method to depreciate the machine, and management thinks the machine would have a value of $33.000 at the end of its 5-year operating life. The applicable depreciation rates are 33.33%. 44.45%. 14.81%, and 7.41%. Working capital would increase by $35,000 initially, but it would be recovered at the end of the project's 5-year life. Madison's marginal tax rate is 25%, and a 14% cost of capital is appropriate for the project. Calculate the project's NPV, IRR, MIRR, and payback. Do not round intermediate calculations. Round the monetary value to the nearest dollar and percentage values and payback to two decimal places. Negative values, if any, should be indicated by a minus sign.arrow_forwardInitial Investment - Basic calculationarrow_forward

- please help witht the question below thank youarrow_forwardInitial investment-Basic calculation Cushing Corporation is considering the purchase of a new grading machine to replace the existing one. The existing machine was purchased 3 years ago at an installed cost of $19,500; it was being depreciated under MACRS using a 5-year recovery period. (See table E for the applicable depreciation percentages.) The existing machine is expected to have a usable life of at least 5 more years. The new machine costs $34,700 and requires $4,800 in installation costs; it will be depreciated using a 5-year recovery period under MACRS. The existing machine can currently be sold for $24,600 without incurring any removal or cleanup costs. The firm is subject to a 40% tax rate. Calculate the initial investment associated with the proposed purchase of a new grading machine. The initial investment will be $. (Round to the nearest dollar.) Data Table (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a…arrow_forwardNonearrow_forward

- help please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forwardnitial investment at various sale prices Edwards Manufacturing Company (EMC) is considering replacing one machine with another. The old machine was purchased 3 years ago for an installed cost of $10,000. The firm is depreciating the machine under MACRS, using a 5-year recovery period. (See table Data table (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) Rounded Depreciation Percentages by Recovery Year Using MACRS for First Four Property Classes Percentage by recovery year* Recovery year 3 years 5 years 7 years 10 years 1 33% 20% 14% 10% 2 45% 32% 25% 18% 3 15% 19% 18% 14% 4 7% 12% 12% 12% 5 12% 9% 9% 6 5% 9% 8% 7 9% 7% 8 4% 6% 9 6% 10 6%…arrow_forwardnitial investment—Basic calculation Cushing Corporation is considering the purchase of a new grading machine to replace the existing one. The existing machine was purchased 2 years ago at an installed cost of $19,800; it was being depreciated under MACRS using a 5-year recovery period. (See table LOADING... for the applicable depreciation percentages.) The existing machine is expected to have a usable life of at least 5 more years. The new machine costs $35,900 and requires $4,500 in installation costs; it will be depreciated using a 5-year recovery period under MACRS. The existing machine can currently be sold for $25,700 without incurring any removal or cleanup costs. The firm is subject to a 40% tax rate. Calculate the initial investment associated with the proposed purchase of a new grading machine. Data table (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) Rounded Depreciation…arrow_forward

- eBook The Darlington Equipment Company purchased a machine 5 years ago, prior to the TCJA, at a cost of $80,000. The machine had an expected life of 10 years at the time of purchase, and it is being depreciated by the straight-line method by $8,000 per year. If the machine is not replaced, it can be sold for $5,000 at the end of its useful life. A new machine can be purchased for $170,000, including installation costs. During its 5-year life, it will reduce cash operating expenses by $55,000 per year. Sales are not expected to change. At the end of its useful life, the machine is estimated to be worthless. The new machine is eligible for 100% bonus depreciation at the time of purchase. The old machine can be sold today for $55,000. The firm's tax rate is 25%. The appropriate WACC is 9%. a. If the new machine is purchased, what is the amount of the initial cash flow at Year 0 after bonus depreciation is considered? Cash outflow should be indicated by a minus sign. Round your answer to…arrow_forwardRequired information [The following information applies to the questions displayed below.] Montego Production Company is considering an investment in new machinery for its factory. Various information about the proposed investment follows: Initial investment Useful life Salvage value Annual net income generated Montego's cost of capital Assume straight line depreciation method is used. Help Montego evaluate this project by calculating each of the following: $ 860,000 6 years Net Present Value $ 20,000 $ 66,000 11% Required: 4. Recalculate Montego's NPV assuming its cost of capital is 12 percent. (Future Value of $1, Present Value of $1. Future Value Annuity of $1, Present Value Annuity of $1.) Note: Use appropriate factor(s) from the tables provided. Negative amount should be indicated by a minus sign. Round your answer to 2 decimal places.arrow_forwardGive typing answer with explanation and conclusionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education