Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

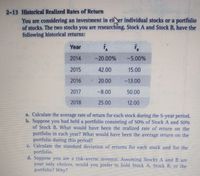

Transcribed Image Text:2-13 Historical Realized Rates of Return

You are considering an investment in ei er individual stocks or a portfolio

of stocks. The two stocks you are researching, Stock A and Stock B, have the

following historical returns:

Year

2014

-20.00%

-5.00%

2015

42.00

15.00

2016

20.00

-13.00

2017

-8.00

50.00

2018

25.00

12.00

a. Calculate the average rate of return for each stock during the 5-year period.

b. Suppose you had held a portfolio consisting of 50% of Stock A and 50%

of Stock B. What would have been the realized rate of return on the

portfolio in each year? What would have been the average return on the

portfolio during this period?

C. Calculate the standard deviation of returns for each stock and for the

portfolio.

d. Suppose you are a risk-averse investor. Assuming Stocks A and B are

your only choices, would you prefer to hold Stock A. Stock B, or the

portfolio? Why?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Financearrow_forwardReview the excerpted table of historic returns shown below. The returns have all been annualized after having calculated monthly returns for the previous five years. In addition, information is provided about the average, the volatility, and the sensitivity of the possible investments. Time Period # Market Return Firm W Firm X Firm Y Firm Z T-Bill 1 0.333 0.191 0.218 0.955 0.601 0.035 2 -0.144 -0.423 -0.632 -0.747 -0.472 0.039 3 0.143 0.348 0.470 0.379 0.378 0.040 4 0.316 0.871 0.868 -0.192 0.502 0.036 5 0.178 0.912 0.499 0.694 0.364 0.036 6 -0.014 0.532 0.168 -0.671 -0.064 0.038 … … … … … … … … … … … … … … 59 0.374 0.556 1.014 0.023 0.698 0.037 60 0.173 0.547 0.092 0.658 0.222 0.036 Average Return 0.082 0.113 0.067 0.167 0.121 0.029 Standard…arrow_forwardF1 plaese help.....arrow_forward

- Historical Realized Rates of Return You are considering an investment in either individual stocks or a portfolio of stocks. The two stocks you are researching, Stock A and Stock B, have the following historical returns: ΤΑ -17.00% 37.00 28.00 ЇВ -6.00% 16.00 -12.00 -5.00 47.00 23.00 21.00 a. Calculate the average rate of return for each stock during the 5-year period. Do not round intermediate calculations. Round your answers to two decimal places. Stock A: Stock B: % % Std. Dev. b. Suppose you had held a portfolio consisting of 50% of Stock A and 50% of Stock B. What would have been the realized rate of return on the portfolio in each year? What would have been the average return on the portfolio during this period? Do not round intermediate calculations. Round your answers to two decimal places. Negative values, if any, should be indicated by a minus sign. Year 2017 2018 2019 2020 2021 Average return c. Calculate the standard deviation of returns for each stock and for the portfolio.…arrow_forward19. You have developed data which give (1) the percentage annual returns of the market for the past five years and (2) similar percentage annual returns information on Stocks A and B. Which of the possible answers best describes the historical beta for A and B? Years Market % returns Stock A % returns Stock B % returns 2023 3% 16% 5% 2022 5% 20% 5% 2021 1% 10% 5% 2020 -10% -25% 5% 2019 6% 24% 5% A) bA > 0; bB = 1. B) bA > +1; bB = 0. C) bA = 0; bB < ─1. D) bA < +1; bB = 0. E) bA > ─1; bB > 1. F) None of the above (state your answer)arrow_forwardUsing the data in the following table, calculate the volatility (standard deviation) of a portfolio that is 75% invested in stock A and 25% in stock B.arrow_forward

- The table below lists the annual return on stock W between 2015 and 2019. Year 2015 2016 2017 2018 2019 Annual Return 12% -10% 20% -4% -8% The annual realized compounded return on stock W between 2015 and 2019 is closest to _____. A. 1.33% B. 2.33% C. 2% D. 3%arrow_forwardProblem 3:Here are the annual returns for five different stocks. Determine the expected return and risk for a period of five years for each of the stocks. Problem 4:a. Find the coefficient of variation (CV) for each of the actions in problem 3.b. Explain which of the investments a risk averse investor would prefer and which a risk lover investor would prefer. Answer clearly and in detail. Show all the computations that led to the result.arrow_forwardThe income statement, also known as the profit and loss (P&L) statement, provides a snapshot of the financial performance of a company during a specified period of time. It reports a firm's gross income, expenses, net income, and the income that is available for distribution to its preferred and common shareholders. The income statement is prepared using the generally accepted accounting principles (GAAP) that match the firm's revenues and expenses to the period in which they were incurred, not necessarily when cash was received or paid. Investors and analysts use the information given in the income statement and other financial statements and reports to evaluate the company's financial performance and condition. Consider the following scenario: Cold Goose Metal Works Inc.'s income statement reports data for its first year of operation. The firm's CEO would like sales to increase by 25% next year. 1. Cold Goose is able to achieve this level of increased sales, but its interest costs…arrow_forward

- Review the following market information: Current Stock Market Return 11.25% Current T-Bill Price $979.43 Historic T-Bill Average Return 2.80% Historic Stock Market Average Return 8.10% Stock Beta 1.23 What is the required return (rounded to two places)?arrow_forwardUsing the data in the following table, calculate the volatility (standard deviation) of a portfolio that is 60% invested in stock A and 40% in stock B. The volatility of the portfolio is %. (Round to two decimal places.) Data table (Click on the following icon in order to copy its contents into a spreadsheet.) Year Stock A Stock B 2010 2011 2012 2013 2014 2015 -10% 19% 4% -3% 5% 12% 19% 39% 24% -8% -8% 35% Print Done Хarrow_forwardHistorical Realized Rates of Return Stocks A and B have the following historical returns: Year 2012 -15.10% -14.90% 2013 21.50 27.00 2014 12.50 31.60 2015 -4.00 -6.10 2016 29.25 6.55 Calculate the average rate of return for each stock during the 5-year period. Round your answers to two decimal places. Stock A % Stock B % Assume that someone held a portfolio consisting of 50% of Stock A and 50% of Stock B. What would have been the realized rate of return on the portfolio in each year? What would have been the average return on the portfolio during this period? Round your answers to two decimal places. Year Portfolio 2012 % 2013 % 2014 % 2015 % 2016 % Average return % Calculate the standard deviation of returns for each stock and for the portfolio. Round your answers to two decimal places. rA rB Portfolio Std. Dev. % % % If you are a risk-averse investor then, assuming these are your only choices, would you prefer…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education