Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

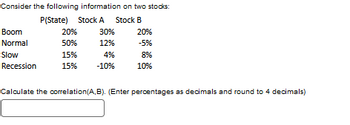

Transcribed Image Text:Consider the following information on two stocks:

P(State) Stock A Stock B

Boom

20%

30%

20%

Normal

50%

12%

-5%

Slow

15%

4%

8%

Recession

15%

-10%

10%

Calculate the correlation (A,B). (Enter percentages as decimals and round to 4 decimals)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- A stock has had the following year-end prices and dividends: Year 1 Price Dividend $ 43.41 2 48.39 $0.66 3 57.31 0.69 4 45.39 0.80 5 52.31 0.85 6 61.39 0.93 What are the arithmetic and geometric returns for the stock? (Do not round intermediate calculations. Round the final answers to 2 decimal places.)arrow_forwardA stock has had the following year-end prices and dividends: TIT Year Price Dividend $16.25 1 18.43 $ .15 2 19.43 .30 3 17.93 .33 4 20.27 .34 23.38 .40 What are the arithmetic and geometric returns for the stock? (Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places.) Arithmetic return |% Geometric returnarrow_forwardSuppose you are given the following information about 2 stocks, what weight would you invest in stock A (with the rest going into stock B) to maximize the Sharpe Ratio? E(RA)=16% E(RB)=8% σA=22% σB=12% σA,B=−0.003696 rf=3% Enter weight in decimal form, rounded to 4th digit, as in "0.1234"arrow_forward

- The following table displays hypothetical stock quotations. Use the information in the table to answer the questions that follow. Listed Stock Quotes Company Ticker High Low Last Price* Net Change** YTD %*** Div. Yield P/E Ratio MarkMin MM 93.06 67.68 84.60 4.56 1.66 0 46 MarlRedBiro MRB 14.00 9.15 10.77 2.01 7.19 6.0 10 TStar TS 341.06 221.69 284.22 2.70 5.02 2.4 26 *Last price for the day **Net change in price from previous day ***Year-to-date percentage change in stock price Of the three stocks listed, a retiree who lives partially off of investment income would be best off holding because of its . You can calculate that MarkMin had per-share earnings for the most recent 12-month period of . If you had purchased 100 shares of TStar stock yesterday at the last price of the day, you would have of if you sold all 100 shares at the last price today.arrow_forwardConsider a market value-weighted index consisting of 3 stocks: A, B, and C. The stocks' prices at time 0 (p0) and time 1 (p1) are given below, along with the number of shares outstanding. Calculate the index levels at time 0. Round your answer to 4 decimal places. For example, if your answer is 3.205%, then please write down 0.0321. stock p0 p1 outstanding shares 43 45 200 69 50 500 11 12 600 A B Carrow_forwardUse the information in the following stock quote to answer the question: As of February 1, 2XX1 Name Symbol Open High Low Close Net Chg Div Yield PE Target TGT 87.01 87.32 86.75 87.05 -0.32 2.56 2.93 16.76 What was Target’s earnings per share over the last year? (Round your answer to 2 decimal places. (e.g., 32.16))arrow_forward

- What is Stock X's geometric returns if it has the following returns? Year 1 8% Year 2 - 5% Year 3 10% Year 4 - 6% Year 5 15% a. 4.1%. b. 5.2% c. 6.8% d. 8.5%arrow_forwardA stock has had the following year-end prices and dividends: Year 1 2355N 4 6 Price $ 64.63 71.50 77.30 63.57 73.71 82.75 Dividend Arithmetic average return Geometric average return $.66 .71 .77 .86 .93 What are the arithmetic and geometric returns for the stock? Note: Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16. % %arrow_forwardUse the portion of the stock table shown below to answer the questions that follow. Round dollar amounts to the nearest cent, if necessary. YTD %CHG 52- HI Week LO STOCK DIV YLD % VOL 100s CLOSE NET CHG 2.8 37.43 21.10 A1 0.99 3.7 789 27.02 –0.1 2.4 48.30 30.78 B1 ... 1303 41.68 0.4 If you purchased 400 shares of B1 stock at $45.03, what would the loss be if the shares were sold at the closing price indicated in the table.arrow_forward

- Given the time series of historical stock returns below, what is the standard deviation? (Hint: theexpected return is 4%)Time Period 1 2 3 4 5return (%) 5% -7% 12% 13% -3% a. 7.585%b. 0.79%c. 8.888%d. 2.155%arrow_forwardA stock has had the following year-end prices and dividends: Year 1234 in 10 5 6 Price $64.68 71.55 77.35 63.62 73.81 83.25 Dividend Arithmetic average return. Geometric average return $.67 .72 .78 .87 .94 What are the arithmetic and geometric returns for the stock? Note: Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g.. 32.16. % %arrow_forwardProblem 2-12 (Algo) Consider the three stocks in the following table. Pt represents price at time t, and Qt represents shares outstanding at time t. Stock C splits two for one in the last period. Stock Po A B P1 01 P2 02 00 140 145 145 145 145 145 135 290 130 290 130 290 270 290 280 290 145 580 C Required: Calculate the first-period rates of return on the following indexes of the three stocks (t = 0 to t = 1): Note: Do not round intermediate calculations. Round your answers to 2 decimal places. a. A market-value-weighted index. b. An equally weighted index. a. Rate of return b. Rate of return % %arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education