FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

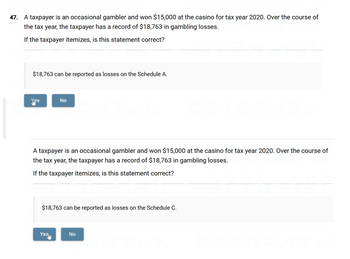

Transcribed Image Text:47. A taxpayer is an occasional gambler and won $15,000 at the casino for tax year 2020. Over the course of

the tax year, the taxpayer has a record of $18,763 in gambling losses.

If the taxpayer itemizes, is this statement correct?

$18,763 can be reported as losses on the Schedule A.

Yes

No

A taxpayer is an occasional gambler and won $15,000 at the casino for tax year 2020. Over the course of

the tax year, the taxpayer has a record of $18,763 in gambling losses.

If the taxpayer itemizes, is this statement correct?

$18,763 can be reported as losses on the Schedule C.

Yes

No

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- In the current tax year, a taxpayer sells a painting for $12,000. She purchased the painting two years ago for $8,000. The short-term capital gains rate is 25%. The long-term capital gains rate is 15%. What is the taxpayer's gain for the current tax year? O $600 short-term capital gain. O $600 long-term capital gain. O $1,000 long-term capital gain. O$1,000 short-term capital gain An individual with a taxable income of $50,000 sells 300 shares of stock at a market price of $100 per share. At the individual's present level of income, there is a marginal ordinary income tax rate of 25% and a long-term capital gains rate of 15%. 200 shares of the stock were acquired 13 months earlier at a price of $80 per share, and 100 shares were acquired two years earlier at a price of $60 per share. What is this individual's tax liability after this transaction? O $2,000 O $1,800 O $8,000 O $1,200arrow_forwardMr. A is in the trading business. On June 2, 20A, he purchased an office equipment with a useful life of three years for P950,000, VAT not included. How much was the input tax?arrow_forwardA tax payer is treating real property used solely for business purposes for new real property to be used in his business. The real property originally cost $35,000 and he has taken $18,000 dollars in depreciation. The old real property is currently worth $20,000 dollars and the new real property the taxpayer wants in exchange is only worth $16,500.The other party agrees to get the taxpayer $3500 in addition to the new real property. What is the gain or loss recognized by the taxpayer on this transaction?arrow_forward

- True or False 1. The hobby losses is deductible for 2022. 2. The education expenses is deductible if maintain or improves skills of the taxpayer. 3. A taxpayer can deduct $55 per day for meals and incidentals without keeping receipts on a business trip. 4. A taxpayer can take depreciation on a business auto and use the $0.60 mileage rate in the same years. 5. Transportation costs are allowed only when the taxpayer visits various clients in the same days. I want answer within one hour,Thanksarrow_forwardA man earned wages of $38,100, received $1800 in interest from a savings account, and contributed $3400 to a tax-deferred retirement plan. He was entitled to a personal exemption of $4050 and had deductions totaling $6350. Find his gross income, adjusted gross income, and taxable income. His gross income was $ (Simplify your answer.) Carrow_forwardTin rents her beach house for 60 days and uses it for personal use for 30 days during the year. The rental income is $6,000 and the expenses are as follows: Mortgage interest $9,000 Real estate taxes 3,000 Utilities 2,000 Maintenance 1,000 Insurance 500 Depreciation (rental part) 4,000 Using the IRS approach, total expenses that Tin can deduct on her tax return associated with the beach house are: a.$6,000. b.$0. c.$8,000. d.$12,000.arrow_forward

- On November 1 of this year, Jaxon borrowed $42,000 from Bucksnort Savings and Loan for use in his business. In December, Jaxon paid interest of $3,780 relating to the 12-month period from November of this year through October of next year. How much interest, if any, can Jaxon deduct this year if his business uses the cash method of accounting for tax purposes?arrow_forwardDetermine the taxpayer's current-year (1) economic income and (2) gross income for tax purposes from the following events: (LO.1) a. Ja-ron's employment contract as chief executive of a large corporation was terminated, and he was paid $500,000 not to work for a competitor of the corporation for five years. b. Elliot, a six-year-old child, was paid $5,000 for appearing in a television commercial. His parents put the funds in a savings account for the child's education. c. Valery found a suitcase that contained $100,000. She could not determine who the owner was. d. Winn purchased a lottery ticket for $5 and won $750,000. e. Larry spent $1,000 to raise vegetables that he and his family consumed. The cost of the vegetables in a store would have been $2,400. f. Dawn purchased an automobile for $1,500 that was worth $3,500. The seller was in desperate need of cash.arrow_forwardCapital gains. Nanouk files as head of household. In 2023, she earned a salary of $116, 150. She also realized a gain of $40,000 on the sale of a capital asset that she had held for eight years. She had no other income or transactions. She had no "for AGI" deductions and took the standard deduction ($20, 800). How much is her income tax liability for 2023?arrow_forward

- A calendar-year taxpayer had net Code Sec. 1231 losses of $8,000 in 2018. He had net Code Sec. 1231 gains of $5,250 and $4,600 in 2019 and 2020, respectively. There were no net Code Sec. 1231 losses in 2015, 2016, and 2017. What portion of the net Code Sec. 1231 gain is reported as ordinary income, and what portion is considered long-term capital gain in 2020? $5,250 is reported as ordinary income; no portion is treated as long-term gain. No long-term capital gain is reported and $3,400 is reported as ordinary income. $2,750 is reported as ordinary income and $1,850 is reported as long-term capital gain. $2,150 is reported as long-term capital gain and $2,400 is reported as ordinary income.arrow_forwardCameron works as a construction worker. During the 2020 financial year, he received the amounts listed below. Advise Cameron which amounts to include in his 2020 tax return as Assessable Income. Also give reasons why amounts are to be excluded. Refer to law. Salary payments totaling $200,000 from him employer, private use of a company car provided by his employer (Taxable Value of $15,000), a bonus payment of $5,000 that was earned during May 2020, yet not paid into his bank account until 25 July 2020, a Net Capital Gain of $10,000 from selling his speedboat, (e) a total of $5,000 earned from selling handmade fishing lures – he only makes and sells the lures in his spare time and for fun.arrow_forwardA taxpayer has unutilized or excess Creditable Withholding Taxes (CWT) for the taxable year The taxpayer has collected its CWT certificates or BIR Form 2307 from its income payors/customers. 1. What are the options of the taxpayer in relation to its unutilized or excess CWT? 2. Assuming during the review of the taxpayer for his Annual Income Tax Return filed for the year 2019, the taxpayer decided to apply for a refund instead of its initial decision of carrying the excess forward to the next taxable periods. Is the application valid?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education