Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Please given correct answer general accounting

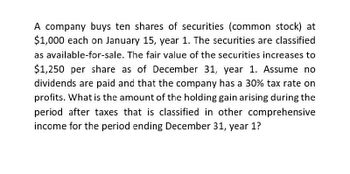

Transcribed Image Text:A company buys ten shares of securities (common stock) at

$1,000 each on January 15, year 1. The securities are classified

as available-for-sale. The fair value of the securities increases to

$1,250 per share as of December 31, year 1. Assume no

dividends are paid and that the company has a 30% tax rate on

profits. What is the amount of the holding gain arising during the

period after taxes that is classified in other comprehensive

income for the period ending December 31, year 1?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- On January 1, 2019, Kittson Company had a retained earnings balance of 218,600. It is subject to a 30% corporate income tax rate. During 2019, Kittson earned net income of 67,000, and the following events occurred: 1. Cash dividends of 3 per share on 4,000 shares of common stock were declared and paid. 2. A small stock dividend was declared and issued. The dividend consisted of 600 shares of 10 par common stock. On the date of declaration, the market price of the companys common stock was 36 per share. 3. The company recalled and retired 500 shares of 100 par preferred stock. The call price was 125 per share; the stock had originally been issued for 110 per share. 4. The company discovered that it had erroneously recorded depreciation expense of 45,000 in 2018 for both financial reporting and income tax reporting. The correct depreciation for 2018 should have been 20,000. This is considered a material error. Required: 1. Prepare journal entries to record Items 1 through 4. 2. Prepare Kittsons statement of retained earnings for the year ended December 31, 2019.arrow_forwardDuring 2021, Anthony Company purchased debt securities as a long-term investment and classified them as trading. All securities were purchased at par value. Pertinent data are as follows: The net holding gain or loss included in Anthonys income statement for the year should be: a. 0 b. 3,000 gain c. 9,000 loss d. 12,000 lossarrow_forwardOn July 1, Year 1, XYZ Corporation purchased as a long-term investment a $2 million face amountABC Co. 6% bond for $2,025,000 plus accrued interest to yield 5.75%. On December 31, Year 1,the bonds had a fair value of $1,850,000. What amount of income should XYZ report on its incomestatement for the year ended December 31, Year 1, related to this bond investment if it is classifiedas a held-to-maturity security?a. $120,000b. $116,438c. $121,500d. $115,000arrow_forward

- On July 1, Year 2, San Benon Company purchased 4,000 of the P1,000 face amount, 8% bonds of Oat Corp. for 3,692,000 to yield a 10% per annum. The bonds, which mature on July 1, Year 5, pay interest semiannually on January 1 and July 1. San Benon classifies the securities as at amortized cost. What is the investment carrying value at December 31, Year 2?arrow_forwardOn July 1, Year 1, Hill Inc. bought and classified the following 10-year debt investments as trading securities. At December 31, Year 1, Hill prepares its financial statements for the end of the fiscal year. At December 31, Year 1, Hill determines the fair value of these securities: Security Cost Fair Value AX PH JB $100,000 40,000 82,000 $94,000 64,000 85,000 At what amount will Hill report these investments in its balance sheet at December 31, Year 1, and how will they be classified? Select one: a. $243,000; current assets Ob. $222,000; current assets о c. $222,000; long-term assets d. $140,000; current assetsarrow_forwardDodd Co.'s debt securities at December 31 included available-for-sale securities with a cost basis of $24, 000 and a fair value of $30,000. Dodd's income tax rate was 20% . What amount of unrealized gain or loss should Dodd recognize in its income statement at December 31?arrow_forward

- Use the following information on a company's investments in debt securities to answer the following question. The company's accounting year ends December 31. Investment Date of Acquisition 9/20/23 $38,000 Colt Compan y bonds Cost Fair Value Date Sold Selling 12/31/23 Price $37,000 2/10/24 $42,000 Dana Compan y bonds 10/2/23 14,000 14,200 1/17/24 13,000 If the above investments are categorized as available-for-sale securities, what is the net effect on 2024 other comprehensive income? Select one: a. $ 800 increase b. $0 c. $3,800 increase d. $ 800 decreasearrow_forwardThe income tax rate is 30%. 2. Diluted earnings per, share 1. Basic earnings per share Amaze Company reported the following information at yeár-end: 2021 2020 Ordinary shares outstanding Nonconvertible preference outstanding shares 10% convertible bonds payable - face amount 1,000,000 1,000,000 360,000 10,000 300,000 10,000 The entity provided the following additional information: On September 1, 2021, the entity sold 60,000 additional ordinary shares. Net income for the year ended December 31, 2021 was P6,700,000. During 2021, the entity paid dividends of P30 per share on the nonconvertible preference share. The 10% convertible bonds are convertible into 40 ordinary shares for each P1,000 bond. Unexercised share options to purchase 30,000 ordinary shares at P20 per share were outstanding at the beginning and end of 2021. The average market price of ordinary share was P30 during 2021. The market price was P40 on December 31, 2021. Warrants to purchase 20,000 ordinary shares at P45 per…arrow_forwardDuring 2021, Paver Financial Corporation had the following trading investment transactions: Feb. 1 Purchased 560 CBF common shares for $35,280. Mar. 1 Purchased 750 RSD common shares for $21,750. Apr. 1 Purchased 7% MRT bonds at face value, for $56,000. Paver received interest from these bonds semi-annually on April 1 and October 1. July 1 Received a cash dividend of $3 per share on the CBF common shares. Aug. 1 Sold 180 CBF common shares at $62 per share. Oct. 1 Received the semi-annual interest on the MRT bonds. 1 Sold the MRT bonds for $57,900. Dec. 30 RSD declared a dividend of $1.60 per share, payable on January 15 next year. Dec. 31 The market prices of the CBF and RSD common shares were $59 and $30 per share, respectively. Determine the balance in each of the statement of income accounts that is affected in the transactions above and indicate how the accounts would be presented on the statement of income for the year ended December…arrow_forward

- Entity A has 200,000 ordinary shares outstanding on January 1, 20x1. Entity A offers rights issue to its existing shareholders that enable them to acquire 1 ordinary share at a subscription price of P120 for every 5 rights held. The rights are exercised on May 1, 20x1. The market price of one ordinary share immediately before exercise is P180. Entity A reported profit after tax of P2,700,000 in 20x1. What is the basic earnings per share in 20x1? * O 12.58 O 12.67 O 11.71 O 11.67arrow_forwardDuring the year ended December 31, 2024, Rakai Corporation, a public company, had the following transactions related to investments held for trading purposes: Feb. 1 Purchased 575 IBF common shares for $25,300. Mar. 1 Purchased 1,500 Raimundo common shares for $48,000. Apr. 1 Purchased $200,000 of CRT 3% bonds at par. Interest is payable semi-annually on April 1 and October 1. July 1 Received a cash dividend of $1.50 per share on the IBF common shares. Aug. 1 Sold 250 IBF common shares at 548 per share. Oct. 1 Received the semi-annual interest on the CRT bonds. 1 Sold the CRT bonds for $205,000. Dec. 31 The fair values of the IBF and Raimundo common shares were $50 and $28 per share, respectively. Instructions Record the transactions and any required year-end adjusting entries. Show the financial statement presentation of the investments and any related accounts in the financial statements for the year ended December 31, 2024.arrow_forwardEdna Recording Studios, Inc., reported earnings available to common stock of $4,200,000last year. From those earnings, the company paid a dividend of $1.28 on each of its 1,000,000 common shares outstanding. The capital structure of the company includes 30% debt, 15% preferred stock, and 55% common stock. It is taxed at a rate of 21%. a. If the market price of the common stock is $46 and dividends are expected to grow at a rate of 6% per year for the foreseeable future, what is the company's cost of retained earnings financing? b. If underpricing and flotation costs on new shares of common stock amount to $7 per share, what is the company's cost of new common stock financing? c. The company can issue $2.01 dividend preferred stock for a market price of $34 per share. Flotation costs would amount to $4 per share. What is the cost of preferred stock financing? d. The company can issue $1,000-par-value, 8% annual coupon, 5-year bonds that can be sold for…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning