FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

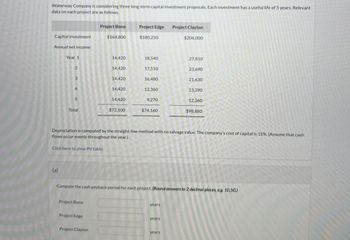

Transcribed Image Text:Waterway Company is considering three long-term capital investment proposals. Each investment has a useful life of 5 years. Relevant

data on each project are as follows.

Project Bono

Project Edge

Project Clayton

Capital investment

$164,800

$180,250

$206,000

Annual net income:

Year 1

14,420

18,540

27,810

2

14,420

17,510

23,690

3

14,420

16,480

21,630

4

14,420

12,360

13,390

5

14,420

9,270

12,360

Total

$72,100

$74,160

$98,880

Depreciation is computed by the straight-line method with no salvage value. The company's cost of capital is 15%. (Assume that cash

flows occur evenly throughout the year.)

Click here to view PV table.

(a)

Compute the cash payback period for each project. (Round answers to 2 decimal places, eg. 10.50.)

Project Bono

years

Project Edge

years

Project Clayton

years

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The cost of the project is $100,000. You expect the project to make $500,000 in 7years (CF of year 7 = $500,000). Youjr cost of capital is 15%. The IRR for this project equals___. A)25.85%B)23.94%C)22.01%D)17.85%arrow_forwardAn Investment project provides the cash flow inflows of $615 per year for 8 years. a) What is the project payback period if the initial cost is $1,750? X years. b) What is the project payback period if the initial cost is $3,400? X years. c) WHat is the project payback period if the initial cost is $5,100 X years.arrow_forwardConsider an investment project in which you invest $3,500 today in order to receive $525 at the end of each of the next 10 years. If the cost of capital is 12% per year, what is the IRR and should the project be accepted? 7.23%, accept project 7.23%, reject project 5.28%, accept project 5.28%, reject project 8.14%, reject project 8.14%, accept project a. b. C. d. e. O f.arrow_forward

- The Fizzy Beverage Co. is considering two alternative capital projects. Project 1: expansion of its existing traditional line of Fizzy beverages. Project 2: introduction of a new “healthy” line of beverages. The company has already spent $1,400,000 on research into the feasibility of these projects and has arrived at the following financial projections. · Both projects are estimated to have a life of 5 years. The required fixed asset investment or capital spending for project 1 is $30,000,000 and for project 2 is $35,000,000. Fixed assets will be depreciated straight line to zero. Fixed asset salvage value estimate for project 1 is $6,200,000 and for project 2 is $8,500,000 · In order to support anticipated sales, either project will require an increase in inventory of $8,600,000, an increase in accounts receivable of $2,800,000, and an increase in accounts payable of $6,300,000 · Cost of goods sold is projected at 35% of sales for either project. Selling,…arrow_forwardplease ASAP, direct thumps up :)arrow_forwardJacob Inc. is considering a capital expansion project. The initial investment of undertaking this project is $188,500. This expansion project will last for five years. The net operating cash flows from the expansion project at the end of year 1, 2, 3, 4 and 5 are estimated to be $28,500, $38,780, $58,960, $77,680 and $95,380 respectively. Jacob has a weighted average cost of capital of 18%. What is the modified internal rate of return if Jacob undertakes this project. Assuming that the positive cash inflow from undertaking this project will be reinvested at the weighted average cost of capital.arrow_forward

- There are two projects under consideration by the Rainbow factory. Each of the projects will require an initial investment of $34,000 and is expected to generate the following cash flows: First Year Second Year Third Year Total Alpha Project $32,000 $22,000 $5,000 $59,000 Beta Project 8,000 23,500 28,000 59,500 Present value and future values table: https://openstax.org/books/principles-managerial-accounting/pages/time-value-of-money A. If the discount rate is 12%, compute the NPV of each project. Round your present value factor to three decimal places and final answer to answer to 2 decimal places. Alpha Project $_________ Beta Project $________ B. Which project should be recommended. _____________arrow_forwardGiven the following attributes of an investment project with a 5-year life and an after-tax discountrate of 12%, calculate both the IRR and MIRR of the project using the built-in functions in Excel:investment outlay, time 0, $5,000; after-tax cash inflows, year 1, $800; year 2, $900; year 3, $1,500;year 4, $1,800; and year 5, $3,200. What accounts for the difference in these two measures?arrow_forwardProjects A and B have first costs of $5,000 and $9,000 respectively. Project A has net annual benefits of $2,500 during each year of its 5-year useful life, after which it can be replaced identically. • Project B has net annual benefits of $3,300 during each year of its 10-year life. Use present worth analysis, an interest rate of 30% per year, and a 10-year analysis period to determine which project to select. Project A Project Barrow_forward

- You are evaluating three mutually exclusive public-works projects with the respective costs and benefits included in the table below. The useful life of each of the projects is 30 years and MARR is 12% annually. Should any of the projects be selected? (Hint: use incremental B-C Analysis) A B C Capital Investment $10,500,000 $12,000,000 $14,000,000 Annual Operating and Maintenance Costs $850,000 $925,000 $930,000 Market Value $1,350,000 $1,950,000 $2,100,000 Annual Benefit $2,250,000 $2,565,000 $2,700,000arrow_forwardA county in Tennessee is considering the following public interest project. Initial Cost $22.5M Annual Maintenance Cost $525K EUAB $3.3M Given a useful life of 12 years and an interest rate of 4%, the benefit /cost ratio is........... A. 1.01 B. 1.67 C. 1.48 D. 1.51.arrow_forwardContinental Railroad Company is evaluating three capital investment proposals by using the net present value method. Relevant data related to the proposals are summarized as follows: MaintenanceEquipment RampFacilities ComputerNetwork Amount to be invested $614,361 $418,741 $186,316 Annual net cash flows: Year 1 318,000 229,000 134,000 Year 2 296,000 206,000 92,000 Year 3 270,000 183,000 67,000 Present Value of $1 at Compound Interest Year 6% 10% 12% 15% 20% 1 0.943 0.909 0.893 0.870 0.833 2 0.890 0.826 0.797 0.756 0.694 3 0.840 0.751 0.712 0.658 0.579 4 0.792 0.683 0.636 0.572 0.482 5 0.747 0.621 0.567 0.497 0.402 6 0.705 0.564 0.507 0.432 0.335 7 0.665 0.513 0.452 0.376 0.279 8 0.627 0.467 0.404 0.327 0.233 9 0.592 0.424 0.361 0.284 0.194 10 0.558 0.386 0.322 0.247 0.162 Required: 1. Assuming that the desired rate of return is 20%, prepare a net present value analysis for each proposal. Use…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education