Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

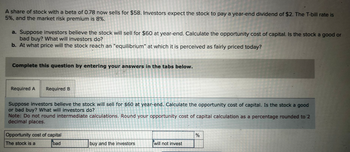

Transcribed Image Text:A share of stock with a beta of 0.78 now sells for $58. Investors expect the stock to pay a year-end dividend of $2. The T-bill rate is

5%, and the market risk premium is 8%.

a. Suppose investors believe the stock will sell for $60 at year-end. Calculate the opportunity cost of capital. Is the stock a good or

bad buy? What will investors do?

b. At what price will the stock reach an "equilibrium" at which it is perceived as fairly priced today?

Complete this question by entering your answers in the tabs below.

Required A Required B

Suppose investors believe the stock will sell for $60 at year-end. Calculate the opportunity cost of capital. Is the stock a good

or bad buy? What will investors do?

Note: Do not round intermediate calculations. Round your opportunity cost of capital calculation as a percentage rounded to 2

decimal places.

Opportunity cost of capital

The stock is a

bad

buy and the investors

will t invest

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- You want to have $35,000 in cash to buy a car 3 years from today. You expect to earn 3.6 percent, compounded annually, on your savings. How much do you need to deposit today if this is the only money you save for this purpose? Can the excel and calculator solution be provided?arrow_forwardAssume that the stock market will be decreasing for the year and you are interested in investing in one of the following stocks. The two stocks are: Stock ABC with a Beta of 1.75 Stock 123 with a Beta of -0.8 If you want to maximize the value of the investment which stock should you acquire. Please explain.arrow_forwardYou are considering an investment in Justus Corporation's stock, which is expected to pay a dividend of $1.50 a share at the end of the year (D1 = $1.50) and has a beta of 0.9. The risk-free rate is 5.7%, and the market risk premium is 4.0%. Justus currently sells for $28.00 a share, and its dividend is expected to grow at some constant rate, g. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the question below. Open spreadsheet Assuming the market is in equilibrium, what does the market believe will be the stock price at the end of 3 years?arrow_forward

- Suppose that your estimates of the possible one-year returns from investing in the common stock of the AYZ Corporation were as follows: Probability of occurrence 0.15 0.25 0.3 0.15 0.15 Possible return -10% 5% 20% 35% 50% What are the expected return? Calculate the standard deviation?arrow_forward2. Answer both questions: a. You purchase 100 shares of stock for $40 a share. The stock pays a $2 per share dividend at year-end. What is the rate of return on your investment if the year-end stock prices turn out to be $38, $40, and $42? What is your real (inflation-adjusted) rate of return in each case, assuming an inflation rate of 3%? b. Consider the following information on the returns on stock and bond investment. Scenario Profitability Stocks Bonds Recession .2 -5% +14% Normal Economy .6 +15% +8% Boom .2 +25% +4% i) Calculate the expected rate of return and standard deviation in each investment. ii) Do your results support or contradict the historical record on the relationship between risk and return in the financial market in both Canada and the United States? iii) Which investment would you prefer? Explain your answer.arrow_forwardSuppose you have $375,000 in cash, and you decide to borrow another $63,750 at a 7% interest rate to invest in the stock market. You invest the entire $438,750 in a portfolio J with a 20% expected return and a 28% volatility. a. What is the expected return and volatility (standard deviation) of your investment? b. What is your realized return if J goes up 39% over the year? c. What return do you realize if J falls by 19% over the year?arrow_forward

- You are considering the purchase of a new stock. The stock is expected to grow at 2.52% for the foreseeable future and just paid a $2.88 dividend (D0). The required return is 8.2%. Based on this, what is the value of the stock? Round calculations to the nearest cent.arrow_forwardYou have $19,878 to invest in a stock portfolio. Your choices are Stock "X" with an expected return of 12.5% and Stock Y with an expected return of 8.24%. If your goal is to create a portfolio with an expected return of 11.92%, how much money will you invest in Stock X? State of Economy Probability of State of Economy Return Stock A Return Stock B Return Stock C Boom 0.20 19.41% 20.65% 29.51% Good 0.35 8.08% 10.59% 13.88% Poor 0.40 5.53% 3.23% 5.04% Bust 0.05 1.77% 1.47% 1.16% Your portfolio is invested 23% each in stock A and C and the remaining in stock B. What is the expected return of the portfolio? NOTE: Enter the PERCENTAGE number rounding to two decimals. If your decimal answer is 0.034576, your answer must be 3.46. DO NOT USE the % sign A Stock has a beta of 1, the expected return on the market is 17.72%, and the risk-free rate is 4.85%. What must the expected return on this stock be? NOTE: Enter the PERCENTAGE number rounding to two…arrow_forwardA stock is selling today for $50 per share. At the end of the year, it pays a dividend of $3 per share and sells for $59. Required: a. What is the total rate of return on the stock? b. What are the dividend yield and percentage capital gain? c. Now suppose the year-end stock price after the dividend is paid is $44. What are the dividend yield and percentage capital gain in this case?arrow_forward

- A share of stock with a beta of 0.8 currently sells for $50. Investors expect the stock to pay a year-end dividend of $5. The T-bill rate is 1%, and the market risk premium is 6%. If the stock is perceived to be fairly priced today, what much be investors' expectation of the price of the stock at the end of the year? $_ Hint: [CAPM] Expected Return (R) = Rf + Beta *Market Risk Premium; Expected Return (R) = Dividend Yield + Capital Gains Yield, where dividend yield=D1/PO and capital gains yield = (P1-Po)/POarrow_forwardStan is expanding his business and will sell common stock for the needed funds. If the current risk-free rate is 2.9% and the expected market return is 12.5%, what is the cost of equity for Stan if the beta of the stock is a.0.72, b.0.86,arrow_forwardYou are considering an investment in Justus Corporation's stock, which is expected to pay a dividend of $1.75 a share at the end of the year (D1 = $1.75) and has a beta of 0.9. The risk-free rate is 4.6%, and the market risk premium is 5.5%. Justus currently sells for $31.00 a share, and its dividend is expected to grow at some constant rate, g. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the question below. Open spreadsheet Assuming the market is in equilibrium, what does the market believe will be the stock price at the end of 3 years? (That is, what is ?) Round your answer to two decimal places. Do not round your intermediate calculations. $ fill in the blank 2arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education