Concept explainers

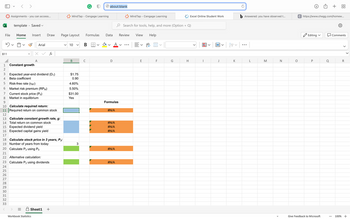

You are considering an investment in Justus Corporation's stock, which is expected to pay a dividend of $1.75 a share at the end of the year (D1 = $1.75) and has a beta of 0.9. The risk-free rate is 4.6%, and the market risk premium is 5.5%. Justus currently sells for $31.00 a share, and its dividend is expected to grow at some constant rate, g. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the question below.

Assuming the market is in equilibrium, what does the market believe will be the stock price at the end of 3 years? (That is, what is ?) Round your answer to two decimal places. Do not round your intermediate calculations.

$ fill in the blank 2

Step by stepSolved in 4 steps

- A Company has just paid an quarterly dividend of $2.5 per share, and that dividend is expected to grow at a constant rate of 5.00% per year in the future. The company's beta is 1.15, the market risk premium is 5.5%, and the risk-free rate is 4.0%. What is the company's current stock price?arrow_forwardYou are considering purchasing a stock that is expected to pay a dividend of $5 at the end of the year. The dividends for this firm are expected to grow at a constant rate of 5%. Based on the riskiness of the stock, you require a return of 9%. If you pay $73 for this stock today, what is your expected return?arrow_forwardAC&DC Company will be worth $135 per share one year from now. This company has a beta of 2.3. The risk-free rate is 5.5% and the market risk premium is 7.0%. Assuming CAPM holds and AC&DC does not pay dividends, how much are you willing to pay for one share today? Show your workings and round your final answer to two decimal places.arrow_forward

- You are considering an investment in Justus Corporation's stock, which is expected to pay a dividend of $1.75 a share at the end of the year (D1 = $1.75) and has a beta of 0.9. The risk-free rate is 4.1%, and the market risk premium is 4.5%. Justus currently sells for $48.00 a share, and its dividend is expected to grow at some constant rate, g. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the question below. X Open spreadsheet Assuming the market is in equilibrium, what does the market believe will be the stock price at the end of 3 years? (That is, what is P3?) Round your answer to two decimal places. Do not round your intermediate calculations. $4arrow_forwardWeber Integrated Systems Inc. is expected to pay a year-end dividend of $0.90 per share (i.e. D1 = $0.90), and that dividend is expected to grow at a constant rate of 4.00% per year in the future. The company's beta is 1.20, the market risk premium is 5.00 %, and the risk - free rate is 4.00 % . What is the company's current stock price? a. $15.00 b. $15.60 c. $16.33 d. $17.77 e. $ 18.20arrow_forwardPeteCorp's stock has a Beta of 1.37. Its dividend is expected to be $3.19 next year, and will grow by 5% per year after that indefinitely. Assume the risk-free rate is 5%, and the Market Risk Premium is 7%. The stock price would currently be estimated to be $________. Round your FINAL answer to 2 decimal places (example: 12.3456 = 12.35), but do NOT round any intermediate work.arrow_forward

- Tanrun Inc. is expected to pay an annual dividend of $0.45 per share in one year. Analysts expect the firm's dividends to grow by 4% forever. Its stock price is $35.1 and its beta is 1.5. The risk-free rate is 2% and the market risk premium is 4.5%. A. What is the best guess for the cost of equity? Recall that both Dividend Growth Model and CAPM can be used to find cost of equity. Here assume the best guess is the simple average of the two.arrow_forwardYou are considering an investment in Justus Corporation's stock, which is expected to pay a dividend of $1.50 a share at the end of the year (D1 = $1.50) and has a beta of 0.9. The risk-free rate is 5.7%, and the market risk premium is 4.0%. Justus currently sells for $28.00 a share, and its dividend is expected to grow at some constant rate, g. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the question below. Open spreadsheet Assuming the market is in equilibrium, what does the market believe will be the stock price at the end of 3 years?arrow_forwardhelp pleasearrow_forward

- Mackenzie Company has a price of $31 and will issue a dividend of $2.00 next year. It has a beta of 1.5, the risk-free rate is 5.4%, and the market risk premium is estimated to be 4.8%. a. Estimate the equity cost of capital for Mackenzie. b. Under the CDGM, at what rate do you need to expect Mackenzie's dividends to grow to get the same equity cost of capital as in part (a)?arrow_forwardYou are considering an investment in Justus Corporation's stock, which is expected to pay a dividend of $2.75 a share at the end of the year (D1 = $2.75) and has a beta of 0.9. The risk-free rate is 5.1%, and the market risk premium is 6%. Justus currently sells for $41.00 a share, and its dividend is expected to grow at some constant rate, g. Assuming the market is in equilibrium, what does the market believe will be the stock price at the end of 3 years? (That is, what is ?) Do not round intermediate calculations. Round your answer to the nearest cent.arrow_forwardClinton Corporation is expected to pay a dividend of $3.50 next year and $5.50 the year after that. At this point (end of year 2 beginning of year 3) the growth rate in dividends is expected to be 0.05 into the foreseeable future. The required return on stock's of similar risk is 12%. What is the current price Po? Answer should be to nearest penny: ex: 20.32 Be sure to round correctly 20.326 would be 20.33 Your Answer: Answerarrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education