Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

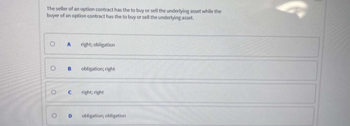

Transcribed Image Text:The seller of an option contract has the to buy or sell the underlying asset while the

buyer of an option contract has the to buy or sell the underlying asset.

O

O

O

A right; obligation

B

с

D

obligation; right

right; right

obligation; obligation

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Which one of the following is true about a firm commitment? Select one: a. A firm commitment is a contract that allows both the buyer or seller an option to engage (or not) in a long-term transaction. b. A firm commitment is a transaction that has already occurred and the commitment to pay or receive payment is pending. c. A firm commitment occurs as a result of a historical relationship and there is an expected commitment to engage in a transaction in the future. d. A firm commitment is an agreement with legally enforceable termsarrow_forwardThe seller (or the writer) of a call option: may have the obligation to sell the underlying asset at a strike price until an expiration date may have the obligation to buy the underlying asset at a strike price until an expiration date has the right to sell the underlying asset at a strike price until an expiration date has the right to buy the underlying asset at a strike price until an expiration date None of these answers are correct.arrow_forwardWhich of the following gives the holder the right to buy the asset at a specified strike price? OA. A future contract OB. A put OC. An ETF OD. A stock OE. A callarrow_forward

- n options markets, option premiums are paid by: option writers to buyers. option buyers to sellers. both option buyers and sellers. put option buyers only.arrow_forwardWhich of the following gives the holder the right to sell the asset at a specified strike price? OA. A stock OB. A put OC. An ETF OD. A future contract OE. A callarrow_forwardDetermine, generally based on justification, in what manner does seller a put option set targeted?arrow_forward

- Which option gives the right to sell an asset at any time prior to or at maturity? *A. European PutB. American PutC. American CallD. European Callarrow_forwardQ> Define Forward and Future contract and also differentiate between hedging and Speculation.arrow_forwardWhich option gives the right to buy an asset any time prior or to maturity? *A. European CallB. American PutC. American CallD. European Putarrow_forward

- on the date of expiry, the price of an expiring forward or future contract must be equal to the spot price. do you agree? why?arrow_forwardEntering in a swap contract is always advantageous for both parties True Falsearrow_forwardIn which of the following contracts BOTH parties have an OBLIGATION to exercise the contract? a) Call Option b) Futures c) Put Option d) all of the above none of the abovearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education