Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

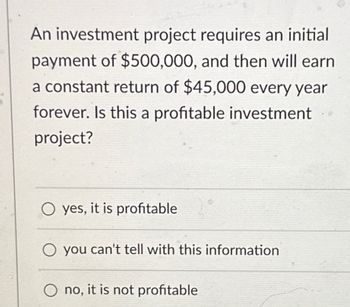

Transcribed Image Text:An investment project requires an initial

payment of $500,000, and then will earn

a constant return of $45,000 every year

forever. Is this a profitable investment

project?

Oyes, it is profitable

O you can't tell with this information

Ono, it is not profitable

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 1 steps

Knowledge Booster

Similar questions

- Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardProject A has an internal rate of return of 10%. Project B costs £100 this year and will generate a cash flow of £105 next year. The two projects are not mutually exclusive. 1. The company should only undertake project A 2. If the appropriate discount rate is below 10%, the company should invest in both projects 3. If the appropriate discount rate is above 5% the company should invest in both projects 4. If the appropriate discount rate is above 5%, the company should not undertake project Barrow_forwardYou run a construction firm. You have just won a contract to build a government office complex. Building it will require an investment of $10.1010.10 million today and $5.105.10 million in one year. The government will pay you $21.2021.20 million in one year upon the building's completion. Suppose the interest rate is 10.2 % 10.2 %. a. What is the NPV of this opportunity? b. How can your firm turn this NPV into cash today?arrow_forward

- solve it correctly. not use excelarrow_forwardSuppose you are considering building a factory that produces turbo jets. Price of a turbo jet right now is $200. Next year the price could go up to $220 or go down to $180 or stay at $200 with equal probabilities. The price then remains fixed for a long time. (This assumption makes this cash flow risky). This will be your revenue. Cost of factory is $300 and it can be built right away since you have infrastructure in place. WACC is 30%. Cost of debt is 10%. You have the option to wait one year and see whether the price goes up or down and then invest only if price is above $180? What is the NPV? 414.22 167.52 312.82 566.67arrow_forward1) Rainbow Corp. is considering an investment whereby it will invest $100 in a perpetuity that will pay the firm $30 annually forever, starting one year from now. If the firm has a payaback period of 3 years, will it do the project? a) Yes b) No 2) If Rainbow has a cost of capital of 10%, will it invest in the project when doing an NPV analysis? a) Yes b) Noarrow_forward

- Don't use chat botarrow_forwardA new investment offers TimeTek future cash flows of $Q in six years and SP in 12 years. Assuming a negative interest rate of throughout the entire time, TimeTek will pay up to $50,000 today to receive these future cash flows. If the interest rate becomes zero (r=0%), what will TimeTek be willing to pay for these same cash flows $Q and SP? O Less than $50,000 O $50,000 O Not enough information to determine More than 50,000arrow_forwardMost you can pay negative NPV? 22. You are getting ready to start a new project that will incur some cleanup and shutdown costs when it is completed. The project costs $5.4 million up front and is expected to generate $1.1 million per year for 10 years and then have some shutdown costs in year 11. Use the MIRR approach to find the maximum shutdown costs you could incur and still meet your cost of capital of 15% on this project. Cald in South Africaarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education