Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

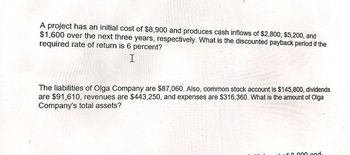

Transcribed Image Text:A project has an initial cost of $8,900 and produces cash inflows of $2,800, $5,200, and

$1,600 over the next three years, respectively. What is the discounted payback period if the

required rate of return is 6 percent?

I

The liabilities of Olga Company are $87,060. Also, common stock account is $145,800, dividends

are $91,610, revenues are $443,250, and expenses are $316,360. What is the amount of Olga

Company's total assets?

£0.000 and-

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Your company is planning to purchase a new log splitter for is lawn and garden business. The new splitter has an initial investment of $180,000. It is expected to generate $25,000 of annual cash flows, provide incremental cash revenues of $150,000, and incur incremental cash expenses of $100,000 annually. What is the payback period and accounting rate of return (ARR)?arrow_forwardGarnette Corp is considering the purchase of a new machine that will cost $342,000 and provide the following cash flows over the next five years: $99,000, $88,000, $92,000. $87,000, and $72,000. Calculate the IRR for this piece of equipment. For further instructions on internal rate of return in Excel. see Appendix C.arrow_forwardBuena Vision Clinic is considering an investment that requires an outlay of 600,000 and promises a net cash inflow one year from now of 810,000. Assume the cost of capital is 10 percent. Required: 1. Break the 810,000 future cash inflow into three components: a. The return of the original investment b. The cost of capital c. The profit earned on the investment 2. Now, compute the present value of the profit earned on the investment. 3. Compute the NPV of the investment. Compare this with the present value of the profit computed in Requirement 2. What does this tell you about the meaning of NPV?arrow_forward

- Towson Industries is considering an investment of $256,950 that is expected to generate returns of $90,000 per year for each of the next four years. What Is the Investments internal rate of return?arrow_forwardProject X costs $10,000 and will generate annual net cash inflows of $4,800 for five years. What is the NPV using 8% as the discount rate?arrow_forwardA project has an initial cost of $8,900 and produces cash inflows of $2,800, $5,200, and $1,600 over the next three years, respectively. What is the discounted payback period if the required rate of return is 6 percent? I The liabilities of Olga Company are $87,060. Also, common stock account is $145,800, dividends are $91,610, revenues are $443,250, and expenses are $316,360. What is the amount of Olga Company's total assets? initial cost of 8-900-and-arrow_forward

- Please provide both Answerarrow_forwardAns... Plsarrow_forwardPerez Company is considering an investment of $26,945 that provides net cash flows of $8,500 annually for four years.(a) What is the internal rate of return of this investment? (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided. Round your present value factor to 4 decimals.)(b) The hurdle rate is 7%. Should the company invest in this project on the basis of internal rate of return?arrow_forward

- Perez Company is considering an investment of $20,957 that provides net cash flows of $6,900 annually for four years. (a) What is the internal rate of return of this investment? (PV of $1, FV of $1, PVA of $1, and FVA of $1) Note: Use appropriate factor(s) from the tables provided. Round your present value factor to 4 decimals. (b) The hurdle rate is 9%. Should the company invest in this project on the basis of internal rate of return? Complete this question by entering your answers in the tabs below. Required A Required B What is the internal rate of return of this investment? Present value factor Internal rate of return % Required A Required Barrow_forwardPerez Company is considering an investment of $30,485 that provides net cash flows of $9,000 annually for four years. (a) What is the internal rate of return of this investment? (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided. Round your present value factor to 4 decimals.) (b) The hurdle rate is 6%. Should the company invest in this project on the basis of internal rate of return? See photo for additional informationarrow_forwardGodoarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,