FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Perez Company is considering an investment of $26,945 that provides net

(a) What is the

(b) The hurdle rate is 7%. Should the company invest in this project on the basis of internal rate of return?

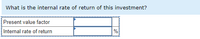

Transcribed Image Text:What is the internal rate of return of this investment?

Present value factor

Internal rate of return

%

Transcribed Image Text:Perez Company is considering an investment of $26,945 that provides net cash flows of $8,500 annually for four years.

(a) What is the internal rate of return of this investment? (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from

the tables provided. Round your present value factor to 4 decimals.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- An investment under consideration has a payback of seven years and a cost of $884,000. Assume the cash flows are conventional. If the required return is 11 percent, what is the worst-case NPV? (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)arrow_forwardJones expects an immediate investment of $73,759.50 to return $15,000 annually for six years, with the first payment to be received one year from now. What rate of interest must Jones eam? (PV of $1. EV of $1. PVA of $1. and EVA of $1) (Use appropriate factor(s) from the tables provided. Round "Table Factor" to 4 decimal places.) Table Factor Interest Rate Present Value Annuity Paymentarrow_forwardJiminez Company has two investment opportunities. Both investments cost $5,000 and will provide the following net cash flows: Year 1 2 3 4 What is the total present value of Investment A's cash flows assuming an 10% minimum rate of return? Use Appendix Table 2. (Do not round your intermediate calculations. Round your answer to the nearest whole dollar.) Multiple Choice O O Investment A $3,000 3,000 3,000 3,000 O O $4,510. $3,452. $3,000. Investment B $3,000 4,000 2,000 1,000 $10,628.arrow_forward

- sarrow_forwardThe HUT is evaluating a 5 year investment projected to yield the following relevant cash flows over its 5 year life: Given that the firm employs a 12% discount rate, what is the value of each of the three criteria: NPV? Profitability Index? Payback Period? Varrow_forwardAlonso Yards Corp. is considering an investment opportunity with the following expected net cash inflows: Alonso Yards Corp. Year 1 $203,000 Year 2 $185,000 Year 3 $106,000 The company uses a discount rate of 9%, and the initial investment of $380,000. Calculate the NPV of the investment.arrow_forward

- Pena Company is considering an investment of $21,705 that provides net cash flows of $6,700 annually for four years. (a) If Pena Company requires a 7% return on its investments, what is the net present value of this investment? (PV of $1. FV of $1. PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided. Round your present value factor to 4 decimals.) (b) Based on net present value, should Pena Company make this investment? Complete this question by entering your answers in the tabs below. Required A Required B What is the net present value of this investment? Years 1-4 Initial investment Net present value Net Cash Flows 6,700 x PV Factor Required A Present Value of Net Cash Flows 0 21,705 Required B >arrow_forwardImagineering, Inc., is considering an investment in CAD-CAM compatible design software with the cash flow profile shown in the table below. Imagineering’s MARR is 18 %/year.What is the present worth of this investment (in millions)? $enter a dollar amount Carry all interim calculations to 2 decimal places and round your answer to the nearest million. The tolerance is ±0.05. EOY 0 1 2 3 4 5 6 7 Cash Flows (M$) $12 $1 $5 $2 $5 $5 $2 $5arrow_forwardSuppose the MARR is 3%. Use the following table to answer the question--The IRR on the incremental cash flow is. CMS FMS Initial Investment $30,000 $39.000 Annual Revenue 6,688 9,102 I Useful Lite (Years) 5 5 OA. 1.0% 2.0% OB. 15.0% 16.0% OC. 20.0% 21.0% OD. 17.0% - 18.0% E. 10.0% 11.0%arrow_forward

- Incognito Company is contemplating the purchase of a machine that provides it with cash savings of $93,000 per year for five years. Interest is 11%. Assume the cash savings.occur at the end of each year. Required: Calculate the present value of the cash savings. Note: Use tables, Excel, or a financial calculator. Round your final answer to the nearest whole dollar. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) Present valuearrow_forwardA project has estimated annual cash flows of $95,000 for 4 years and is estimated to cost $260,000. Assume a minimum acceptable rate of return of 10%. Following is a table for the present value of $1 at compound interest: Year 6% 10% 12% 1 0.943 0.909 0.893 2 0.890 0.826 0.797 3 0.840 0.751 0.712 4 0.792 0.683 0.636 5 0.747 0.621 0.567 Following is a table for the present value of an annuity of $1 at compound interest: Year 6% 10% 12% 1 0.943 0.909 0.893 2 1.833 1.736 1.690 3 2.673 2.487 2.402 4 3.465 3.170 3.037 5 4.212 3.791 3.605 a. Determine the net present value of the project.b.arrow_forwardRegarding the proposed investments, XYZ INC. gathers the following data: a cash cost of 13,000, net annual cash flows of 45,000, and a present value factor of 5.40 rounded for cash inflows over a ten-year period. Find out all the relevant details that will be important when choosing an investment. Please let me know whether you think our firm should receive an investment based on the following information:arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education