SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN: 9780357391266

Author: Nellen

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

help please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no

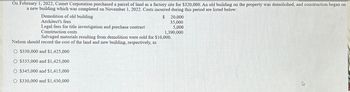

Transcribed Image Text:On February 1, 2022, Comet Corporation purchased a parcel of land as a factory site for $320,000. An old building on the property was demolished, and construction began on

a new building which was completed on November 1, 2022. Costs incurred during this period are listed below:

Demolition of old building

Architect's fees

Legal fees for title investigation and purchase contract

Construction costs

$ 20,000

35,000

5,000

1,390,000

Salvaged materials resulting from demolition were sold for $10,000.

Nelson should record the cost of the land and new building, respectively, as

O $330,000 and $1,425,000

O $335,000 and $1,425,000

O $345,000 and $1,415,000

O $330,000 and $1,430,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- During the current year, Arkells Inc. made the following expenditures relating to plant machinery. Renovated seven machines for $250,000 to improve efficiency in production of their remaining useful life of eight years Low-cost repairs throughout the year totaled $79,000 Replaced a broken gear on a machine for $6,000 A. What amount should be expensed during the period? B. What amount should be capitalized during the period?arrow_forwardOn February 1, 2020, Nelson Corporation purchased a parcel of land as a factory site for $320,000. An old building on the property was demolished, and construction began on a new building which was completed on November 1, 2020. Costs incurred during this period are listed below: Demolition of pold building $20,000 Arcchitects fees $35,000 Legal Fees for title investigation and purchase contract $5,000 Contruction Cost $1,390,000 Salvaged materials resulting from demolition were sold for $10,000. Nelson should record the cost of the land and new building, respectively, as A) $330,000 and $1,425,000.…arrow_forwardOn July 1, 2024, a company purchased a $550,000 tract of land that is intended to be the site of a new office complex. The company incurred additional costs and realized salvage proceeds during 2024 as follows: Demolition of existing building on site $ 72,000 Legal and other fees to close escrow 12,400 Proceeds from sale of demolition scrap 9,800 What would be the balance in the land account as of December 31, 2024?arrow_forward

- On March 1, 2024, Beldon Corporation purchased land as a factory site for $72,000. An old building on the property was demolished, and construction began on a new building that was completed on December 15, 2024. Costs incurred during this period are listed below: Demolition of old building $ 5,000 Architect’s fees (for new building) 11,000 Legal fees for title investigation of land 8,000 Property taxes on land (for period beginning March 1, 2024) 4,200 Construction costs 620,000 Interest on construction loan 6,000 Salvaged materials resulting from the demolition of the old building were sold for $3,200. Required: Determine the amounts that Beldon should capitalize as the cost of the land and the new building.arrow_forwardOn March 1, 2024, Beldon Corporation purchased land as a factory site for $66,000. An old building on the property was demolished, and construction began on a new building that was completed on December 15, 2024. Costs incurred during this period are listed below: Demolition of old building Architect's fees (for new building) Legal fees for title investigation of land Property taxes on land (for period beginning March 1, 2024) Construction costs Interest on construction loan $ 7,000 18,000 5,000 3,600 560,000 8,000 Salvaged materials resulting from the demolition of the old building were sold for $2,600. Required: Determine the amounts that Beldon should capitalize as the cost of the land and the new building. Complete this question by entering your answers in the tabs below. Cost of Land Cost of New Building Determine the amounts that Beldon should capitalize as the cost of the land. Note: Amounts to be deducted should be indicated with a minus sign. Capitalized cost of land: Total…arrow_forwardS On March 1, 2024, Beldon Corporation purchased land as a factory site for $60,000. An old building on the property was demolished, and construction began on a new building that was completed on December 15, 2024. Costs incurred during this period are listed below: Demolition of old building Architect's fees (for new building) Legal fees for title investigation of land Property taxes on land (for period beginning March 1, 2024) Construction costs Interest on construction loan Salvaged materials resulting from the demolition of the old building were sold for $2,000. Required: Determine the amounts that Beldon should capitalize as the cost of the land and the new building. Complete this question by entering your answers in the tabs below. Cost of Land Cost of New Building Determine the amounts that Beldon should capitalize as the cost of the new building. Note: Amounts to be deducted should be indicated with a minus sign. Capitalized cost of building: Total cost of building $ 4,000…arrow_forward

- On February 1, 2019, Edwards Corporation purchased a parcel of land as a factory site for $100,000. It demolished an old building on the property and began construction on a new building that was completed on October 2, 2019. Costs incurred during this period are: Demolition of old building $ 8,000 Architect's fees 25.000 Legal fees for title investigation and purchase contract 4,000 Construction costs 650,000 Edwards sold salvaged materials resulting from the demolition for $2,000. Required: 1. At what amount should Edwards record the cost of the land and the new building, respectively? 2. NEXT LEVEL If management misclassified a portion of the building's cost as part of the cost of the land, what would be the effect on the financial statements?arrow_forwardOn March 1, 2021, Beldon Corporation purchased land as a factory site for $60,000. An old building on the property was demolished, and construction began on a new building that was completed on December 15, 2021. Costs incurred during this period are listed below: Demolition of old building $ 4,000Architect’s fees (for new building) 12,000Legal fees for title investigation of land 2,000Property taxes on land (for period beginning March 1, 2021) 3,000Construction costs 500,000Interest on construction loan 5,000 Salvaged materials resulting from the demolition of the old building were sold for $2,000.Required:Determine the amounts that Beldon should capitalize as the cost of…arrow_forwardOn February 1, 20X0, Larkin Corporation purchased a parcel of land as a factory site for P400,000. An old building on the property was demolished, and construction began on a new building which was completed on November 1, 20X0. Costs incurred during this period are listed as follows: Demolition of the old building - P 25,000; Architect's fees - 35,000; Legal fees for title investigation and purchase contract - 5,000; Construction costs - 890,000; (Salvaged materials resulting from demolition were sold for P10,000.) Larkin should record the cost of the new building asarrow_forward

- On February 1, 2010, Morgan Company purchased a parcel of land as a factory site for $200,000. An old building on the property was demolished, and construction began on a new building which was completed on November 1, 2010. Costs incurred during this period are listed below: $20,000 - Demolition of old building $35,000 - Architect's fees $5,000 - Legal fees for title investigation and purchase contract. $1,090,000 - Construction costs Salvaged materials resulting from demolition were sold for $10,000. Morgan should record the cost of the land and new building, respectively, as: $225,000 and $1,115,000 $210,000 and $1,130,000 $210,000 and $1,125,000 $215.000 and $1.125.000arrow_forwardDuring the current fiscal year, Heinrich Corp. incurred the following costs related to property, plant, and equipment: Amount paid to the contractor for the building constructed P13,000,000 Building permit fee 120,000 Excavation cost 110,000 Architect fee 440,000 Interest that would have been earned had the money used during the period of construction been invested in the money market 330,000 Invoice cost of machine acquired, terms 3/10, n/30 6,500,000 Freight, unloading and delivery charges for machine acquired 100,000 Custom duties and other charges 270,000 Allowance and hotel accommodation, paid to foreign technicians during installation and test run of machine 520,000 Royalty payment on machines purchased (based on units produced and sold) 240,000 Cash paid for the purchase of land (none was allocated to old building) 10,000,000 Mortgage assumed on the land purchased 2,100,000 Realtor’s commission 650,000 Legal fees, realty taxes and documentation expenses 900,000 Amount…arrow_forwardTeradene Corporation purchased land as a factory site and contracted with Maxtor Construction to construct afactory. Teradene made the following expenditures related to the acquisition of the land, building, and equipmentfor the factory:Purchase price of the land $1,200,000Demolition and removal of old building 80,000Clearing and grading the land before construction 150,000Various closing costs in connection with acquiring the land 42,000Architect’s fee for the plans for the new building 50,000Payments to Maxtor for building construction 3,250,000Equipment purchased 860,000Freight charges on equipment 32,000Trees, plants, and other landscaping 45,000Installation of a sprinkler system for the landscaping 5,000Cost to build special platforms and install wiring for the equipment 12,000Cost of trial runs to ensure proper installation of the equipment 7,000Fire and theft insurance on the factory for the first year of use 24,000In addition to the above expenditures, Teradene purchased four…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College