FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

(a) Prepare a statement of equivalent production to determine the equivalent units for direct materials

(From Moulding & Direct Material Added), and conversion costs and the cost per equivalent unit for

direct materials and conversion costs.

(b) Calculate the:

- Total cost of units completed and transferred to the Packaging Department

- Cost of the unexpected losses

- Cost of ending work-in-process inventory in the Polishing Department

(c) Complete All Things Brass Work-In-Process Inventory – Polishing Process T-account, clearly showing the

ending balance.

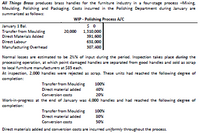

Transcribed Image Text:All Things Brass produces brass handles for the furniture industry in a four-stage process -Mixing

Moulding. Polishing and Packaging Costs incurred in the Polishing Department during January are

summarized as follows:

WIP - Polishing Process A/C

January 1 Bal.

Transfer from Moulding

Direct Materials Added

1,310,000

391,600

20,000

Direct Labour

638,000

Manufacturing Overhead

307,400

Normal losses are estimated to be 2%% of input during the period. Inspection takes place during the

processing operation, at which point damaged handles are separated from good handles and sold as scrap

to local furniture manufacturers at $85 each.

At inspection, 2,000 handles were rejected as scrap. These units had reached the following degree of

completion:

Transfer from Moulding

100%

Direct material added

40%

Conversion costs

20%

Work-in-progress at the end of January was 4,000 handles and had reached the following degree of

completion:

Transfer from Moulding

100%

Direct material added

S0%

Conversion costs

50%

Direct materials added and conversion costs are incurred uniformiy throughout the process.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Equivalent Units of Production and Related Costs The charges to Work in Process-Assembly Department for a period, together with information concerning production, are as follows. All direct materials are placed in process at the beginning of production. Work in Process-Assembly Department Bal., 6,000 units, 25% completed Direct materials, 141,000 units @ $2.1 Direct labor 15,300 To Finished Goods, 138,000 units 296,100 194,700 75,765 ? Factory overhead Bal. 2 units, 65% completed Determine the following: a. The number of units in work in process inventory at the end of the period. units b. Equivalent units of production for direct materials and conversion. If an amount box does not require an entry, leave it blank. Work in Process-Assembly Department Equivalent Units of Production for Direct Materials and Conversion Costs Fquivalentarrow_forwardPlease follow the directions seen in the picture.arrow_forwardOverton Company has gathered the following information. All materials are added at the beginning of the process, and conversion costs are incurred uniformly throughout the process. Units in beginning work in process Units started into production Units in ending work in process Percent complete in ending work in process: Conversion costs Materials Cost of beginning work in process, plus costs incurred during the period: Direct materials Direct labor Overhead (a) Question Part Score (b) Question Part Score (c) Completed and transferred out Ending work in process $ 20,000 $ 164,000 24,000 60 % 100 % Show the assignment of costs to units completed and transferred out and to work in process at the end of the period. $101,200 $164,800 $184,000 2/2 --/2arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education