Concept explainers

Please follow the exact terms and format requested in the image.

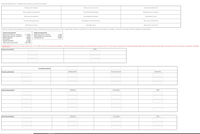

Using the following terms, complete the production cost report shown below:

|

Ending work in |

Total costs to account for | Cost per equivalent unit |

| Units started into production |

Manufacturing |

Beginning work in process |

|

Total units accounted for |

Raw Materials Inventory |

Transferred in costs |

| Incurred during the period | Completed and transferred out |

Total costs accounted for |

| Transferred out costs |

Equivalent units |

Total units to account for |

Materials are added at the beginning of a production process, and ending work in process inventory is 30% complete with respect to conversion costs. Use the information provided to complete a production cost report using the weighted-average method.

PLEASE NOTE: For percent, use whole numbers and "%" (i.e. 25%). For units, use commas as needed (i.e. 1,234). Costs per unit are rounded to two decimal places and shown with "$" and commas as needed (i.e. $1,234.56). All other dollar amounts are rounded to whole dollars and shown with "$" and commas as needed (i.e. $12,345).

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

- Cost of Units Completed and in Process The charges to Work in Process--Assembly Department for a period, together with information concerning production, are as follows. All direct materials are placed in process at the beginning of production.arrow_forwardplease answer within the format by providing formula the detailed workingPlease provide answer in text (Without image)Please provide answer in text (Without image)Please provide answer in text (Without image)arrow_forwardProcess costing divides units into three groups Units from ___________ that are completed during the period. -Transferred in -Work in process -Ending inventory -Beginning Inventory Units that are _______ during the period. -not started -Started and completed -Incomplete Units that are ________ at the end of the period.  -Incomplete -Not started -started and complete arrow_forward

- Equivalent Units of Production and Related Costs The charges to Work in Process-Assembly Department for a period, together with information concerning production, are as follows. All direct materials are placed in process at the beginning of production. Work in Process-Assembly Department Bal., 6,000 units, 25% completed Direct materials, 141,000 units @ $2.1 Direct labor 15,300 To Finished Goods, 138,000 units 296,100 194,700 75,765 ? Factory overhead Bal. 2 units, 65% completed Determine the following: a. The number of units in work in process inventory at the end of the period. units b. Equivalent units of production for direct materials and conversion. If an amount box does not require an entry, leave it blank. Work in Process-Assembly Department Equivalent Units of Production for Direct Materials and Conversion Costs Fquivalentarrow_forwardWhen using the weighted-average method of process costing, total equivalent units produced for a given period equal: Which of the followubg below is correct and why 1. The number of units started and completed during the period plus the number of units in beginning work in process plus the number of units in ending work in process. 2. The number of units in beginning work in process plus the number of units started during the period plus the number of units remaining in ending work in process times the percentage of work necessary to complete the items. 3. The number of units in beginning work in process times the percentage of work necessary to complete the items plus the number of units started and completed during the period plus the number of units started this period and remaining in ending work in process times the percentage of work necessary to complete the items. 4. The number of units transferred out during the period plus the number of units remaining in ending work in…arrow_forwardPlease follow the directions seen in the picture.arrow_forward

- In process costing, costs are accounted for by a. year. b. process. c. job. d. batcharrow_forwardA manufacturer reports three activities: assembling components into products; product design; and purchase order processing. Determine whether each of the following cost drivers relates to assembly, design, or purchase order processing. Cost Driver 1. Number of design changes 2. Finishing machine hours 3. Number of design hours 4. Number of purchase orders received 5. Number of purchase orders processed 6. Direct labor hours to finish production Activityarrow_forwardOverton Company has gathered the following information. All materials are added at the beginning of the process, and conversion costs are incurred uniformly throughout the process. Units in beginning work in process Units started into production Units in ending work in process Percent complete in ending work in process: Conversion costs Materials Cost of beginning work in process, plus costs incurred during the period: Direct materials Direct labor Overhead (a) Question Part Score (b) Question Part Score (c) Completed and transferred out Ending work in process $ 20,000 $ 164,000 24,000 60 % 100 % Show the assignment of costs to units completed and transferred out and to work in process at the end of the period. $101,200 $164,800 $184,000 2/2 --/2arrow_forward

- make a production cost report Please don't give answer & formulae in image based format.. thankuarrow_forwardHow is activity-based cost allocation useful to management for control and evaluation of the performance of a department? List three points only and briefly discuss them. Why is it necessary for the cost accountant to determine the percentage of completion in the ending work in process inventory at the end of the period? Briefly explain.arrow_forwardDuring production, how are the costs in process costing accumulated?A. to cost of goods soldB. to each individual productC. to manufacturing overheadD. to each individual departmentarrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education