FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

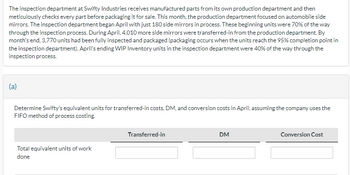

Transcribed Image Text:The inspection department at Swifty Industries receives manufactured parts from its own production department and then

meticulously checks every part before packaging it for sale. This month, the production department focused on automobile side

mirrors. The inspection department began April with just 180 side mirrors in process. These beginning units were 70% of the way

through the inspection process. During April, 4,010 more side mirrors were transferred-in from the production department. By

month's end, 3,770 units had been fully inspected and packaged (packaging occurs when the units reach the 95% completion point in

the inspection department). April's ending WIP Inventory units in the inspection department were 40% of the way through the

inspection process.

(a)

Determine Swifty's equivalent units for transferred-in costs, DM, and conversion costs in April, assuming the company uses the

FIFO method of process costing.

Total equivalent units of work

done

Transferred-in

DM

Conversion Cost

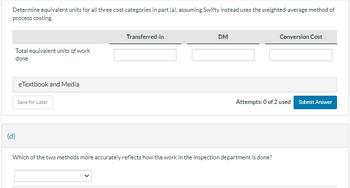

Transcribed Image Text:Determine equivalent units for all three cost categories in part (a), assuming Swifty instead uses the weighted-average method of

process costing.

Total equivalent units of work

done

eTextbook and Media

Save for Later

Transferred-in

DM

Conversion Cost

Attempts: 0 of 2 used Submit Answer

(d)

Which of the two methods more accurately reflects how the work in the inspection department is done?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 1 steps

Knowledge Booster

Similar questions

- Smith Electronic Company’s chip-mounting production department had 300 units of unfinished product, each 50% completed on September 30. During October of the same year, this department put another 900 units into production and completed 1,000 units and transferred them to the next production department. At the end of October, 200 units of unfinished product, 70% completed, were recorded in the ending Work-in-Process Inventory. Smith Electronic introduces all direct materials when the production process is 50% complete. Direct labor and factory overhead (i.e., conversion) costs are added uniformly throughout the process. Following is a summary of production costs incurred during October: Direct Materials Conversion Costs Beginning work-in-process $ 3,712 Costs added in October $ 9,900 6,400 Total costs $ 9,900 $ 10,112 Required: 1. Calculate each of the following amounts using weighted-average process costing:a. Equivalent units of direct materials and…arrow_forwardWoolens Corp. manufactures bolts of wool cloth. The wool cloth is cut and manufactured in the Manufacturing Department. When manufacturing is complete, the bolts of cloth are then transferred to the Inspection Department. In the Inspection Department the bolts of wool cloth pass through various quality control tests. Direct materials for inspecting the wool cloth are added when the inspection process is 90% complete; conversion costs are added evenly throughout. For the current period the Manufacturing Department transferred 25,000 units to the Inspection Department. Beginning work in process in the Inspection Department included 4,000 units that were 70% complete as to conversion. Ending inventory totaled 9,000 units that were 20% complete as to conversion. a. Calculate the Inspection Department's equivalent units for transferred-in, direct materials and conversion costs (respectively) using the FIFO method of process costing.arrow_forwardHarson Co. manufactures a single product in two departments: Forming and Assembly. During May, the Forming department completed a number of units of a product and transferred them to Assembly. Of these transferred units, 62,500 were in process in the Forming department at the beginning of May and 175,000 were started and completed in May. May’s Forming department beginning inventory units were 40% complete with respect to materials and 80% complete with respect to conversion. At the end of May, 76,250 additional units were in process in the Forming department and were 80% complete with respect to materials and 20% complete with respect to conversion. The Forming department had $683,750 of direct materials and $446,050 of conversion cost charged to it during May. Its beginning inventory included $99,075 of direct materials cost and $53,493 of conversion cost. 1. Compute the number of units transferred to Assembly. 2. Compute the number of equivalent units with respect to both materials…arrow_forward

- At the start of June, the Polishing Department of Corona Counters, Inc. had 15,000 units in beginning inventory. During the month, it received 25,000 units from the Machining Department. It started and completed 17,000 units and transferred 32,000 units to the Packaging Department. It had 8,000 units in ending Work-in-Process Inventory. Direct materials are added at the beginning of the process. Units in beginning Work-in-Process Inventory were 50% complete in respect to conversion costs. Units in ending Work-in-Process Inventory were 40% complete with respect to conversion costs. Prepare the production cost report for the Polishing Department for the equivalent units of production for the month of June. Use the FIFO method.arrow_forwardOn March 1, the Mixing Department had 200 rolls of paper in process. During March, the Mixing Department completed the mixing process for those 200 rolls and also started and completed the mixing process for an additional 4,800 rolls of paper. The department started but did not finish the mixing process for an additional 500 rolls, which were 20% complete with respect to both direct materials and conversion work at the end of March. Direct materials and conversion costs are incurred evenly throughout the mixing process.arrow_forwardWhat will be the equivalent units for materials and cost per unit of materials.arrow_forward

- Smith Electronic Company's chip-mounting production department had 300 units of unfinished product, each 50% completed on September 30. During October of the same year, this department put another 900 units into production and completed 1,000 units and transferred them to the next production department. At the end of October, 200 units of unfinished product, 70% completed, were recorded in the ending Work-in-Process Inventory. Smith Electronic introduces all direct materials when the production process is 50% complete. Direct labor and factory overhead (i.e., conversion) costs are added uniformly throughout the process. Following is a summary of production costs incurred during October: Beginning work-in-process Costs added in October Total costs Direct Materials $ 8,200 $ 8,200 Required: 1. Calculate each of the following amounts using weighted-average process costing: a. Equivalent units of direct materials and conversion. b. Equivalent unit costs of direct materials and conversion.…arrow_forwardRSTN Company produces its product in two sequential processing departments. During October, the first process finished and transferred 295,000 units of its product to the second process. Of these units, 34,000 were in process at the beginning of the month and 261,000 were started and completed during the month. At month-end, 27,500 units were in process. Compute the number of equivalent units of production for direct materials for the first process for October under each of the following three separate assumptions using the FIFO method. 1 All direct mastarrow_forwardRSTN Company produces its product in two sequential processing departments. During October, the first process finished and transferred 295,000 units of its product to the second process. Of these units, 34,000 were in process at the beginning of the month and 261,000 were started and completed during the month. At month-end, 27,500 units were in process. Compute the number of equivalent units of production for direct materials for the first process for October under each of the following three separate assumptions using the FIFO method. 1 All direct mastarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education