Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Financial accounting 2-23-54

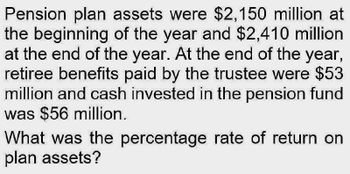

Transcribed Image Text:Pension plan assets were $2,150 million at

the beginning of the year and $2,410 million

at the end of the year. At the end of the year,

retiree benefits paid by the trustee were $53

million and cash invested in the pension fund

was $56 million.

What was the percentage rate of return on

plan assets?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- I need answer this question accountingarrow_forwardPension plan assets were $80 million at the beginning of the year and $83 million at the end of the year. The return on plan assets was 5%. At the end of the year, cash invested in the pension fund was $7 million. What was the amount of the retiree benefits paid by the trustee?arrow_forwardNeed help solve accounting questionarrow_forward

- Pension plan assets were $320 million at the beginning of the year. The return on plan assets was 5%. At the end of the year, retiree benefits paid by the trustee were $14 million and cash invested in the pension fund was $18 million. What was the amount of the pension plan assets at year-end? Note: Enter your answer in millions (i.e., 10,000,000 should be entered as 10). Pension plan assets millionarrow_forwardThe projected benefit obligation was $480 million at the beginning of the year. Service cost for the year was $26 million. At the end of the year, pension benefits paid by the trustee were $22 million and there were no pension-related other comprehensive income accounts. The actuary's discount rate was 5%. What was the amount of the projected benefit obligation at year-end? End of the year PBO C millionarrow_forwardSagararrow_forward

- For Windsor Corporation, year-end plan assets were $1,999,000. At the beginning of the year, plan assets were $1,773,000. During the year, contributions to the pension fund were $112,000, and benefits paid were $203,000.Compute Windsor’s actual return on plan assets.arrow_forwardFor Blossom Corporation, year-end plan assets were $1,998,000. At the beginning of the year, plan assets were $1,774,000. During the year, contributions to the pension fund were $129,000, and benefits paid were $191,000. Compute Blossom's actual return on plan assets. Actual return on plan assets $arrow_forwardThe projected benefit obligation was $300 million at the beginning of the year. Service cost for the year was $17 million. At the end of the year, pension benefits paid by the trustee were $13 million and there were no pension-related other comprehensive income accounts. The actuary’s discount rate was 5%. What was the amount of the projected benefit obligation at year-end?arrow_forward

- For Skysong Corporation, year-end plan assets were $ 2,000,000. At the beginning of the year, plan assets were $ 1,764,000. During the year, contributions to the pension fund were $ 113,000, and benefits paid were $ 184,000.Compute Skysong’s actual return on plan assets.arrow_forwardFor Stubby Corporation, year-end plan assets were P2, 000,000. At the beginning of the year, plan assets were P1, 780,000. During the year, contributions to the pension fund were P120, 000, and benefits paid were P200, 000. Compute Warren’s actual return on plan assets.arrow_forwardPlease no written by hand solutions Pension plan assets were $80 million at the beginning of the year and $83 million at the end of the year. The return on plan assets was 5%. At the end of the year, cash invested in the pension fund was $7 million. What was the amount of the retiree benefits paid by the trustee?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning