Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

Need help with this question solution general accounting

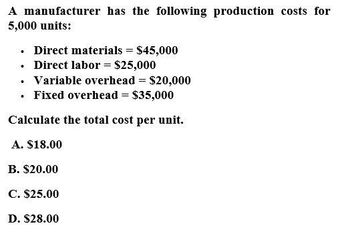

Transcribed Image Text:A manufacturer has the following production costs for

5,000 units:

⚫ Direct materials = $45,000

•

. Direct labor = $25,000

⚫ Variable overhead = $20,000

•

⚫ Fixed overhead = $35,000

Calculate the total cost per unit.

A. $18.00

B. $20.00

C. $25.00

D. $28.00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- A firm has 100,000 in direct materials costs, 50,000 in direct labor costs, and 80,000 in overhead. Which of the following is true? a. Prime costs are 150,000; conversion costs are 180,000. b. Prime costs are 130,000; conversion costs are 150,000. c. Prime costs are 150,000; conversion costs are 130,000. d. Prime costs are 180,000; conversion costs are 150,000.arrow_forwardThe following product costs are available for Stellis Company on the production of erasers: direct materials, $22,000; direct labor, $35,000; manufacturing overhead, $17,500; selling expenses, $17,600; and administrative expenses; $13,400. What are the prime costs? What are the conversion costs? What is the total product cost? What is the total period cost? If 13,750 equivalent units are produced, what is the equivalent material cost per unit? If 17,500 equivalent units are produced, what is the equivalent conversion cost per unit?arrow_forwardWhat is the conversion cost to manufacture insulated travel cups if the costs are: direct materials, $17,000; direct labor, $33,000; and manufacturing overhead, $70,000? A. $16,000 B. $50,000 C. $103,000 D. $120000arrow_forward

- Direct materials = $10 per unitDirect labor = $5 per unitVariable manufacturing overhead = $2 per unitFixed manufacturing overhead = $1,000Units produced is 1,000 units What is the cost per unit using the absorption method? What is the cost per unit using the variable method?arrow_forwardEon Ltd produces 15,000 products with Variable Cost per unit being £7 direct materials, £10 direct labour, and £24 variable overhead. In addition to the per-unit costs, the fixed overhead is £75,000. What is the unit cost of the product using the absorption costing technique? a. £42 b. £46 c. £52 d. £56arrow_forwardLighthouse Company had the following information: At a manufacturing level of 5,000 units, variable and fixed manufacturing costs are $30 and $8 per unit, respectively. Selling price is $60 per unit. What is the total manufacturing cost for 10,000 units? a. $300,000 b. $380,000 c. $340,000 d. $600,000arrow_forward

- Company XYZ has total prime cost of $12,000 and total conversion cost of $24,000. Assume that manufacturing overhead cost is five times the direct labor cost how much is the direct materials cost Select one: O a. 8,000 O b.4.000 O C. None of the given answers O d. 12.000 O e. 20,000arrow_forwardComplete the following manufacturing cost schedule (a through j) for Lazer Tag. Parts Produced 50,000 100,000. TOTAL COSTS: Variable $75,000 $150,000. Fixed ..arrow_forwardCompany XYZ has total prime cost of $6,000 and total conversion cost of $12,000. Assume that manufacturing overhead cost is three times the direct labor cost, how much is the direct materials cost? Select one: O a. 6,000 O b. None of the given answers O C. 4,000 O d. 9,000 O e. 3,000arrow_forward

- clarks Ltd uses the following cost function: Y = $7000 + $8.50X. If the number of units produced in a month is 200, what would be the total cost? a) $7,170 b) $7008.50 c) $8,700 d) $7,800arrow_forwardThe standard costs and actual costs for direct materials for the manufacture of 3,000 actual units of product are Actual Material price per pound of direct material Quantity of material in pound per unit of product Actual production untis of product BDMOV (AQ SQ) for Actual Production x SP C DMCV DMPV + DMOV Actual cost per unit of product (AC) Standard costs per unit of product (SC) $8.00 Alternate formula to compute DMCV= (Actual cost-standard cost) per unit x # of units 065 3,000 Required: Compute the followings variances and indicate if they are favorable (F) or unfavorable (UF) A. Direct material Price variance (DMPV) B. Direct matenal Quantity variance (DMQV) C. Total Direct material Cost variance (DMCV) Solution: A.DMPV = (AP-SP) x AQ for Actual Production Standard Variance $ For UF ($1,462 50) F ($5,250.00) F AQ $8.75 SQ 0.45 ($6.712 50) F 1950 1350 Acronyms: AP Actual price per unit of Material SP Standard price per unit of Material AQ-Actual quantity of Material for Actual…arrow_forwardLillibridge & Friends, Incorporated provides you with the following data for its single product: Sales price per unit $ 170 Fixed costs (per quarter): Selling, general, and administrative (SG&A) 1,500,000 Manufacturing overhead 4,500,000 Variable costs (per unit): Direct labor 20 Direct materials 23 Manufacturing overhead 21 SG&A 17 Number of units produced per quarter 500,000 units Required: Compute the amounts for each of the following assuming that the production levels are within the relevant range if the number of units is 500,000 per quarter. Also calculate if the number of units increases to 600,000 per quarter. Note: Do not round intermediate calculations. Round your answers to 2 decimal places.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,