Principles of Cost Accounting

17th Edition

ISBN: 9781305087408

Author: Edward J. Vanderbeck, Maria R. Mitchell

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

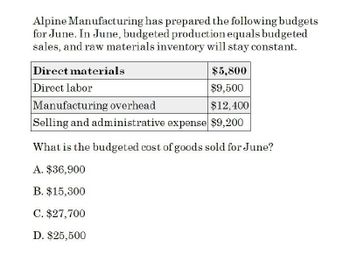

What is the budgeted cost of goods sold for June on this general accounting question?

Transcribed Image Text:Alpine Manufacturing has prepared the following budgets

for June. In June, budgeted production equals budgeted

sales, and raw materials inventory will stay constant.

Direct materials

Direct labor

Manufacturing overhead

$5,800

$9,500

$12,400

Selling and administrative expense $9,200

What is the budgeted cost of goods sold for June?

A. $36,900

B. $15,300

C. $27,700

D. $25,500

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Digital Solutions Inc. uses flexible budgets that are based on the following data: Prepare a flexible selling and administrative expenses budget for October for sales volumes of 500,000, 750,000, and 1,000,000.arrow_forwardBudgeted income statement and supporting budgets for three months Bellaire Inc. gathered the following data for use in developing the budgets for the first quarter (January, February, March) of its fiscal year: Estimated sales at 125 per unit: Estimated finished goods inventories: Work in process inventories are estimated to be insignificant (zero). Estimated direct materials inventories: Manufacturing costs: Selling expenses: Instructions Prepare the following budgets using one column for each month and a total column for the first quarter, as shown for the sales budget: Prepare a sales budget for March. Prepare a production budget for March. Prepare a direct materials purchases budget for March. Prepare a direct labor cost budget for March. Prepare a factory overhead cost budget for March. Prepare a cost of goods sold budget for March. Prepare a selling and administrative expenses budget for March. Prepare a budgeted income statement with budgeted operating income for March.arrow_forwardSales, production, direct materials purchases, and direct labor cost budgets The budget director of Gourmet Grill Company requests estimates of sales, production, and other operating data from the various administrative units every month. Selected information concerning sales and production for July is summarized as follows: Estimated sales for July by sales territory: Estimated inventories at July 1: Desired inventories at July 31: Direct materials used in production: Anticipated purchase price for direct materials: Direct labor requirements: Instructions Prepare a sales budget for July. Prepare a production budget for July. Prepare a direct materials purchases budget for July. Prepare a direct labor cost budget for July.arrow_forward

- Sales, production, direct materials purchases, and direct labor cost budgets The budget director of Royal Furniture Company requests estimates of sales, production, and other operating data from the various administrative units every month. Selected information concerning sales and production for February is summarized as follows: Estimated sales of King and Prince chairs for February by sales territory: Estimated inventories at February 1: Desired inventories at February 28: Direct materials used in production: Anticipated purchase price for direct materials: Direct labor requirements: Instructions Prepare a sales budget for February. Prepare a production budget for February. Prepare a direct materials purchases budget for February. Prepare a direct labor cost budget for February.arrow_forwardBudgeted income statement and supporting budgets The budget director of Birding Homes Feeders Inc., with the assistance of the controller, treasurer, production manager, and sales manager, has gathered the following data for use in developing the budgeted income statement for January: Estimated sales for January: Estimated inventories at January 1: Desired inventories at January 31: Direct materials used in production: Anticipated cost of purchases and beginning and ending inventory of direct materials: Direct labor requirements: Estimated factory overhead costs for January: Estimated operating expenses for January: Estimated other revenue and expense for January: Estimated tax rate: 25% Instructions Prepare a sales budget for January. Prepare a production budget for January. Prepare a direct materials purchases budget for January. Prepare a direct labor cost budget for January. Prepare a factory overhead cost budget for January. Prepare a cost of goods sold budget for January. Work in process at the beginning of January is estimated to be 9,000, and work in process at the end of January is estimated to be 10,500. Prepare a selling and administrative expenses budget for January. Prepare a budgeted income statement for January.arrow_forwardThe sales department of Macro Manufacturing Co. has forecast sales for its single product to be 20,000 units for June, with three-quarters of the sales expected in the East region and one-fourth in the West region. The budgeted selling price is 25 per unit. The desired ending inventory on June 30 is 2,000 units, and the expected beginning inventory on June 1 is 3,000 units. Prepare the following: a. A sales budget for June. b. A production budget for June.arrow_forward

- Budgeted income statement and supporting budgets The budget director of Gold Medal Athletic Co., with the assistance of the controller, treasurer, production manager, and sales manager, has gathered the following data for use in developing the budgeted income statement for March: Estimated sales for March: Estimated inventories at March 1: Desired inventories at March 31: Direct materials used in production: Anticipated cost of purchases and beginning and ending inventory of direct materials: Direct labor requirements: Estimated factory overhead costs for March: Estimated operating expenses for March: Estimated other revenue and expense for March: Estimated tax rate: 30% Instructions Prepare a sales budget for March. Prepare a production budget for March. Prepare a direct materials purchases budget for March. Prepare a direct labor cost budget for March. Prepare a factory overhead cost budget for March. Prepare a cost of goods sold budget for March. Work in process at the beginning of March is estimated to be 15,300, and work in process at the end of March is desired to be 14,800. Prepare a selling and administrative expenses budget for March. Prepare a budgeted income statement for March.arrow_forwardOperating Budget, Comprehensive Analysis Allison Manufacturing produces a subassembly used in the production of jet aircraft engines. The assembly is sold to engine manufacturers and aircraft maintenance facilities. Projected sales in units for the coming 5 months follow: The following data pertain to production policies and manufacturing specifications followed by Allison Manufacturing: a. Finished goods inventory on January 1 is 32,000 units, each costing 166.06. The desired ending inventory for each month is 80% of the next months sales. b. The data on materials used are as follows: Inventory policy dictates that sufficient materials be on hand at the end of the month to produce 50% of the next months production needs. This is exactly the amount of material on hand on December 31 of the prior year. c. The direct labor used per unit of output is 3 hours. The average direct labor cost per hour is 14.25. d. Overhead each month is estimated using a flexible budget formula. (Note: Activity is measured in direct labor hours.) e. Monthly selling and administrative expenses are also estimated using a flexible budgeting formula. (Note: Activity is measured in units sold.) f. The unit selling price of the subassembly is 205. g. All sales and purchases are for cash. The cash balance on January 1 equals 400,000. The firm requires a minimum ending balance of 50,000. If the firm develops a cash shortage by the end of the month, sufficient cash is borrowed to cover the shortage. Any cash borrowed is repaid at the end of the quarter, as is the interest due (cash borrowed at the end of the quarter is repaid at the end of the following quarter). The interest rate is 12% per annum. No money is owed at the beginning of January. Required: 1. Prepare a monthly operating budget for the first quarter with the following schedules. (Note: Assume that there is no change in work-in-process inventories.) a. Sales budget b. Production budget c. Direct materials purchases budget d. Direct labor budget e. Overhead budget f. Selling and administrative expenses budget g. Ending finished goods inventory budget h. Cost of goods sold budget i. Budgeted income statement j. Cash budget 2. CONCEPTUAL CONNECTION Form a group with two or three other students. Locate a manufacturing plant in your community that has headquarters elsewhere. Interview the controller for the plant regarding the master budgeting process. Ask when the process starts each year, what schedules and budgets are prepared at the plant level, how the controller forecasts the amounts, and how those schedules and budgets fit in with the overall corporate budget. Is the budgetary process participative? Also, find out how budgets are used for performance analysis. Write a summary of the interview.arrow_forwardPilsner Inc. purchases raw materials on account for use in production. The direct materials purchases budget shows the following expected purchases on account: Pilsner typically pays 25% on account in the month of billing and 75% the next month. Required: 1. How much cash is required for payments on account in May? 2. How much cash is expected for payments on account in June?arrow_forward

- Mesa Aquatics, Inc. estimated direct labor hours as 1,900 in quarter 1, 2,000 in quarter 2.2,200 in quarter 3, and 1,800 in quarter 4. a sales and administration budget using the information provided.arrow_forwardAt the beginning of the period, the Fabricating Department budgeted direct labor of 72,000 and equipment depreciation of 18,500 for 2,400 hours of production. The department actually completed 2,350 hours of production. Determine the budget for the department, assuming that it uses flexible budgeting.arrow_forwardFlexible overhead budget Leno Manufacturing Company prepared the following factory overhead cost budget for the Press Department for October of the current year, during which it expected to require 20,000 hours of productive capacity in the department: Assuming that the estimated costs for November are the same as for October, prepare a flexible factory overhead cost budget for the Press Department for November for 18,000, 20,000, and 22.000 hours of production.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT