EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

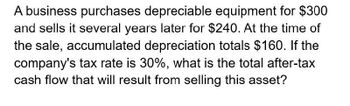

Transcribed Image Text:A business purchases depreciable equipment for $300

and sells it several years later for $240. At the time of

the sale, accumulated depreciation totals $160. If the

company's tax rate is 30%, what is the total after-tax

cash flow that will result from selling this asset?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- A company purchases depreciable equipment for $215 and sells it a few years later for $180. At the time of the sale, accumulated depreciation totals $120. If the company's tax rate is 36%, what is the total after-tax cash flow that will result from selling this asset?arrow_forwardA company purchases depreciable equipment for $215 and sells it a few years later for $180. At the time of the sale, accumulated depreciation totals $120. If the company's tax rate is 36%, what is the total after-tax cash flow that will result from selling this asset? Answerarrow_forwardA company purchases depreciable equipment for $250 and sells it five years later for $180. At the time of the sale, accumulated depreciation totals $120. If the company's tax rate is 35%, what is the total after-tax cash flow that will result from selling this asset?arrow_forward

- What is the total after tax cash flow that will result from selling this asset on these financial accounting question?arrow_forwardYou decide to sell a price of equipment for $5,000. It had been depreciated to $3,000. The original purchase price was $6,000. Your tax rate is 20%. What are your after-tax proceeds from the sale? A) $400 B) $600 C) $5,000 D) $4,600 E) $5,400arrow_forwardWhat is the expected after - tax cash flow from selling a piece of equipment if Probst purchases the equipment today for $548, 860.00, the tax rate is 39.9 percent, the equipment will be sold in 3 years for $98, 800.00, and the equipment will be depreciated to $72, 600.00 over 12 years using straight - line depreciation? $106, 885.74 (plus or minus $10) $262, 538.29 (plus or minus $10) - $72, 688.20 (plus or minus $10) $230,867.00 (plus or minus $10) None of the above is within $10 of the correct answerarrow_forward

- Consider an asset that costs $1,075, 196 and is depreciated straight-line to zero over its 15-year tax life. The asset is to be used in a 5-year project; at the end of the project, the asset can be sold for $109, 800. If the relevant tax rate is 0.39, what is the aftertax cash flow from the sale of this asset (SVNOT)?arrow_forwardThe tax on $2,600 of profit on a capital asset is deferred. A person in a 40 percent tax bracket will have to pay what amount of taxes when the asset is sold? (Round your answer to the nearest whole number.)arrow_forwardConsider an asset that costs $601,119 and is depreciated straight-line to zero over its 10-year tax life. The asset is to be used in a 4-year project; at the end of the project, the asset can be sold for $184,314. If the relevant tax rate is 0.27, what is the aftertax cash flow from the sale of this asset?arrow_forward

- a. Calculate the after tax income if (1) Corrie Company keeps the warehouse and (2) if Corrie Company sells the warehouse.arrow_forwardConsider an asset that costs $1,280,170 and is depreciated straight-line to 83,206 over its 14-year tax life. The asset is to be used in a 4-year project; at the end of the project, the asset can be sold for $128,169. If the relevant tax rate is 0.21, what is the aftertax cash flow from the sale of this asset (SVNOT)?arrow_forwardEaster Corporation will replace one of its assets with an updated model. The current asset was purchased two years ago at a cost of $70,000. It has been depreciated under MACRS using a five-year recovery period. The company can sell this existing asset for $30,000. The new asset is going to cost $80,000 and will also be depreciated under MACRS using a five-year recovery period. If the assumed tax rate is 40 percent on both ordinary income and capital gains, the initial investment will be equal to what amount after adjusting for taxes?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT