FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

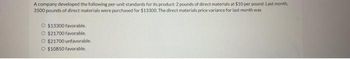

Transcribed Image Text:A company developed the following per-unit standards for its product: 2 pounds of direct materials at $10 per pound. Last month,

3500 pounds of direct materials were purchased for $13300. The direct materials price variance for last month was

O $13300 favorable.

O $21700 favorable.

O $21700 unfavorable.

O $10850 favorable.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 3.arrow_forwardApril Corporation developed the following per-unit standards for its product: 2 pounds of direct materials at $3.75 per pound. Last month, 2,000 pounds of direct materials were used to produce 900 units of product. The direct materials usage variance for last month was: Multiple Choice $200 favorable. $750 unfavorable. $1,800 favorable. $200 unfavorable.arrow_forwardSubm The standards for product V28 call for 8.0 pounds of a raw material that costs $18.80 per pound. Last month, 1,900 pounds of the raw material were purchased for $35,340. The actual output of the month was 210 units of product V28. A total of 1,800 pounds of the raw material were used to produce this output. The direct materials purchases variance is computed when the materials are purchased. Required: a. What is the materials price variance for the month? b. What is the materials quantity variance for the month? Note: Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Input all amounts as positive values. a. Materials price variance b. Materials quantity variancearrow_forward

- Company XYZ uses a single raw material in its production process. The standard price for a unit of material is $2.00. During the month the company purchased and used 600 units of this material at a price of $2.25 per unit. The standard quantity required per finished product is 2 units and during the month, the company produced 310 finished units. How much was the material quantity variance? A. $40 favorable. B. $45 unfavorable. C. $45 favorable. D. $40 unfavorable.arrow_forward1. The standard and actual prices per pound of raw material are $4.00 and $4.50, respectively. A total of 10,500 pounds of raw material was purchased and then used to produce 5,000 units. The quantity standard allows two pounds of the raw material per unit produced. What was the materials quantity variance? a. $5,000 unfavorable b. $5,000 favorable c. $2,000 favorable d. $2,000 unfavorable 2. Referring to the facts in question 1 above, what was the material price variance? a. $5,250 favorable b. $5,250 unfavorable c. $5,000 unfavorable d. $5,000 favorablearrow_forwardThe standard direct labor cost for producing one unit of product is 4 direct labor hours at a standard rate of pay of $20. Last month, 15000 units were produced and 58500 direct labor hours were actually worked at a total cost of $1050000. The direct labor quantity variance was O $45000 favorable. O $30000 favorable. O $45000 unfavorable. O$30000 unfavorable.arrow_forward

- Zillow Inc. has the following data related to direct materials costs for the current month: actual cost for 7,000 pounds of material at $2.50 per pound and standard cost for 6,700 pounds of material at $3.20 per pound. What is the direct materials price variance? Group of answer choices -$4,900 favorable $4,900 unfavorable -$960 unfavorable $960 favorablearrow_forwardplease answer complete and correct with full working like explanation , formula , computation and steps need correct answer with all work thanksarrow_forwardMyers Corporation has the following data related to direct materials costs for November: actual costs for 4,700 pounds of material at $5.30 per pound; and standard costs for 4,410 pounds of material at $6.20 per pound. What is the direct materials price variance? a. $4,230 favorable b. $1,798 favorable c. $1,798 unfavorable d. $4,230 unfavorablearrow_forward

- In its first month of operations, Multiplex Corporation purchased 40,000 pounds of material for $3.40 per pound. The company used 38,000 pounds of the material to produce 18,000 units of its only product. Multiplex uses a standard cost system and its standard quantity and price per unit are 2 pounds at $3.50 per pound. What was the material efficiency variance for the month? Multiple Choice $5,000 unfavorable None of these. $7,000 favorable $7,000 unfavorable $5,000 favorablearrow_forward5. During August, 10,000 units were produced. The standard quantity of material allowed per unit was 10 pounds at a standard cost of $3 per pound. If there was an unfavorable usage variance of $18,750 for August, the actual quantity of materials used must be * O 23,438 pounds. O 93,750 pounds. O 31,875 pounds. O 106,250 pounds. 6. ColorPro uses part 87A in the production of color printers. Unit manufacturing costs for part 87A are: Direct materials $8 Direct labor Variable overhead Fixed overhead 4 ColorPro uses 100,000 units of 87A per year. Filbert Company has offered to sell ColorPro 100,000 units of 87A per year for $12. Fixed overhead is unavoidable. Should ColorPro make or buy the part? * 2 Make the part because it will save $100,000 over buying it. O Make the part because it will save $1,100,000 over buying it. Buy the part because it will save $300,000 over making it. Buy the part because it will save $100,000 over making it. Buy the part because it will save 1,100,000 over…arrow_forwardThe Ferguson Company estimated that October sales would be 100,000 units with an average selling price of $6.00. Actual sales for October were 105,000 units, and average selling price was $5.95. The sales volume variance was: Multiple Choice О $5,250 unfavorable. $5,250 favorable. $5,000 unfavorable. О $5,000 favorable.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education