Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

thumb_up100%

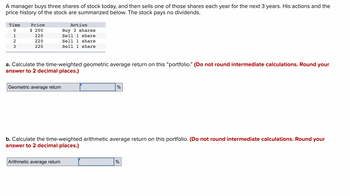

Transcribed Image Text:A manager buys three shares of stock today, and then sells one of those shares each year for the next 3 years. His actions and the

price history of the stock are summarized below. The stock pays no dividends.

Time

0

1

2

3

Price

$ 200

220

220

220

a. Calculate the time-weighted geometric average return on this "portfolio." (Do not round intermediate calculations. Round your

answer to 2 decimal places.)

Geometric average return

Action

Buy 3 shares

Sell 1 share

Sell 1 share

Sell 1 share

Arithmetic average return

%

b. Calculate the time-weighted arithmetic average return on this portfolio. (Do not round intermediate calculations. Round your

answer to 2 decimal places.)

%

Transcribed Image Text:c. Calculate the dollar-weighted average return on this portfolio. (Do not round intermediate calculations. Round your answer to 2

decimal places.)

Dollar-weighted average return

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- You buy 100 shares of stock at a price of $51.37, using 30% initial margin. Some time later, the stock is trading at $49.07, and you sell it and repay the loan. What is your return on this position? Assume no dividends were paid and no interest was accrued on the broker's loan. Enter answer in percents, to two decimal places.arrow_forwardEXCEL PROJECT AND EXCEL SOLUTION Consider the following stocks, all of which will pay a liquidating dividend in a year and nothing in the interim: Stock A Stock B Stock с Stock D Market Capitalization (5 million) 800 750 950 900 Expected Liquidating Dividend ($ million) 1000 1000 1000 1000 Beta PLEASE SHOW SOLUTIONS IN EXCEL 0.77 1.46 1.25 1.07 a. Calculate the expected return of each stock. b. What is the sign of correlation between the expected return and market capitalization of the stocks? In Problem 20, assume the risk-free rate is 3% and the market risk premium is 7%. a. What does the CAPM predict the expected return for each stock should be? b. Clearly, the CAPM predictions are not equal to the actual expected returns, so the CAPM does not hold. You decide to investigate this further. To see what kind of mistakes the CAPM is making, you decide to regress the actual expected return onto the expected return predicted by the CAPM.49 What is the intercept and slope coefficient of…arrow_forwardXYZ's stock price and dividend history are as follows: Year Beginning-of-Year Price 2019 2020 2021 2022 $88 108 78 88 Dividend Paid at Year-End $4 An investor buys three shares of XYZ at the beginning of 2019, buys another two shares at the beginning of 2020, sells one share at the beginning of 2021, and sells all four remaining shares at the beginning of 2022 Arithmetic average rate of return Geometric average rate of return Required: a. What are the arithmetic and geometric average time-weighted rates of return for the investor? (Round your year-by-year rates of return and final answers to 2 decimal places. Do not round other calculations.) Dollar-weighted rate of return 4 4 4 % % b. What is the dollar-weighted rate of return? (Hint Carefully prepare a chart of cash flows for the four dates corresponding to the turns of the year for January 1, 2019, to January 1, 2022. If your calculator cannot calculate IRR, you will have to use trial and error or a spreadsheet program.) (Round your…arrow_forward

- An investor opens a margin account with an initial deposit of $5500. He then purchases 870 shares of a stock at $44. His margin account has a maintenance margin requirement of 30%. Ignoring commissions and interest, IF the price changed to 27 WHAT IS YOUR NEW EQUITY The correct answer is AT WHAT PRICE YOU WILL GET A MARGIN CALL PRICE?arrow_forwardVijayarrow_forwardIn you cash account, you buy 100 shares of XYZ Corporation at a price of $10 per share. Two months later, XYZ pays a dividend $0.21 per share. You sell all 100 shares of XYZ three months later at a price of $12 per share. If you wanted to lever up the returns of this trade, you could have executed it in your _____ account. A) cash B) margin C) brokerage D) bankarrow_forward

- You buy stock on margin in your brokerage account when it is trading at $42.76 per share. You have $4050 in equity (cash) in your account and buy 195 shares. Your broker makes a margin loan so you can pay the difference at an annual rate of 0.0825 One year later the stock price is 44.9 What is the margin percentage in the account one year after the trade is made? Group of answer choices 0.4933 0.4698 0.4247 0.4447 0.4014arrow_forwardWhat about for these? (b) Suppose you have purchased some GameStop shares on margin at $5per share. You ask your broker to put in a limit sell order at $7, anda stop loss order at $4.50.i. What will happen if the stock price falls to $4.50?ii. What will happen if the stock price rises to $7?iii. Now suppose you had instead short-sold your GameStop shares(as in the first part of the question). What instructions mightyou give to your broker to minimise your losses and lock in yourgains?arrow_forwardAt the beginning of 2007, an investor buys 2 shares at $100 each. At the beginning of 2008, he buys another 3 shares at $120 each. At the beginning of 2009, he sells 1 share at $110 each. At the beginning of 2010, he sells the remaining 4 shares at $130 each. The stock does not pay any dividend. Calculate the dollar-weighted rate of return.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education