Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

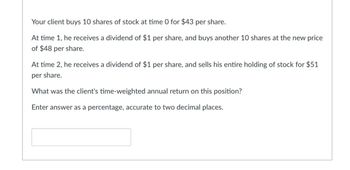

Transcribed Image Text:Your client buys 10 shares of stock at time 0 for $43 per share.

At time 1, he receives a dividend of $1 per share, and buys another 10 shares at the new price

of $48 per share.

At time 2, he receives a dividend of $1 per share, and sells his entire holding of stock for $51

per share.

What was the client's time-weighted annual return on this position?

Enter answer as a percentage, accurate to two decimal places.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- An investor buys shares in a mutual fund for $22. At the end of the year the fund distributes a dividend of $0.52, and after the distribution the net asset value of a share is $24.85. What is the investor's percentage return on the investment? Round your answer to two decimal places. 1arrow_forwardCompute the total and annual returns on the described investment. Five years after buying 200 shares of XYZ stock for $40 per share, you sell the stock for $11,500. The total return is %. (Do not round until the final answer. Then round to one decimal place as needed.)arrow_forwardAn investor purchased a stock one year ago for $82.00. It paid an annual cash dividend of $6.21 and is now worth $93.84. What total return did the investor earn? Would the investor have experienced a capital gain? Explain. The investor would experience a capital gain in the amount of $11.8411.84. The total return earned by the investor is $enter your response here. The total percentage return by the investor 22.0722.07%.arrow_forward

- Suppose you can buy 983 shares of Vertex Pharmaceuticals Incorporated (VRTX) stock on margin at $167 per share. Your initial margin is 51% and you borrow at the 7 percent. You sell your VRTX shares 6 months later for $185 per share. There were no dividends paid and the prices reflect commissions paid. What is your percent return if you buy on margin? [Enter the answer in as a percent (e.g., 5.55% = 5.55) - not a decimal]arrow_forwardYou purchase 110 shares for $40 a share ($4,400), and after a year the price falls to $35. Calculate the percentage return on your investment if you bought the stock on margin and the margin requirement was (ignore commissions, dividends, and interest expense): 15 percent. Use a minus sign to enter the amount as a negative value. Round your answer to one decimal place. % 50 percent. Use a minus sign to enter the amount as a negative value. Round your answer to one decimal place. % 75 percent. Use a minus sign to enter the amount as a negative value. Round your answer to one decimal place. %arrow_forwardIn your portfolio, you own Delta Air Lines and Coca Cola Company stock in which you initially purchase ten shares of each stock at $85 and $30 respectively. At the end of a month, DAL is valued at $90 and KO is valued at $28. Assume, they don’t pay a dividend. What is the initial value of the investment? What is the return (expressed as a percent) for Delta at the end of the first month? What is the return (expressed as a percent) for Coke at the end of the first month?arrow_forward

- An investor buys shares in a mutual fund for $22. At the end of the year the fund distributes a dividend of $0.57, and after the distribution the net asset value of a share is $24.04. What is the investor's percentage return on the investment? Round your answer to two decimal places.arrow_forwardAn investor buys shares in a mutual fund for $20. At the end of the year the fund distributes a dividend of $0.67, and after the distribution the net asset value of a share is $24.57. What is the investor's percentage return on the investment? Round your answer to two decimal places. %arrow_forwardAt the beginning of 2007, an investor buys 2 shares at $100 each. At the beginning of 2008, he buys another 3 shares at $120 each. At the beginning of 2009, he sells 1 share at $110 each. At the beginning of 2010, he sells the remaining 4 shares at $130 each. The stock does not pay any dividend. Calculate the dollar-weighted rate of return.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education