Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

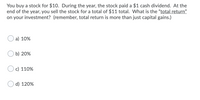

You buy a stock for $10. During the year, the stock paid a $1 cash dividend. At the end of the year, you sell the stock for a total of $11 total. What is the “total return” on your investment? (remember, total return is more than just

Transcribed Image Text:You buy a stock for $10. During the year, the stock paid a $1 cash dividend. At the

end of the year, you sell the stock for a total of $11 total. What is the "total return"

on your investment? (remember, total return is more than just capital gains.)

a) 10%

b) 20%

c) 110%

d) 120%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- You invested in a stock with a price of $46.92. You sold the stock a year later for $52.86. During the year, you received a dividend of $0.85. What is your return? 14.47% 10.85% 11.24% 12.85% 12.66%arrow_forwardYou bought a stock one year ago for $48.32 per share and sold it today for $44.64 per share. It paid a $1.14 per share dividend today. a. What was your realized return? b. How much of the return came from dividend yield and how much came from capital gain?arrow_forwardYou purchased a stock at a price of $70.72. The stock paid a dividend of $2.03 per share and the stock price at the end of the year is $63.02. What are your capital gains on this investment?arrow_forward

- You purchased 100 shares of stock for a share price of $16.14. You sold the stock two years later for a share price of $18.22. You also received total dividend payments of $1.54 per share. What was your total return on your investment?arrow_forward7. You invest $7,873 in stock and receive $102, $123, $121, and $155 in dividends over the following 4 years. At the end of the 4 years, you sell the stock for $11,900. What was the IRR on this investment? Review Only Click the icon to see the Worked Solution (Calculator Use). Click the icon to see the Worked Solution (Spreadsheet Use). The IRR on this investment is %. (Round to the nearest whole percent.)arrow_forwardYou originally purchased Hershey stock at $161. It paid a dividend of $3.00 in the last year. Currently, the stock is selling for $156 per share. What is your total return if you sell the stock today?arrow_forward

- You bought a stock one year ago for $51.79 per share and sold it today for $57.42 per share. It paid a $1.03 per share dividend today. What was your realized return?arrow_forwardToday, you sold your Riot Blockchain, Inc stock (ticker: RIOT) for $54.5/share. Last year, you paid $51.5/share for that stock. During the year, RIOT paid you $2/share in dividends. If inflation averaged 2.8% during the year, your approximate real rate of return on the RIOT investment is: a. 12.5 percent b. 9.7 percent c. 12.2 percent d. 3.5 percent e. 6.9 percentarrow_forwardAn investor purchased a stock one year ago for $82.00. It paid an annual cash dividend of $6.21 and is now worth $93.84. What total return did the investor earn? Would the investor have experienced a capital gain? Explain. The investor would experience a capital gain in the amount of $11.8411.84. The total return earned by the investor is $enter your response here. The total percentage return by the investor 22.0722.07%.arrow_forward

- Suppose you owned stock in a company for the last three years. You originally bought the stock three years ago for $30 and just sold it for $56. The stock paid an annual dividend of $1.35 on the last day of each of the past three years. What is your realized return on this investment?15.36 percent 36.14 percent 26.85 percent 37.58 percentarrow_forwardYou invested in a beverage stock earlier this year; January 1, at the price of $42.50. Suppose at the end of the year; December 31, the price of the stock sells at $48.78. Determine the capital gain yield of the stock.arrow_forwardYou purchased a stock at the end of last year at a price of $98. At the end of this year, the stock pays a dividend of $2.10 and you sell the stock for $107. What is your return for the year? Now suppose that dividends are taxed at 15 percent and long-term capital gains (over 11 months) are taxed at 30 percent. What is your aftertax return for the year? (Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places.) Pretax return 11.33 % Aftertax return %arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education