FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

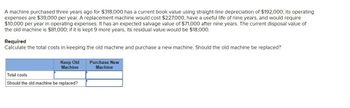

Transcribed Image Text:A machine purchased three years ago for $318,000 has a current book value using straight-line depreciation of $192,000; its operating

expenses are $39,000 per year. A replacement machine would cost $227,000, have a useful life of nine years, and would require

$10,000 per year in operating expenses. It has an expected salvage value of $71,000 after nine years. The current disposal value of

the old machine is $81,000; if it is kept 9 more years, its residual value would be $18,000.

Required

Calculate the total costs in keeping the old machine and purchase a new machine. Should the old machine be replaced?

Keep Old

Machine

Total costs

Should the old machine be replaced?

Purchase New

Machine

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A manufacturing company is considering acquiring a new injection-molding machine ata cost of $150,000. Because of a rapid change inproduct mix, the need for this particular machine isexpected to last only eight years, after which timethe machine is expected to have a salvage value of$10,000. The annual operating cost is estimatedto be $11,000. The addition of the machine to thecurrent production facility is expected to generatean annual revenue of $48,000. The firm has only$100,000 available from its equity funds, so it mustborrow the additional $50,000 required at an interest rate of 10% per year with repayment of principal and interest in eight equal annual amounts. Theapplicable marginal income tax rate for the firm is40%. Assume that the asset qualifies for a sevenyear MACRS property class.(a) Determine the after-tax cash flows.(b) Determine the NPW of this project atMARR = 14%.arrow_forwardCommercial Hydronics is considering replacing one of its larger control devices. A new unit sells for $27,000 (delivered). An additional $4,000 will be needed to install the device. The new device has an estimated 17-year service life. The estimated salvage value at the end of 17 years will be $2,000. The new control device will be depreciated as a 7-year MACRS asset. The existing control device (original cost = $20,000) has been in use for 11 years, and it has been fully depreciated (that is, its book value equals zero). Its scrap value is estimated to be $2,000. The existing device could be used indefinitely, assuming the firm is willing to pay for its very high maintenance costs. The firm's marginal tax rate is 40 percent. The new control device requires lower maintenance costs and frees up personnel who normally would have to monitor the system. Estimated annual cash savings from the new device will be $10,000. The firm's cost of capital is 12 percent.Evaluate the relative merits…arrow_forwardRandi Corporation is considering the replacement of some machinery that has zero book value and a current market value of $2,800. One possible alternative is to invest in new machinery that costs $30,000. The new equipment has a four-year service life and an estimated salvage value of $3,500, will produce annual cash operating savings of $9,400, and will require a $2,200 overhaul in year 3. The company uses straight-line depreciation. Required: Prepare a net-present-value analysis of Randi's replacement decision, assuming an 8% hurdle rate and no income taxes. Should the machinery be acquired? Note: Round calculations to the nearest dollar.arrow_forward

- Two stamping machines are under consideration for purchase by a metal recycling company. The manual model will cost $25,000 to buy with an eight-year life and a $5,000 salvage value. Its annual operating costs will be $16,000. A computer-controlled model will cost $95,000 to buy and it will have a twelve-year life if upgraded at the end of year six for $15,000. Its terminal salvage value will be $23,000, with annual operating costs of $7,500 for labor and $2,500 for maintenance. The company's minimum attractive rate of return is 18%.arrow_forwardA company is considering replacing an old piece of machinery, which cost $600,000and has $350,000 of accumulated depreciation to date, with a new machine that has apurchase price of $545,000. The old machine could be sold for $231,000. The annualvariable production costs associated with the old machine are estimated to be $61,000per year for eight years. The annual variable production costs for the new machine areestimated to be $19,000 per year for eight years. a.) Prepare and show in solution a differential analysis dated September 13 on whetherto continue with the old machine (Alternative 1) or replace the old machine (Alternative 2). b.) What is the sunk cost in the scenario?arrow_forwardLooner Industries is currently analyzing the purchase of a new machine that costs $158,000 and requires $19,900 in installation costs. Purchase of this machine is expected to result in an increase in net working capital of $29,600 to support the expanded level of operations. The firm plans to depreciate the machine under MACRS using a five-year recovery period (see the table attached for the applicable depreciation percentages) and expects to sell the machine to net $10,300 before taxes at the end of its usable life. The firm is subject to a 21% tax rate c. Assuming a five-year usable life, calculate the terminal cash flow if the machine were sold to net (1) $8,895 or (2) $169,900 (before taxes) at the end of five years. d. Discuss the effect of sale price on terminal cash flow using your findings in part c.arrow_forward

- The management of Ballard MicroBrew is considering the purchase of an automated bottling machine for $59,000. The machine would replace an old piece of equipment that costs $15,000 per year to operate. The new machine would cost $7,000 per year to operate. The old machine currently in use is fully depreciated and could be sold now for a salvage value of $25,000. The new machine would have a useful life of 10 years with no salvage value. Required: 1. What is the annual depreciation expense associated with the new bottling machine? 2. What is the annual incremental net operating income provided by the new bottling machine? 3. What is the amount of the initial investment associated with this project that should be used for calculating the simple rate of return? 4. What is the simple rate of return on the new bottling machine? (Round your answer to 1 decimal place i.e. 0.123 should be considered as 12.3%.)arrow_forwarda. A new operating system for an existing machine is expected to cost $837,000 and have a useful life of six years. The system yields an incremental after-tax income of $245,000 each year after deducting its straight-line depreciation. The predicted salvage value of the system is $105,000. b. A machine costs $570,000, has a $58,000 salvage value, is expected to last eight years, and will generate an after-tax income of $155,000 per year after straight-line depreciation. Assume the company requires a 10% rate of return on its investments. Compute the net present value of each potential investment. (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided.) Complete this question by entering your answers in the tabs below. Required A Required B A new operating system for an existing machine is expected to cost $837,000 and have a useful life of six years. The system yields an incremental after-tax income of $245,000 each year after deducting its…arrow_forwardBumps Unlimited, a highway contractor, must decide whether to overhaul a tractor and scraper or replace it. The old equipment was purchased 5 years ago for $130,000; it had a 12-year projected life. If traded for a new tractor and scraper, it can be sold for $60,000. Overhauling the equipment will cost $20,000. If overhauled, O&M cost will be $25,000/year and salvage value will be negligible in 7 years. If replaced, a new tractor and scraper can be purchased for $150,000. O&M costs will be $12,000/year. Salvage value after 7 years will be $35,000. Using a 15% MARR and an annual worth analysis, should the equipment be replaced?arrow_forward

- CTI Corporation purchased a special-purpose turnkey stamping machine four years ago for $18,000. It was estimated at that time that this machine would have a life of 10 years and a salvage value of $4,000 with a removal cost of $1,500. These estimates are still good. This machine has annual operating costs of $3,000. A new machine, which is more efficient, will reduce the annual operating costs to $1,500 but will require an investment of $22,000, plus $2,000 for installation. The life of the new machine is estimated to be 12 years with a salvage value of $4,000 and a removal cost of $2,000. An offer of $7,000 has been made for the old machine, and the purchaser is willing to pay for its removal. Find the economic advantage of replacement or of continuing with the present machine. State any assumptions that you make. (Assume i = 12%.)arrow_forwardThere is old machinery with a value of $95,565, with an expected life of 20 years. There is a sale of old equipment with a book value of $30,000 and a market value of $66,000.It is intended to replace that machine with a new one worth $145,000 with a useful life of 10 years. It will ultimately be sold at market value for $90,000, to generate salvage value.Old operating costs are $95,565 and new costs are $56,984. There is an initial working capital of $35,000, with movements of 15% of the initial working capital untilyear 6. From year 7 and 8 they are 20% of the initial working capital and in the ninth year 14% of the initial working capital.The WACC required for this project is 17% with a tax rate of 38.5%. The following table shows the depreciation of the new equipment.Depreciation1 20%2 15%3 15%4 10%5 10%6 10%7 7%8 5%9 5%10 3%Calculate your PV, NPV, IRR, TIRM, PAYBACK, IR and ROIPlease if you can send me the excel to: 0229275@up.edu.mxor tell me the steps to follow and if you can…arrow_forwardThe management of Ballard MicroBrew is considering the purchase of an automated bottling machine for $55,000. The machine would replace an old piece of equipment that costs $14,000 per year to operate. The new machine would cost $6,000 per year to operate. The old machine currently in use could be sold now for a salvage value of $20,000. The new machine would have a useful life of 10 years with no salvage value. Required: 1. What is the annual depreciation expense associated with the new bottling machine? 2. What is the annual incremental net operating income provided by the new bottling machine? 3. What is the amount of the initial investment associated with this project that should be used for calculating the simple rate of return? 4. What is the simple rate of return on the new bottling machine? (Round your answer to 1 decimal place i.e. 0.123 should be considered as 12.3%.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education