The management of Ballard MicroBrew is considering the purchase of an automated bottling machine for $59,000. The machine would replace an old piece of equipment that costs $15,000 per year to operate. The new machine would cost $7,000 per year to operate. The old machine currently in use is fully

Required:

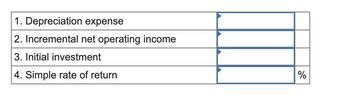

1. What is the annual depreciation expense associated with the new bottling machine?

2. What is the annual incremental net operating income provided by the new bottling machine?

3. What is the amount of the initial investment associated with this project that should be used for calculating the simple

4. What is the simple rate of return on the new bottling machine? (Round your answer to 1 decimal place i.e. 0.123 should be considered as 12.3%.)

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

- You have been asked to evaluate the proposed acquisition of a new Machine for your company. The machine’s basic price is $100,000. Assume that the machine can be depreciated using straight line over three years. The Machine would require an increase in net working capital (spare parts inventory) of $4,000 at the start of the project. This working capital will be recovered at Year 3. The machine would have no effect on revenues, but it is expected to save the firm $40,000 per year in before tax operating costs. This machine will help the firm reduce its labor costs. Assume that the firm’s marginal tax rate is 35%. a) If the cost of capital (WACC) is 10% , should the machine be purchased? Show all your work in the attached excel file. b) What is the minimum cost savings required to justify the purchase of this machine? Click here to get the Excel Template for this problem. (I attached a picture) Please upload your completed excel file.arrow_forwardBlossom Company is considering the purchase of a new machine. The invoice price of the machine is $151,000, freight charges are estimated to be $4,000, and installation costs are expected to be $6,000. The salvage value of the new equipment is expected to be zero after a useful life of 5 years. The company could retain the existing equipment and use it for an additional 5 years if it doesn't purchase the new machine. At that time, the equipment's salvage value would be zero. If Blossom purchases the new machine now, it would have to scrap the existing machine. Blossom's accountant, Donna Clark, has accumulated the following data for annual sales and expenses, with and without the new machine: 1. 2. 3. Without the new machine, Blossom can sell 13,000 units of product annually at a per-unit selling price of $100. If it purchases the new machine, the number of units produced and sold would increase by 10%, and the selling price would remain the same. The new machine is faster than the old…arrow_forwardA manufacturer is considering the replacement of one of its boring machines with a newer and more efficient one. The relevant details for both defender and challenger are as follows:• Defender: The current book value of the old boring machine is $50,000, and it has a remaining useful life of five years. The salvage value expected from scrapping the old machine at the end of five years is zero, but the company can sell the machine now to another firm in the industry for $10,000.• Challenger: The new boring machine can be purchased at a price of $150,000 and has an estimated useful life of seven years. It has an estimated salvage value of $50,000 and is expected to realize economic savings on electric power usage, labor, and repair costs and to reduce the amount of reworks. In total, annual savings of $80,000 will be realized if the new machine is installed.The firm uses an MARR of 12%. Using the opportunity-cost approach, address the following questions:(a) What is the initial cash…arrow_forward

- Masters Machine Shop is considering a four-year project to improve its production efficiency. Buying a new machine press for $892,800 is estimated to result in $297,600 in annual pretax cost savings. The press falls in the MACRS five-year class (MACRS Table), and it will have a salvage value at the end of the project of $130,200. The press also requires an initial investment in spare parts inventory of $37,200, along with an additional $5,580 in inventory for each succeeding year of the project. If the shop's tax rate is 22 percent and its discount rate is 19 percent, what is the NPV for this project?arrow_forwardXYZ Co. is considering the purchase of a new machine. The machine will cost $250,000 and requires installation costs of $25,000. The existing machine can be sold currently for $25,070. It was purchased three years ago for $83,000 and depreciated using MACRS (5 years). It can be operated for another four years. Its market value at that time, if sold, would be $14,000. The new machine has expected life of five years and expected to provide operating cash savings of $88,000 a year for 2 years and $50,000 a year for the next two years before depreciation and taxes (EBD&T). After four years the new machine can be sold for $12,750. To support the increased business resulting from the purchase of new machine, A/R will increase by $12,000; inventory will increase by $25,000 and current liabilities by $41,000. The cost of capital is 17% and the tax rate is 40%. What is NPV? Question 9 options: $56,900 -$65,880 -$63,118 -$76,890arrow_forwardThe Campbell Company is considering adding a robotic paint sprayer to its production line. The sprayer's base price is $1,000,000, and it would cost another $20,000 to install it. The machine falls into the MACRS 3-year class (the applicable MACRS depreciation rates are 33.33%, 44.45%, 14.81%, and 7.41%), and it would be sold after 3 years for $576,000. The machine would require an increase in net working capital (inventory) of $15,500. The sprayer would not change revenues, but it is expected to save the firm $424,000 per year in before-tax operating costs, mainly labor. Campbell's marginal tax rate is 35%. Cash outflows, if any, should be indicated by a minus sign. Do not round intermediate calculations. Round your answers to the nearest dollar. What is the Year-0 net cash flow? $ If the project's cost of capital is 11 %, what is the NPV of the project? $arrow_forward

- Henrie's Drapery Service is investigating the purchase of a new machine for cleaning and blocking drapes. The machine would cost $102,990, including freight and installation. Henrie's estimated the new machine would increase the company's cash inflows, net of expenses, by $30,000 per year. The machine would have a five-year useful life and no salvage value. Click here to view Exhibit 12B-1 and Exhibit 12B-2, to determine the appropriate discount factor(s) using table. Required: 1. What is the machine's internal rate of return? (Round your answer to the nearest whole percentage, i.e. 0.123 should be considered as 12%.) 2. Using a discount rate of 14%, what is the machine's net present value? Interpret your results. 3. Suppose the new machine would increase the company's annual cash inflows, net of expenses, by only $26,475 per year. Under these conditions, what is the internal rate of return? (Round your answer to the nearest whole percentage, i.e. 0.123 should be considered as 12%.) 1.…arrow_forwardRiverview Company is evaluating the proposed acquisition of a new production machine. The machine's base price is $200,000, and installation costs would amount to $28,000. Also, $10,000 in net working capital would be required at installation. The machine will be depreciated for 3 years using simplified straight line depreciation. The machine would save the firm $110,000 per year in operating costs. The firm is planning to keep the machine in place for 2 years. At the end of the second year, the machine will be sold for $100,000. Riverview has a cost of capital of 12% and a marginal tax rate of 34%. What is the NPV of the project? $9,555 $19,016 - $9,783 $3,875 $12,155arrow_forwardTwo stamping machines are under consideration for purchase by a metal recycling company. The manual model will cost $25,000 to buy with an eight-year life and a $5,000 salvage value. Its annual operating costs will be $16,000. A computer-controlled model will cost $95,000 to buy and it will have a twelve-year life if upgraded at the end of year six for $15,000. Its terminal salvage value will be $23,000, with annual operating costs of $7,500 for labor and $2,500 for maintenance. The company's minimum attractive rate of return is 18%.arrow_forward

- Tanaka Machine Shop is considering a four-year project to improve its production efficiency. Buying a new machine press for $397,000 is estimated to result in $145,000 in annual pretax cost savings. The press qualifies for 100 percent bonus depreciation and it will have a salvage value at the end of the project of $46,000. The press also requires an initial investment in spare parts inventory of $15,100, along with an additional $2,100 in inventory for each succeeding year of the project. The shop's tax rate is 21 percent and its discount rate is 8 percent. Calculate the project's NPV. Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. NPVarrow_forwardBaghibenarrow_forwardThe management of Ro Corporation is investigating automating a process. Old equipment, with a current salvage value of $21,000, would be replaced by a new machine. The new machine would be purchased for $462,000 and would have a 6 year useful life and no salvage value. By automating the process, the company would save $159,000 per year in cash operating costs. The simple rate of return on the investment is closest to (Ignore income taxes.): (Round your answer to 1 decimal place.) Garrison_16e_Rechecks_2019_10_12 Multiple Choice 18.6% 17.7% 34.4% 16.7%arrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education