Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

General Accounting

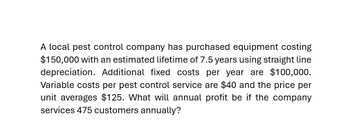

Transcribed Image Text:A local pest control company has purchased equipment costing

$150,000 with an estimated lifetime of 7.5 years using straight line

depreciation. Additional fixed costs per year are $100,000.

Variable costs per pest control service are $40 and the price per

unit averages $125. What will annual profit be if the company

services 475 customers annually?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Gardner Denver Company is considering the purchase of a new piece of factory equipment that will cost $420,000 and will generate $95,000 per year for 5 years. Calculate the IRR for this piece of equipment. For further Instructions on internal rate of return in Excel, see Appendix C.arrow_forwardKeleher Industries manufactures pet doors and sells them directly to the consumer via their web site. The marketing manager believes that if the company invests in new software, they will increase their sales by 10%. The new software will increase fixed costs by $400 per month. Prepare a forecasted contribution margin income statement for Keleher Industries reflecting the new software cost and associated increase in sales. The previous annual statement is as follows:arrow_forwardA local pest control company has purchased equipment costing $150,000 with an estimated lifetime of 7.5 years using straight line depreciation. Additional fixed costs per year are $100,000. Variable costs per pest control service are $40 and the price per unit averages $125. What will annual profit be if the company services 475 customers annually?arrow_forward

- Solve this accounting problemarrow_forwardThe engineering team at Manuel’s Manufacturing, Inc., is planning to purchase an enterprise resource planning (ERP) system. The software and installation from Vendor A costs $395,000 initially and is expected to increase revenue $110,000 per year every year. The software and installation from Vendor B costs $280,000 and is expected to increase revenue $110,000 per year. Manuel’s uses a 4-year planning horizon and a 8.0 % per year MARR. What is the present worth of each investment?Vendor A: $Vendor B: $Carry all interim calculations to 5 decimal places and then round your final answer to the nearest dollar. The tolerance is ±20.arrow_forwardThe engineering team at Manuel's Manufacturing, Inc., is planning to purchase an enterprise resource planning (ERP) system. The software and installation from Vendor A costs $410,000 initially and is expected to increase revenue $110,000 per year every year. The software and installation from Vendor B costs $290,000 and is expected to increase revenue $95,000 per year. Manuel's uses a 4- year planning horizon and a 12.0% per year MARR. Part a 8 Your answer is incorrect. What is the present worth of each investment? Vendor A: $ Vendor B: $ Carry all interim calculations to 5 decimal places and then round your final answer to the nearest dollar. The tolerance is ±20.arrow_forward

- The engineering team at Manuel’s Manufacturing, Inc., is planning to purchase an enterprise resource planning (ERP) system. The software and installation from Vendor A costs $380,000 initially and is expected to increase revenue $125,000 per year every year. The software and installation from Vendor B costs $280,000 and is expected to increase revenue $95,000 per year. Manuel’s uses a 4-year planning horizon and a 10% per year MARR. What is the annual worth of each investment?Vendor A: $enter a dollar amount rounded to the nearest dollar Vendor B: $enter a dollar amount rounded to the nearest dollararrow_forwardLopez Company is considering replacing one of its old manufacturing machines. The old machine has a book value of $47,000 and a remaining useful life of five years. It can be sold now for $57,000. Variable manufacturing costs are $47,000 per year for this old machine. Information on two alternative replacement machines follows. The expected useful life of each replacement machine is five years. Machine A Machine B Purchase price $ 118,000 $ 132,000 Variable manufacturing costs per year 20,000 14,000 (a) Compute the income increase or decrease from replacing the old machine with Machine A.(b) Compute the income increase or decrease from replacing the old machine with Machine B.(c) Should Lopez keep or replace its old machine?(d) If the machine should be replaced, which new machine should Lopez purchase?arrow_forwardThe engineering team at Manuel’s Manufacturing, Inc., is planning to purchase an enterprise resource planning (ERP) system. The software and installation from Vendor A costs $380,000 initially and is expected to increase revenue $125,000 per year every year. The software and installation from Vendor B costs $280,000 and is expected to increase revenue $95,000 per year. Manuel’s uses a 4-year planning horizon and a 10%/year MARR. Solve, a. What is the annual worth of each investment?b. What is the decision rule for determining the preferred investment basedon annual worth ranking? c. Which (if either) ERP system should Manuel purchase?arrow_forward

- Lopez Company is considering replacing one of its old manufacturing machines. The old machine has a book value of $49,000 and a remaining useful life of five years. It can be sold now for $59,000. Variable manufacturing costs are $44,000 per year for this old machine. Information on two alternative replacement machines follows. The expected useful life of each replacement machine is five years. Machine A Machine B Purchase price $ 122,000 $ 136,000 Variable manufacturing costs per year 18,000 15,000 (a) Compute the income increase or decrease from replacing the old machine with Machine A. (b) Compute the income increase or decrease from replacing the old machine with Machine B. (c) Should Lopez keep or replace its old machine? (d) If the machine should be replaced, which new machine should Lopez purchase?arrow_forwardLopez Company is considering replacing one of its old manufacturing machines. The old machine has a book value of $45,000 and a remaining useful life of five years. It can be sold now for $52,000. Variable manufacturing costs are $36,000 per year for this old machine. Information on two alternative replacement machines follows. The expected useful life of each replacement machine is five years. Machine A Machine B Purchase price $ 115,000 $ 125,000 Variable manufacturing costs per year 19,000 15,000 (a) Compute the income increase or decrease from replacing the old machine with Machine A.(b) Compute the income increase or decrease from replacing the old machine with Machine B.(c) Should Lopez keep or replace its old machine?(d) If the machine should be replaced, which new machine should Lopez purchase?arrow_forwardLopez Company is considering replacing one of its old manufacturing machines. The old machine has a book value of $49,000 and a remaining useful life of four years. It can be sold now for $59,000. Variable manufacturing costs are $43,000 per year for this old machine. Information on two alternative replacement machines follows. The expected useful life of each replacement machine is four years. Machine A Machine B Purchase price $ 121,000 $ 135,000 Variable manufacturing costs per year 19,000 15,000 (a) Compute the income increase or decrease from replacing the old machine with Machine A. (b) Compute the income increase or decrease from replacing the old machine with Machine B. (c) Should Lopez keep or replace its old machine? (d) If the machine should be replaced, which new machine should Lopez purchase?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College