Practical Management Science

6th Edition

ISBN: 9781337406659

Author: WINSTON, Wayne L.

Publisher: Cengage,

expand_more

expand_more

format_list_bulleted

Question

Ee 432.

Transcribed Image Text:A linear programming computer package is needed.

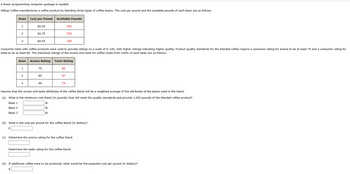

Hilltop Coffee manufactures a coffee product by blending three types of coffee beans. The cost per pound and the available pounds of each bean are as follows.

Bean Cost per Pound Available Pounds

1

2

3

1

$0.50

2

$0.70

3

$0.45

Consumer tests with coffee products were used to provide ratings on a scale of 0-100, with higher ratings indicating higher quality. Product quality standards for the blended coffee require a consumer rating for aroma to be at least 75 and a consumer rating for

taste to be at least 80. The individual ratings of the aroma and taste for coffee made from 100% of each bean are as follows:

Bean Aroma Rating Taste Rating

75

BEE

85

60

85

450

87

550

74

350

Assume that the aroma and taste attributes of the coffee blend will be a weighted average of the attributes of the beans used in the blend.

(a) What is the minimum-cost blend (in pounds) that will meet the quality standards and provide 1,000 pounds of the blended coffee product?

Bean 1

lb

Bean 2

lb

Bean 3

lb

(b) What is the cost per pound for the coffee blend (in dollars)?

(c) Determine the aroma rating for the coffee blend.

Determine the taste rating for the coffee blend.

(d) If additional coffee were to be produced, what would be the expected cost per pound (in dollars)?

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 5 images

Knowledge Booster

Similar questions

- Need from d to garrow_forwardQuestion 39arrow_forward● ● In order to drum up business, Ms. Smith purchased seasons tickets for both the Senators and the Redblacks. Should Redblacks tickets be expensed? Yes or No Should Senators tickets be expensed? Yes or No ● The cost for the Senators tickets (2) for $1,500 each. Ms. Smith will take a client to every hockey game; she has not missed a game in over five years. The cost for the Redblacks tickets (4) for $350 each. The same goes for the Redblacks, she hasn't missed a game either and it's a family tradition for her, her spouse and their two nieces to attend the games together. Ms. Smith pays $75 a month for a storage locker that she has had for over 3 years. Everything in the storage locker was bequeathed to her from her great uncle. She has no use for the items, but she can't seem to let them go. Should storgae locker fee be claimed? If yes, how much Ms. Smith has a business bank account and the monthly banking fees associated with this account are $5 a month. ● Should banking fees be…arrow_forward

- Hypothesis statements for the thesis on "Evaluating the importance of risk management mechanism in the banking sector from a customer's perspective"arrow_forwardWhich of the following attorney's fees would not be deductible? Check all that apply!! Question 4 options: Attorney's fee paid by a sole proprietor to assist in collecting delinquent accounts Attorney's fee paid for preparing a title opinion and handling a closing pursuant to the purchase of a personal residence. Attorney's fee paid for preparing a title opinion and handling a closing pursuant to the purchase of a rental property. Attorney's fee paid for the purpose of preparing a Last Will and Testament. Attorney's fee paid by a landlord to assist in the eviction of tenants Attorney's fee paid to handle a defense of a business related criminal chargearrow_forwardQuestion 14 Public owners are expected to negotiate bid prices submitted by contractors in an attempt to maximize the value of construction services acquired. True O Falsearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage,

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage, Operations ManagementOperations ManagementISBN:9781259667473Author:William J StevensonPublisher:McGraw-Hill Education

Operations ManagementOperations ManagementISBN:9781259667473Author:William J StevensonPublisher:McGraw-Hill Education Operations and Supply Chain Management (Mcgraw-hi...Operations ManagementISBN:9781259666100Author:F. Robert Jacobs, Richard B ChasePublisher:McGraw-Hill Education

Operations and Supply Chain Management (Mcgraw-hi...Operations ManagementISBN:9781259666100Author:F. Robert Jacobs, Richard B ChasePublisher:McGraw-Hill Education

Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning

Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning Production and Operations Analysis, Seventh Editi...Operations ManagementISBN:9781478623069Author:Steven Nahmias, Tava Lennon OlsenPublisher:Waveland Press, Inc.

Production and Operations Analysis, Seventh Editi...Operations ManagementISBN:9781478623069Author:Steven Nahmias, Tava Lennon OlsenPublisher:Waveland Press, Inc.

Practical Management Science

Operations Management

ISBN:9781337406659

Author:WINSTON, Wayne L.

Publisher:Cengage,

Operations Management

Operations Management

ISBN:9781259667473

Author:William J Stevenson

Publisher:McGraw-Hill Education

Operations and Supply Chain Management (Mcgraw-hi...

Operations Management

ISBN:9781259666100

Author:F. Robert Jacobs, Richard B Chase

Publisher:McGraw-Hill Education

Purchasing and Supply Chain Management

Operations Management

ISBN:9781285869681

Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. Patterson

Publisher:Cengage Learning

Production and Operations Analysis, Seventh Editi...

Operations Management

ISBN:9781478623069

Author:Steven Nahmias, Tava Lennon Olsen

Publisher:Waveland Press, Inc.