Practical Management Science

6th Edition

ISBN: 9781337406659

Author: WINSTON, Wayne L.

Publisher: Cengage,

expand_more

expand_more

format_list_bulleted

Question

Q14.

Subject :- Account

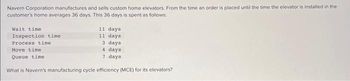

Transcribed Image Text:Navern Corporation manufactures and sells custom home elevators. From the time an order is placed until the time the elevator is installed in the

customer's home averages 36 days. This 36 days is spent as follows:

Wait time

Inspection time

Process time

11 days.

11 days

3 days

4 days

7

days

Move time

Queue time

What is Navern's manufacturing cycle efficiency (MCE) for its elevators?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- QUESTION 2 CLO 4: Explain the role of risk management in portfolio management Evaluate risk measurement techniques (20 marks) a) with The average returns, standard deviations and betas for three funds are given below along data for the S&P 500 index. The risk free return during the sample period is 6%. The average returns, standard deviations and betas for three funds are given below along with data for the S&P 500 index. The risk free return during the sample period is 6%. a) The average returns, standard deviations and betas for three funds are given below along with data for the S&P 500 index. The risk free return during the sample period is 6%. Fund Avg Return St Dev Beta A 13.6% 40% 11 B 13.1% 25% 10 12.4% 30% 13 S&P 500 120% 15% 10 i) ii) You wish to evaluate the three mutual funds using the Sharpe measure for performance evaluation. The fund with the highest Sharpe measure of performance is (Show your workings) Calculate and rank the funds using Jensen's alpha, Treynor measure,…arrow_forward1arrow_forwardQ 9. Discuss the importance of search engines.arrow_forward

- - QUESTION 1 Green Tea 4 Life Ltd has requested your help in preparing their financial statements as they are unsure of the requirements of NZ IFRS 16 Leases for lessees. You are provided with the following lease details: Green Tea 4 Life Ltd is the Commencement date Lease term Economic life of asset Interest expense SCF classification IDC incurred by the lessee Upfront payment due on the commencement date Fixed payments per annum at year end Ownership transfer at end of lease Lessee's incremental borrowing rate The depreciation method used by the lessee The relevant present value discount factors are: Present value of $1 in n periods Present value of an annuity -5 1-8% Lessee 1 April 2019 5 years 10 years CFOA $10000 $30 000 $200 000 No 8% Straight line 0.6806 3.9927 (i) Prepare the journal entry to initially recognise the ROU asset and lease liability, at the commencement date. (ii) Complete the lessee's table in the space provided. Determine the total interest expense that would be…arrow_forwardQUESTION 25 LF Corporation, a manufacturer of Mexican foods, contracted in 2025 to purchase 2,000 pounds of a spice mixture at $5.00 per pound, delivery to be made in spring of 2026. By 12/31/25, the price per pound of the spice mixture had increased to $5.30 per pound. In 2025, LF should recognize a loss of $10,000 a loss of $600. no gain or loss. O a gain of $600arrow_forwardWhat is section 1981? Question 13 options: A Federal law that complements the Civil Rights Act of 1964 which states, all persons shall have the same right to make and enforce contracts as enjoyed by white citizens. A Federal law that complements the Civil Rights Act of 1964 which states, all persons shall have the same right to make and enforce contracts as enjoyed by non-transgendered citizens. A Federal law that complements to make and enforce contracts as enjoyed by ethnic origins and age groups. None of the abovearrow_forward

- Compensatory damages compensates a Plaintiff for injuries suffered, such as medical expenses and loss of consortium. Question 12 options: TRUE FALSE None of the above All of the abovearrow_forwardQuestion: How do you use the Silver-Meal ordering policy to find the Total annual Cost for the damand and parameters listed below? Month Period Demand Jan. 1 110 Feb. 2 40 Mar. 3 150 Apr. 4 130 May 5 60 Jun. 6 30 Jul. 7 20 Aug. 8 30 Sep. 9 80 Oct. 10 120 Nov. 11 130 Dec. 12 100 Total 1000 Given cost parameter: Value Order cost $25 Unit cost $8 Holding cost rate (monthly) 5%arrow_forwardQ1. Dallas Mavericks’ owner Mark Cuban proved his business intelligence once again with the acquisition of star player Kristaps Porzingis. To benefit from this blockbuster trade even further, Cuban plans to sell one-time-only special edition Porzingis jerseys at a price of $380 each during the first month of the season (i.e., during October 2019 only). The production cost for each of these jerseys would be $100 thanks to their golden details, and any unsold jersey during October will be sold for $80 during November 2019. Knowing the fan base for years, Cuban estimates demand for these special edition jerseys to follow a normal distribution with a mean of 10,000 units and a standard deviation of 2,000. partc. Cuban also plans to sell these special edition jerseys in his vacation resort. Knowing that people are wealthier in the resort, he sets a price of $500 for each jersey (although production cost stays the same). This time however, he cannot sell any unsold jerseys outside the…arrow_forward

- Question 7 The major stated advantage of maquiladoras is to lower costs of taxation. True Falsearrow_forwardi need Q2 solutionarrow_forwardQuestion 3 Dr. Peter Kraljic claims that there is no single best way existed for managing purchasing in allcircumstances. He proposed “Kraljic Purchasing Portfolio model”. Elaburate the FOUR (4)Purchasing Portfolio with suitable examples answer should be elaborated with proper examples.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage,

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage, Operations ManagementOperations ManagementISBN:9781259667473Author:William J StevensonPublisher:McGraw-Hill Education

Operations ManagementOperations ManagementISBN:9781259667473Author:William J StevensonPublisher:McGraw-Hill Education Operations and Supply Chain Management (Mcgraw-hi...Operations ManagementISBN:9781259666100Author:F. Robert Jacobs, Richard B ChasePublisher:McGraw-Hill Education

Operations and Supply Chain Management (Mcgraw-hi...Operations ManagementISBN:9781259666100Author:F. Robert Jacobs, Richard B ChasePublisher:McGraw-Hill Education

Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning

Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning Production and Operations Analysis, Seventh Editi...Operations ManagementISBN:9781478623069Author:Steven Nahmias, Tava Lennon OlsenPublisher:Waveland Press, Inc.

Production and Operations Analysis, Seventh Editi...Operations ManagementISBN:9781478623069Author:Steven Nahmias, Tava Lennon OlsenPublisher:Waveland Press, Inc.

Practical Management Science

Operations Management

ISBN:9781337406659

Author:WINSTON, Wayne L.

Publisher:Cengage,

Operations Management

Operations Management

ISBN:9781259667473

Author:William J Stevenson

Publisher:McGraw-Hill Education

Operations and Supply Chain Management (Mcgraw-hi...

Operations Management

ISBN:9781259666100

Author:F. Robert Jacobs, Richard B Chase

Publisher:McGraw-Hill Education

Purchasing and Supply Chain Management

Operations Management

ISBN:9781285869681

Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. Patterson

Publisher:Cengage Learning

Production and Operations Analysis, Seventh Editi...

Operations Management

ISBN:9781478623069

Author:Steven Nahmias, Tava Lennon Olsen

Publisher:Waveland Press, Inc.