Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

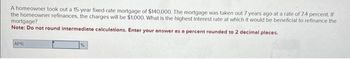

Transcribed Image Text:A homeowner took out a 15-year fixed-rate mortgage of $140,000. The mortgage was taken out 7 years ago at a rate of 7.4 percent. If

the homeowner refinances, the charges will be $1,000. What is the highest interest rate at which it would be beneficial to refinance the

mortgage?

Note: Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.

APR

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Consider a home mortgage of $125,000 at a fixed APR of 4.5% for 25 years. a. Calculate the monthly payment. b. Determine the total amount paid over the term of the loan. c. Of the total amount paid, what percentage is paid toward the principal and what percentage is paid for interest. ..... a. The monthly payment is $ (Do not round until the final answer. Then round to the nearest cent as needed.)arrow_forwardYou recently took out a mortgage on a house for $325,000. The mortgage was at 14% interestfixed interest rate for 30 years. What is the payoff amount immediately after the 30th payment? (Show using BA II Plus or By Hand)arrow_forwardConsider a 25-year, $320,000 mortgage with a rate of 6.95 percent. Three years into the mortgage, rates have fallen to 5.65 percent. What would be the monthly saving to a homeowner from refinancing the outstanding mortgage balance at the lower rate? Note: Do not round intermediate calculations. Round your answer to 2 decimal places. Answer is complete but not entirely correct. $ 1,201.78 Savingsarrow_forward

- A homeowner took out a 25-year fixed-rate mortgage of $205,000. The mortgage was taken out 7 years ago at a rate of 7.05 percent. If the homeowner refinances, the charges will be $3,350. What is the highest interest rate at which it would be beneficial to refinance the mortgage? Note: Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places. APR %arrow_forwardIf Bobby takes out a mortgage for 30 years at an interest rate of 4% and his monthly repayments are $835.48, what is the loan principal (that is, the balance of the loan at drawdown)? Give your answer to the nearest ten dollars. Do not include commas or the dollar sign in your answer.arrow_forwardA mortgage broker is offering a $279,000 30-year mortgage with a teaser rate. In the first two years of the mortgage, the borrower makes monthly payments on only a 4.5 percent APR interest rate. After the second year, the mortgage interest rate charged increases to 7.5 percent APR. What are the monthly payments in the first two years? (Do not round intermediate calculations and round your final answer to 2 decimal places.) Monthly payment What are the monthly payments after the second year? (Do not round intermediate calculations and round your final answer to 2 decimal places.) Monthly payment > 2 D TRENE VAR TVUNG S 2006- E - Earrow_forward

- A mortgage broker is offering a $279,000 30-year mortgage with a teaser rate. In the first two years of the mortgage, the borrower makes monthly payments on only a 4.5 percent APR interest rate. After the second year, the mortgage interest rate charged increases to 7.5 percent APR. What are the monthly payments in the first two years? (Do not round intermediate calculations and round your final answer to 2 decimal places.) Monthly payment What are the monthly payments after the second year? (Do not round intermediate calculations and round your final answer to 2 decimal places.) Monthly paymentarrow_forwardA homeowner took out a 20-year fixed-rate mortgage of $175,000. The mortgage was taken out 6 years ago at a rate of 6.75 percent. If the homeowner refinances, the charges will be $3,050. What is the highest interest rate at which it would be beneficial to refinance the mortgage? Note: Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places. Answer is complete but not entirely correct. APR 6.00arrow_forwardA mortgage broker is offering a 30-year $192,900 mortgage with a teaser rate. In the first two years of the mortgage, the borrower makes monthly payments on only a 4.9 percent APR interest rate. After the second year, the mortgage interest rate charged increases to 7.9 percent APR. What are the monthly payments in the first two years? (Do not round intermediate calculations and round your final answer to 2 decimal places.) Monthly payment What are the monthly payments after the second year? (Do not round intermediate calculations and round your final answer to 2 decimal places.) Monthly paymentarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education