FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

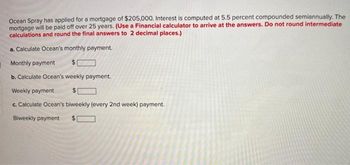

Transcribed Image Text:Ocean Spray has applied for a mortgage of $205,000. Interest is computed at 5.5 percent compounded semiannually. The

mortgage will be paid off over 25 years. (Use a Financial calculator to arrive at the answers. Do not round intermediate

calculations and round the final answers to 2 decimal places.)

a. Calculate Ocean's monthly payment.

Monthly payment

$

b. Calculate Ocean's weekly payment.

Weekly payment

c. Calculate Ocean's biweekly (every 2nd week) payment.

Biweekly payment

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Guadalupe has a mortgage of $581,000 through her bank for property purchased. The loan is repaid by end of month payments of $3,577.53 with an interest rate of 4.53% compounded monthly over 21 years. What is the interest paid in the 2nd year of the mortgage?Interest paid in 2nd year = TVM FORMULAarrow_forwardAnushka and Benicio borrowed $47,000 at 7% compounded semi-annually as a second mortgage loan against their current home. Repayment amount is $9,400 at the end of every year. a. How many payments are required to repay the loan? Number of payments b. Use the given information to complete the amortization table below. Determine the missing values for the first two payment intervals, the last two payment intervals, and the totals. Report results to the nearest cent. Payment Number 0 1 2 ⠀ : N-1 N Total Amount Paid ($) 9,400.00 9,400.00 ⠀ ⠀ 9,400.00 Interest Paid ($) Principal Repaid ($) Outstanding Balance ($) 47,000.00 0.00arrow_forwardKaren obtained a $25.000 loan at 4.5% compounded semiannually. a-1. What monthly payment will repay the loan in 7 1/2 years? (Do not round Intermedlate calculations and round your final answer to 2 decimal places.) Monthly payment $4 a-2. How much interest will Karen pay over the life of the loan? (Round Intermedlate calculations to 2 declmal places and round your final answer to the nearest dollar.) Total interest %$4 6 of 9 Next > < Prev connect Tarrow_forward

- Theodore D. Kat is applying to his credit union for a mortgage of $200,000. The bank has quoted 8% an interest rate. He would pay off the mortgage over 25- years (amortization period) and make a payment at the end of each month. A. Calculate EAR (1/100 of one percent, no %, e.g. 9.35) B. How much are Theodore's monthly payments?arrow_forwardA mortgage balance of $28,000 is to be repaid over a 15-year term by equal monthly payments at 4.9% compounded semi-annually. At the request of the mortgagor, the monthly payments were set at $425. (a) (b) What is the size of the last payment? (c) Determine the difference between the total amount required to amortize the mortgage with the contractual monthly payments rounded to the nearest cent and the total actual amount paid. How many payments will the mortgagor have to make? (a) The mortgagor will have to make payments. (Round up to the nearest whole number.)arrow_forwardOn September 12, Jody Jansen went to Sunshine Bank to borrow $4,200 at 8% interest. Jody plans to repay the loan on January 27. Assume the loan is on ordinary interest. (Use Days in a year table) a. What interest will Jody owe on January 27? (Do not round intermediate calculations. Round your answer to the nearest cent.) Interest b. What is the total amount Jody must repay at maturity? (Do not round intermediate calculations. Round your answer to the nearest cent.) Maturity valuearrow_forward

- On September 12, Jody Jansen went to Sunshine Bank to borrow $2,300 at 9% interest. Jody plans to repay the loan on January 27, Assume the loan is on ordinary interest. (Use Days in a year table) a. What interest will Jody owe on January 27? Note: Do not round intermediate calculations. Round your answer to the nearest cent. Interest b. What is the total amount Jody must repay at maturity? Note: Do not round intermediate calculations. Round your answer to the nearest cent. Maturity valuearrow_forwardJennifer has a 60-month fixed installment loan, with a monthly payment of $223.04. The amount she borrowed was $11,000.00 at 8.0% APR. A split second after making her 36th payment, Jennifer decided to pay off the remaining balance on the loan. What is the total amount due to pay off the balance? Use the actuarial method. If you use the Finance Charge Table 11.2, page 632, and the "unearned interest formula", page 635, in your textbook to solve this problem, the result will match exactly with one of the answers. If you use a spreadsheet to do the computation, your result will not match exactly with any of the answers, but it will differ only very little (mostly less than $1) from the "correct" answer. $4,788.06 $4,897.69 $4,931.79 $5,063.35arrow_forwardA house sells for $309,500 and a 4% down payment is made. A mortgage is secured at 4% for 20 years. Compute an amortization schedule for the first 3 months. Round your answers to two decimal places, if necessary. The value of the mortgage is $297,120 and the monthly payment is $1800.55 . Part: 0 / 3 0 of 3 Parts Complete Part 1 of 3 Payment number Interest Payment on Principal Balance of Loan 1 $ $ $ Procedure for Computing an Amortization Schedule Step 1 Find the interest for the first month. Use =IPrt , where =t112 . Enter this value in a column labeled Interest. Step 2 Subtract the interest from the monthly payment to get the amount paid on the principal. Enter this amount in a column labeled Payment on Principal. Step 3 Subtract the amount of the payment on principal found in step 2 from the principal to…arrow_forward

- On September 1, the home mortgage balance was $262,000 for the home owned by Kim Thompson. The interest rate for the loan is 8 percent. Assuming that Kim makes the September monthly mortgage payment of $2620 , calculate the following: (a) The amount of interest included in the September payment (round your answer to the nearest cent). (b) The amount of the monthly mortgage payment that will be used to reduce the principal balance. (c) The new balance after Kim makes this monthly mortgage payment.arrow_forwardMelynda and Andrés borrowed $60,000 at 7.25% compounded annually as a second mortgage loan against their current home. Repayment amount is $5,900 at the end of every six months. a. How many payments are required to repay the loan? Number of payments b. Use the given information to complete the amortization table below. Determine the missing values for the first two payment intervals, the last two payment intervals, and the totals. Report results to the nearest cent.arrow_forwardA couple borrows $300,000 at an APR of 4.8% compounded monthly on a 30-year mortgage with monthly payments of $1,574. (a) How much of the first payment goes to interest? (b) Find the total interest paid over the life of the loan. (c) After making their 70th payment, they refinance the loan at an APR of 3.6% compounded monthly for 15 years. The refinanced amount includes the unpaid balance from the original loan plus a refinance charge of $2,000. Find the new monthly payment. (d) Find the amount saved by refinancing.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education