FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Aging of receivables; estimating allowance for doubtful accounts Trophy Fish Company supplies flies and fishing gear to sporting goods stores and outfitters throughout the western United States. The

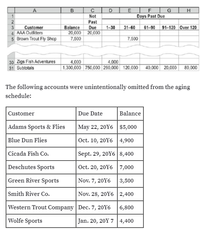

Transcribed Image Text:A

H

Not

Days Past Due

Past

Customer

4 AAA Outfitters

5 Brown Trout Fly Shop

Balance

Due

1-30

31-60

61-90

91-120 Over 120

20,000 20,000

7,500

7,500

30 Zigs Fish Adventures

31 Subtotals

4,000

| 1,300,000 750,000 290,000 120,000 40,000 20,000 80,000

4,000

The following accounts were unintentionally omitted from the aging

schedule:

Customer

Due Date

Balance

Adams Sports & Flies

May 22, 20Y6 $5,000

Blue Dun Flies

Oct. 10, 20Y6 4,900

Cicada Fish Co.

Sept. 29, 20Y6 8,400

Deschutes Sports

Oct. 20, 20Y6 7,000

Green River Sports

Nov. 7, 20Y6

3,500

Smith River Co.

Nov. 28, 20Y6 2,400

Western Trout Company Dec. 7, 20Y6

6,800

Wolfe Sports

Jan. 20, 20Y 7| 4,400

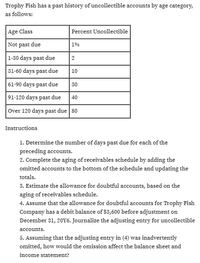

Transcribed Image Text:Trophy Fish has a past history of uncollectible accounts by age category,

as follows:

Age Class

Not past due

Percent Uncollectible

19%

|1-30 days past due

2

31-60 days past due

10

61-90 days past due

30

91-120 days past due

40

Over 120 days past due 80

Instructions

1. Determine the number of days past due for each of the

preceding accounts.

2. Complete the aging of receivables schedule by adding the

omitted accounts to the bottom of the schedule and updating the

totals.

3. Estimate the allowance for doubtful accounts, based on the

aging of receivables schedule.

4. Assume that the allowance for doubtful accounts for Trophy Fish

Company has a debit balance of $3,600 before adjustment on

December 31, 20Y6. Journalize the adjusting entry for uncollectible

accounts.

5. Assuming that the adjusting entry in (4) was inadvertently

omitted, how would the omission affect the balance sheet and

income statement?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Entries for bad debt expense under the direct write-off and allowance methods Seaforth International wrote off the following accounts receivable as uncollectible for the year ending December 31: Customer Kim Abel Lee Drake Jenny Green Mike Lamb Total Aging Class (Number of Days Past Due) 0-30 days 31-60 days 61-90 days 91-120 days More than 120 days Total receivables The company prepared the following aging schedule for its accounts receivable on December 31: Aging Class (Number of Days Past Due) 0-30 days 31-60 days 61-90 days 91-120 days More than 120 days Total receivables Bad Debt Expense Accounts Receivable-Kim Abel Accounts Receivable-Lee Drake Accounts Receivable-Jenny Green Accounts Receivable-Mike Lamb Allowance for Doubtful Accounts Accounts Receivable-Kim Abel Accounts Receivable-Lee Drake Accounts Receivable-Jenny Green Accounts Receivable-Mike Lamb Bad Debt Expense Amount $24,200 34,150 29,700 17,600 $105,650 Allowance for Doubtful Accounts Feedback Receivables Balance on…arrow_forwardAging of Receivables Schedule The accounts receivable clerk for Kirchhoff Industries prepared the following partially completed aging of receivables schedule as of the end of business on November 30: Not Days Past Due Past Over Customer Balance Due 1-30 31-60 61-90 90 Academy Industries Inc. 5,500 5,500 Ascent Company 3,100 3,100 Zoot Company 7,700 7,700 Subtotals 886,200 535,200 195,000 85,100 44,300 26,600 The following accounts were unintentionally omitted from the aging schedule and not included in the subtotals above: Customer Balance Due Date Conover Industries $12,400 July 9 Keystone Company 8,900 September 19 Moxie Creek Inc. 17,700 October 17 Rainbow Company 10,600 November 5 Swanson Company 23,900 December 21 Question Content Area a. Determine the number of days past due for each of the preceding accounts as of November 30. If an…arrow_forwardComplete a,b,&c please and thank youarrow_forward

- Entry for Uncollectible Accounts Outlaw Bike Co. is a wholesaler of motorcycle supplies. An aging of the company's accounts receivable on December 31 and a historical analysis of the percentage of uncollectible accounts in each age category are given below. Age Interval Balance Estimated UncollectibleAccounts Percent Estimated UncollectibleAccounts Amount Not past due $892,000 3/4 % $6,690 1-30 days past due 285,000 1.00 2,850 31-60 days past due 101,000 8.00 8,080 61-90 days past due 63,000 16.00 10,080 91-180 days past due 43,100 50.00 21,550 Over 180 days past due 17,700 80.00 14,160 Total $1,401,800 $63,410 Assume that the allowance for doubtful accounts for Outlaw Bike Co. had a debit balance of $5,140 as of December 31. Journalize the adjusting entry for uncollectible accounts as of December 31. If an amount box does not require an entry, leave it blank.arrow_forwardEstimating Doubtful Accounts Performance Bike Co. is a wholesaler of motorcycle supplies. An aging of the company's accounts receivable on December 31 and a historical analysis of the percentage of uncollectible accounts in each age category are as follows: Estimate what the proper balance of the allowance for doubtful accounts should be as of December 31. Performance Bike Co. Estimation of Uncollectible Accounts December 31 Age Interval Balance Estimated Uncollectible Accounts Percent Estimated Uncollectible Accounts Amount Not past due $736,000 1/2% $fill in the blank 1 1-30 days past due 81,000 2 fill in the blank 2 31-60 days past due 36,800 8 fill in the blank 3 61-90 days past due 26,500 16 fill in the blank 4 91-180 days past due 19,100 39 fill in the blank 5 Over 180 days past due 14,000 65 fill in the blank 6 Total $913,400arrow_forwardEstimating doubtful accounts Outlaw Bike Co. is a wholesaler of motorcycle supplies. An aging of the company's accounts receivable on December 31 and a historical analysis of the percentage of uncollectible account in each age category are as follows: Age Class Not past due 1-30 days past due 31-60 days past due 61-90 days past due 91-180 days past due Over 180 days past due Total Estimate what the proper balance of the allowance for doubtful accounts should be as of December 31. Balance $868,000 95,500 43,400 31,200 22,600 16,500 $1,077,200 Percent Uncollectible 1/2% 4 8 16 38 80arrow_forward

- Estimating Doubtful Accounts Performance Bike Co. is a wholesaler of motorcycle supplies. An aging of the company's accounts receivable on December 31 and a historical analysis of the percentage of uncollectible accounts in each age category are as follows: Estimate what the proper balance of the allowance for doubtful accounts should be as of December 31. Performance Bike Co. Estimation of Uncollectible Accounts December 31 Age Interval Balance Estimated Uncollectible Accounts Percent Estimated Uncollectible Accounts Amount Not past due $668,000 1/2% $ 1-30 days past due 73,500 3 31-60 days past due 33,400 8 61-90 days past due 24,000 18 91-180 days past due 17,400 41 Over 180 days past due 12,700 80 Total $829,000arrow_forwardRequired information Use the following information for the Exercises below. Skip to question [The following information applies to the questions displayed below.]Daley Company prepared the following aging of receivables analysis at December 31. Days Past Due Total 0 1 to 30 31 to 60 61 to 90 Over 90 Accounts receivable $ 625,000 $ 407,000 $ 101,000 $ 47,000 $ 29,000 $ 41,000 Percent uncollectible 3 % 4 % 7 % 9 % 12 % Exercise 9-9 Percent of receivables method LO P3 a. Estimate the balance of the Allowance for Doubtful Accounts assuming the company uses 5% of total accounts receivable to estimate uncollectibles, instead of the aging of receivables method.b. Prepare the adjusting entry to record Bad Debts Expense using the estimate from part a. Assume the unadjusted balance in the Allowance for Doubtful Accounts is a $13,100 credit.c. Prepare the adjusting entry to record bad debts expense…arrow_forwardAging of receivables schedule The accounts receivable clerk for Evers Industries prepared the following partially completed aging of receivables schedule as of the end of business on July 31: The following accounts were unintentionally omitted from the aging schedule and not included in the preceding subtotals Customer Balance Dud Date Boyd Industries $36,000 April 7 Hodges Company 11,500 May 29 Kent Creek Inc. 6,600 June 8 Lockwood Company 7,400 August 10 Van Epps Company 13,000 July 2 A. Determine the number of days past clue for each of the preceding accounts as of july 31. B. Complete the aging of recivables schedule by adding the omitted accounts to the bottom of the schedule and updating the totals.arrow_forward

- Required information [The following information applies to the questions displayed below.] Daley Company prepared the following aging of receivables analysis at December 31. Days Past Due 31 to 60 $ 56,000 7% Accounts receivable Percent uncollectible Total 0 $ 670,000 $ 416,000 Req A Req B and C 3% Complete this question by entering your answers in the tabs below. 1 to 30 $ 110,000 a. Estimate the balance of the Allowance for Doubtful Accounts assuming the company uses 5% of total accounts receivable to estimate uncollectibles, instead of the aging of receivables method. b. Prepare the adjusting entry to record bad debts expense using the estimate from part a. Assume the unadjusted balance in the Allowance for Doubtful Accounts is a $14,000 credit. c. Prepare the adjusting entry to record bad debts expense using the estimate from part a. Assume the unadjusted balance in the Allowance for Doubtful Accounts is a $3,000 debit. Estimated balance of allowance for uncollectibles 4%arrow_forwardA summary of Milan Fashion's December 31, 2021, accounts receivable aging schedule is presented below along with the estimated percent uncollectible for each age group: Age Group Amount % 0-60 days $40,000 0.5 61-90 days 15,000 1.5 91-120 days 2,000 15.0 Over 120 days 800 80.0 The allowance for uncollectible accounts had a credit balance of $1,600 at January 1, 2021. During the year bad debts of $1,150 were written off. Also, $150 previously written off were paid by a customer. Required: Prepare all 2021 journal entries with respect to bad debts and the allowance for uncollectible accounts. Show computations. Prepare a T account for the allowance for uncollectible accounts from 1/1 to 12/31/21.arrow_forwardAccounting for uncollectible accounts (aging-of-receivables method), notes receivable, and accrued interest revenue Sleepy Recliner Chairs completed the following selected transactions: Record the transactions in the journal of Sleepy Recliner Chairs. Explanations are not required. (Round to the nearest dollar.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education