FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:of credit sales. At the end of the year, the company ages its accounts receivable and adjusts the

balance in the Allowance for Uncollectible Accounts to correspond to the aging schedule.

During July to December of 20X7, Texas Gulf Carts completed the following transactions:

August 9

Made a compound entry to write off uncollectible

accounts: J. Aguilar, $200; Scaton Co., $100; and T.

Taylor, $700.

Sept. 30

Recorded uncollectible account expense equal to 1%% of credit

sales of $140,000

Oct. 18

Wrote off accounts receivable as uncollectible the $500 account

receivable from Lantz Co. and the $400 ac

unt receivable from

Navisor Corp.

Dec. 31

Recorded uncollectible-account expense based on the aging of

reccivables, which follows:

Age of Accounts

1-30

31 - 60

61 – 90

Over 90

Total

Days

Days

Days

Days

$163,000

$100,000

$40,000

$14,000

9,000

Estimated percent uncollectible

0.1%

0.5%

5%

30%

Required:

a. Record the transactions in the journal.

b. Open the Allowance for Uncollectible Account and post entries affecting that

account. Keep a running balance.

c. Show how Texas Gulf Carts should report accounts receivable on its balance

sheet at December 31, 20X7.

Question 4

The June 30, 20X 9, balance sheet of Ram Technologies reports the following:

Accounts Receivable...

Allowance for Uncollectible Accounts (Cr).....

$265,000

7,100

At the end of each quarter, RAM estimates uncollectible-account expense to be 2% of credit sales.

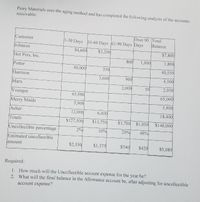

Transcribed Image Text:Perry Materials uses the aging method and has completed the following analysis of the accounts

receivable:

Over 90 Total

Balance

Customer

1-30 Days 31-60 Days 61-90 Days Days

Johnson

$4,600

$3,200

$7,800

Hot Pots, Inc.

800

1,000

1,800

Potter

40,000

550

40,550

Harrison

3,600

900

4,500

Marx

2,000

50

2,050

Younger

65,000

65,000

Merry Maids

5,900

5,900

Acher

12,000

6,400

18,400

Totals

$127,500

$13,750

$3,700 $1,050

$146,000

Uncollectible percentage

2%

10%

20%

40%

Estimated uncollectible

amount

$2,550

$1,375

$740

$420

$5,085

Required:

1. How much will the Uncollectible account expense for the year be?

2. What will the final balance in the Allowance account be, after adjusting for uncollectible

account expense?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 3 images

Knowledge Booster

Similar questions

- Use the following information for the next two questions: ABC Co. has the following information on December 31, 20x1 before any year-end adjustments. Net credit sales Accounts receivable, December Allowance for doubtful accounts, Dec. 31 (before any necessary year-end adjustments) Percentage of credit sales The aging of receivables is shown below: Days outstanding 0 - 60 61 - 120 Over 120 Total accounts receivables a. 12,600 b. 18,900 c. 19,200 d. 23,400 Receivable balances 378,000 283,500 315,000 976,500 a. 123,300 b. 128,700 c. 143,300 d. 132,300 6,300,000 976,500 53,550 2% Additional information: ABC Co. uses the percentage of credit sales in determining bad debts in monthly financial reports and the aging of receivables for its annual financial statements. Accounts written-off during the year amounted to P119,700 and accounts recovered amounted to P28,350. As of December 31, ABC Co. determined that P63,000 accounts receivable from a certain customer included in the "61-120 days…arrow_forwardIndiana Bones, Inc., has the following account balances at the end of the year before adjustments: Accounts Receivable $60,000 Allowance for Doubtful Accounts $800 credit balance Sales $900,000 Doubtful Accounts Expense 0 Management estimates that 11% of accounts receivable will be uncollectible. After the correct adjusting entry has been made, Doubtful Accounts Expense on the income statement for the year equals:arrow_forwardes Mazie Supply Company uses the percent of accounts receivable method. On December 31, it has outstanding accounts receivable of $85,000, and it estimates that 4% will be uncollectible. Prepare the year-end adjusting entry to record bad debts expense under the assumption that the Allowance for Doubtful Accounts has: (a) a $1,445 credit balance before the adjustment. (b) a $425 debit balance before the adjustment. View transaction list Journal entry worksheet 1 2 Prepare the year-end adjusting entry to record bad debts expense under the assumption that the Allowance for Doubtful Accounts has a $1,445 credit balance before the adjustment. Note: Enter debits before credits. Transaction (a) Record entry General Journal Clear entry Debit Credit View general journal 7arrow_forward

- At the end of the year, a company has a balance in Allowance for Uncollectible Accounts of $220 (credit) before any year-end adjustment. The balance of Accounts Receivable is $15,900. The company estimates that 14% of accounts receivable will not be collected over the next year. Record the adjustment for uncollectible accounts. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet 1 Record the adjustment for uncollectible accounts. Note: Enter debits before credits. Event General Journal Debit Credit 30 F3 888 F7 F9 F10 # 2$ % & 3 4 6 7 8 9. E R Y P { F K L < ? C V alt command option + || .. .. | Harrow_forwardInnovative Tech Incorporated (ITI) has been using the percentage of credit sales method to estimate bad debts. During November, ITI sold services on account for $140,000 and estimated that 1/4 of 1 percent of those sales would be uncollectible. Required: Prepare the November adjusting entry for bad debts. Starting in December, ITI switched to using the aging method. At its December 31 year-end, total Accounts Receivable is $86,700, aged as follows: (1) 1 to 30 days old, $72,000; (2) 31 to 90 days old, $11,000; and (3) more than 90 days old, $3,700. The average rate of uncollectibility for each age group is estimated to be (1) 11 percent, (2) 22 percent, and (3) 44 percent, respectively. Prepare a schedule to estimate an appropriate year-end balance for the Allowance for Doubtful Accounts. Before the end-of-year adjusting entry is made, the Allowance for Doubtful Accounts has a $1,450 credit balance at December 31. Prepare the December 31 adjusting entry. Show how the various…arrow_forwardAt its fiscal year end, under the aging of a company's accounts receivable, the uncollectible accounts are estimated to be $12,000. The unadjusted balance for the Allowance for Doubtful Accounts is $2,000 credit. Assume the company records adjusting entries only at year end. What is the balance in the Allowance for Doubtful Accounts account after adjustment? A. $14,000 B. $12,000 O C. $10,000 D. $2,000arrow_forward

- Warner Company’s year-end unadjusted trial balance shows accounts receivable of $115,000, allowance for doubtful accounts of $760 (credit), and sales of $440,000. Uncollectibles are estimated to be 1.50% of accounts receivable. Prepare the December 31 year-end adjusting entry for uncollectibles. What amount would have been used in the year-end adjusting entry if the allowance account had a year-end unadjusted debit balance of $1,100?arrow_forwardPlease help mearrow_forwardA business has the following balances at the beginning of the year: Accounts receivable: 235000 Allowance for doubtful accounts: -15250The following summary transactions occurred during the year.Sales for the year, 100% on credit: 450000Cash collected on accounts receivable for the year: 445200Write-offs of uncollectable accounts receivable : 28200Received a cheque from a customer whose account was previously written off: 2820The overall rate used to estimate the allowance for doubtful accounts at year end: 8%Using the information above, answer the following questions.What is the balance in the accounts receivable account at year end? 1. What is the balance in the accounts receivable account at year end? 2. What is the balance in the allowance for doubtful accounts at year end? 3. What is the balance in the bad debt expense account at year end?arrow_forward

- At the beginning of current year, ABC company reported that the allowance for doubtful account has a acredit balance of $170,000. The company uses the aging of accounts receivable as a way to estimate the allowance The following schedule was prepared: Not yet due $1,700,000 NL uncollectible1-30 days pasat due $1,200,000 5% uncollectible31-60 days past due $100,000 25% uncollectible61-90 days past due $150,000 50% uncollectibleover 90 days past due. $120,000 100% uncollectible Questions:1) What is the required allowance for doubtful accounts at year-end?2) How much would be the doubtful accounts expense for the current year?3) What is the adjusting entry for the doubtful accounts expense for the current year?4) What is the net realizable value of accounts receivable at year-end?5) What is the effect on current assets should the adjustment was not made?arrow_forwardCasper Company uses its receivables in estimating uncollectible accounts (Bad Debt) expense. The company prepares an adjusting entry to recognize this expense at theend of the month. The beginning credit balance in the Allowance for Doubtful Accounts at July 1 was $64,000. During the month of July, the company wrote of 9,000 in Accounts Receivable but also collected a receivable of 3,000 that had been written off back in April. An aging analysis at July 31 indicated that the new credit balance in the Allowance for Doubful Accounts should be $69,000. On the adjusting entry on July 31, the debt to the Bad Debt Expense would be:arrow_forwardAt the end of the prior year, Durney's Outdoor Outfitters reported the following information. Accounts Receivable, December 31, prior year Accounts Receivable (Gross) (A) $ 48,283 Allowance for Doubtful Accounts (XA) 8,474 Accounts Receivable (Net) (A) $ 39,809 During the current year, sales on account were $306,673, collections on account were $290,750, write-offs of bad debts were $7,059, and the bad debt expense adjustment was $4,775. Required: 1-a. Complete the Accounts Receivable and Allowance for Doubtful Accounts T-accounts to determine the balance sheet values. 1-b. Complete the amounts related to Accounts Receivable and Bad Debt Expense that would be reported on the income statement for the current year. 1-c. Complete the amounts related to Accounts Receivable and Bad Debt Expense that would be reported on the balance sheet for the current year.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education