Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:ces

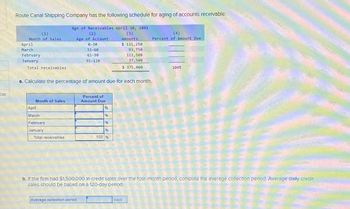

Route Canal Shipping Company has the following schedule for aging of accounts receivable:

(1)

Month of Sales

April

March

February

January

Total receivables

Month of Sales

April

March

a. Calculate the percentage of amount due for each month.

February

January

Age of Receivables April 30, 20X1

(3)

Amounts

Total receivables

(2)

Age of Account

10-30

31-60

61-98

91-120

Percent of

Amount Due

Average collection period

196

$ 131,250

93,750

112,500

37,500

$ 375,000

100 %

(4)

Percent of Amount Due

b. If the firm had $1,500,000 in credit sales over the four-month period, compute the average collection period. Average dally credit

sales should be based on a 120-day period.

days

100%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 4 images

Knowledge Booster

Similar questions

- Aging of Receivables Schedule The accounts receivable clerk for Kirchhoff Industries prepared the following partially completed aging of receivables schedule as of the end of business on November 30: Not Days Past Due Past Over Customer Balance Due 1-30 31-60 61-90 90 Academy Industries Inc. 5,500 5,500 Ascent Company 3,100 3,100 Zoot Company 7,700 7,700 Subtotals 886,200 535,200 195,000 85,100 44,300 26,600 The following accounts were unintentionally omitted from the aging schedule and not included in the subtotals above: Customer Balance Due Date Conover Industries $12,400 July 9 Keystone Company 8,900 September 19 Moxie Creek Inc. 17,700 October 17 Rainbow Company 10,600 November 5 Swanson Company 23,900 December 21 Question Content Area a. Determine the number of days past due for each of the preceding accounts as of November 30. If an…arrow_forwardA year-end review of Accounts Receivable and estimated uncollectible percentages revealed the following: Days Outstanding 1-30 days 31-60 days 61-90 days Over 90 days Accounts Est. Percent Receivable Uncollectible $65,000 3% $43,000 5% $25,000 10% $6,000 52% Before the year-end adjustment, the credit balance in Allowance for Uncollectible Accounts was $700. Under the aging-of-receivables method, the balance in the Allowance for Uncollectible Accounts will be after the adjusting entry is made. OA. $9,020 OB. $1,250 OC. $10,420 OD. $9,720arrow_forwardFernández Company uses the allowance method of accounting for uncollectible accounts. The following summary schedule was prepared from an aging of accounts receivable outstanding on December 31 of the current year. Number of Days Outstanding 0-31 days 31-60 days Over 60 days Amount $500,000 200,000 100,000 The following additional information is available for the current year: Net credit sales for the year Loss allowance: Balance, January 1 Balance before adjustment, December 31 Probability of Collection 0.98 0.90 0.80 A. $752,000 B. $48,000 C. $50,000 D. $748,000 $4,000,000 45,000 (cr.) 2,000 (cr.) B If Fernández bases its estimate of uncollectible accounts on the aging of accounts receivable, Expected Credit Loss for the current year ending December 31 isarrow_forward

- The ADA has the below table regarding its account receivable: Age of Accounts Balance, June 30 Estimated Percentage Uncollectible 1-30 days $130,000 2.00% 31-60 days 70,000 5.00% 61-90 days 32,500 20.00% Over 90 days 3,000 50.00% If the opening balance of Allowance for Doubtful accounts is $7,050, the entries to record estimated uncollectible receivables this year will be: Select one: a. Bad debt expense $7,050 Allowance for doubtful accounts $7,050 b. Allowance for doubtful accounts $14,100 Account receivable $14,100 c. Bad debt expense $14,100 Allowance for doubtful accounts $14,100 d. Account receivable $7,100 Bad debt expense $7,100arrow_forwardSelected data for the Erdin Corporation for the year ended Decmeber 31, 20x5 is provided below: Credit sales Accounts receivable written off Recoveries of previously written of accounts receivable Allowance for doubtful accounts balance, January 1, 20x5 Accounts receivable, December 31, 20x5 Erdin estimates that 0.8% of sales will be uncollectible. Required - $4,500,000 36,500 1,800 33,000 cr. 625,000 Write the journal entries to record the accounts receivable written off, the recoveries and the bad debt expense. Calculate the ending balance in the allowance for doubtful account at December 31, 20x5. Note that the accounts receivable and recoveries have been accounted for in the ending Accounts Receivable balance.arrow_forwardDaley Company prepared the following aging of receivables analysis at December 31. Total 0 Accounts receivable Percent uncollectible $ 625,000 $ 407,000 1 to 30 $ 101,000 Days Past Due 31 to 60 $ 47,000 61 to 90 $ 29,000 Over 90 $ 41,000 3% 4% 7% 9% 12% a. Estimate the balance of the Allowance for Doubtful Accounts assuming the company uses 5% of total accounts receivable to estimate uncollectibles, instead of the aging of receivables method. b. Prepare the adjusting entry to record bad debts expense using the estimate from part a. Assume the unadjusted balance in the Allowance for Doubtful Accounts is a $13,100 credit. c. Prepare the adjusting entry to record bad debts expense using the estimate from part a. Assume the unadjusted balance in the Allowance for Doubtful Accounts is a $2,100 debit. Answer is not complete. Complete this question by entering your answers in the tabs below. Req A Req B and C Estimate the balance of the Allowance for Doubtful Accounts assuming the company…arrow_forward

- Required information Use the following information for the Exercises below. Skip to question [The following information applies to the questions displayed below.]Daley Company prepared the following aging of receivables analysis at December 31. Days Past Due Total 0 1 to 30 31 to 60 61 to 90 Over 90 Accounts receivable $ 625,000 $ 407,000 $ 101,000 $ 47,000 $ 29,000 $ 41,000 Percent uncollectible 3 % 4 % 7 % 9 % 12 % Exercise 9-9 Percent of receivables method LO P3 a. Estimate the balance of the Allowance for Doubtful Accounts assuming the company uses 5% of total accounts receivable to estimate uncollectibles, instead of the aging of receivables method.b. Prepare the adjusting entry to record Bad Debts Expense using the estimate from part a. Assume the unadjusted balance in the Allowance for Doubtful Accounts is a $13,100 credit.c. Prepare the adjusting entry to record bad debts expense…arrow_forwardRequired information [The following information applies to the questions displayed below.] Daley Company prepared the following aging of receivables analysis at December 31. Days Past Due 31 to 60 $ 56,000 7% Accounts receivable Percent uncollectible Total 0 $ 670,000 $ 416,000 Req A Req B and C 3% Complete this question by entering your answers in the tabs below. 1 to 30 $ 110,000 a. Estimate the balance of the Allowance for Doubtful Accounts assuming the company uses 5% of total accounts receivable to estimate uncollectibles, instead of the aging of receivables method. b. Prepare the adjusting entry to record bad debts expense using the estimate from part a. Assume the unadjusted balance in the Allowance for Doubtful Accounts is a $14,000 credit. c. Prepare the adjusting entry to record bad debts expense using the estimate from part a. Assume the unadjusted balance in the Allowance for Doubtful Accounts is a $3,000 debit. Estimated balance of allowance for uncollectibles 4%arrow_forwardA summary of Milan Fashion's December 31, 2021, accounts receivable aging schedule is presented below along with the estimated percent uncollectible for each age group: Age Group Amount % 0-60 days $40,000 0.5 61-90 days 15,000 1.5 91-120 days 2,000 15.0 Over 120 days 800 80.0 The allowance for uncollectible accounts had a credit balance of $1,600 at January 1, 2021. During the year bad debts of $1,150 were written off. Also, $150 previously written off were paid by a customer. Required: Prepare all 2021 journal entries with respect to bad debts and the allowance for uncollectible accounts. Show computations. Prepare a T account for the allowance for uncollectible accounts from 1/1 to 12/31/21.arrow_forward

- Aging of Receivables Schedule The accounts receivable clerk for Kirchhoff Industries prepared the following partially completed aging of receivables schedule as of the end of business on November 30: Not Days Past Due Past Over Customer Balance Due 1-30 31-60 61-90 90 Academy Industries Inc. 5,100 5,100 Ascent Company 3,800 3,800 Zoot Company 7,000 7,000 Subtotals 805,800 486,600 177,300 77,400 40,300 24,200 The following accounts were unintentionally omitted from the aging schedule and not included in the subtotals above: Customer Balance Due Date Conover Industries $11,300 July 11 Keystone Company 8,100 September 19 Moxie Creek Inc. 16,100 October 17 Rainbow Company 9,700 November 4 Swanson Company 21,800 December 21 a. Determine the number of days past due for each of the preceding accounts as of November 30. If an account is not past due,…arrow_forwardPrepare an aging schedule to determine the total estimated uncollectibles at March 31,2018arrow_forwardEstimating Uncollectible Accounts and Reporting Accounts Receivable LaFond Company analyzes its accounts receivable at December 31, and arrives at the age categories below along with the percentages that are estimated as uncollectible. Accounts Estimated Receivable Loss % $ 90,000 20,000 11,000 6,000 Over 180 days past due 4,000 Total accounts receivable $ 131,000 Age Group 0-30 days past due 31-60 days past due 61-120 days past due 121-180 296 4 The balance of the allowance for uncollectible accounts is $520 on December 31, before any adjustments. Transaction Record bad debts expense 5 10 25 (a) What amount of bad debts expense will LaFond report in its income statement for the year? $0 Cash Asset (b) Use the financial statement effects template to record LaFond's bad debts expense for the year. Use negative signs with your answers, when appropriate. Noncash Assets Balance Sheet Liabilities Contributed Capital (c) What is the balance of accounts receivable on it December 31 balance…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education