Concept explainers

NOT IMCOMPLETE - JUST READ AND LOOK ATTACHMENTS.

Allowance Method for Doubtful Accounts

Averys All-Natural Company supplies wigs and hair care products to beauty salons throughout Texas and the Southwest. The

| Days Past Due | |||||||||

| Customer | Balance | Not Past Due |

1–30 | 31–60 | 61–90 | 91–120 | Over 120 | ||

| AAA Beauty | 27,500 | 27,500 | |||||||

| Amelia's Wigs | 3,750 | 3,750 | |||||||

| Zim’s Beauty | 1,650 | 1,650 | |||||||

| Totals | 1,100,000 | 750,000 | 180,000 | 75,000 | 45,000 | 22,000 | 28,000 |

Averys All-Natural Company has a past history of uncollectible accounts by age category, as follows:

| Age Class | Percent Uncollectible |

||

| Not past due | 1 | % | |

| 1–30 days past due | 3 | ||

| 31–60 days past due | 7 | ||

| 61–90 days past due | 16 | ||

| 91–120 days past due | 40 | ||

| Over 120 days past due | 90 |

Instructions:

please look at screen shots attached to see 1-5 answered. This is not incomplete! you just have to read it and not skim through.

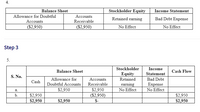

6. Assume that instead of using the allowance method, Averys All-Natural uses the direct writeoff method. Illustrate the effect on the accounts and financial statements of the following:

a. The write-off of the Superior Images account on March 4, 20Y8.

If no account or activity is affected, select "No effect" from the dropdown and leave the corresponding number entry box blank. Enter account decreases and

|

b. The (1) reinstatement and (2) collection of the Superior Images account on August 17, 20Y8.

(1) reinstatement

If no account or activity is affected, select "No effect" from the dropdown and leave the corresponding number entry box blank. Enter account decreases and cash outflows as negative amounts.

|

(2) collection

If no account or activity is affected, select "No effect" from the dropdown and leave the corresponding number entry box blank. Enter account decreases and cash outflows as negative amounts.

|

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

- Entries for Uncollectible Receivables, using Allowance Method Journalize the following transactions in the accounts of Zippy Interiors Company, a restaurant supply company that uses the allowance method of accounting for uncollectible receivables: May 24 Sold merchandise on account to Old Town Cafe, $19,300. The cost of goods sold was $13,900. Sept. 30 Received $5,400 from Old Town Cafe and wrote off the remainder owed on the sale of May 24 as uncollectible. Dec. 7 Reinstated the account of Old Town Cafe that had been written off on September 30 and received $13,900 cash in full payment. If an amount box does not require an entry, leave it blank. May 24-sale May 24-cost Accounting numeric field Sept. 30 Dec. 7-reinstate Dec. 7-collectionarrow_forwardAllowance for Uncollectible Accounts-Aging Method Sales-R-Us beginning general ledger shows an allowance for doubtful accounts balance of $10,000 credit balance. The year-end trial balance before adjustments, reports gross accounts receivable of $100,000 and allowance for doubtful accounts of $5,000 credit. Be sure to use the proper format for all JEs (Journal Entries). 1. 2. Using the aging method, the company estimates that it will be unable to collect 11% of the total accounts receivable at year end. Write the journal entry for updating their ADA account at year end. After making the required journal entry for bad debts at year end, what is the ending balance in allowance for uncollectible accounts? Allowance For Doubtful Accounts 3- On December 31, how much (in total) is owed to Sales-R-Us by customers? What do they expect to receive (the "net realizable value") from customers? 4. Obviously, during the year, some of the ADA was written off, please show the correct JE that had been…arrow_forwardment/chec Show Me How Print Item Estimating Doubtful Accounts Outlaw Bike Co. is a wholesaler of motorcycle supplies. An aging of the company's accounts receivable on December 31, and a historical añalysis of the percentage of uncollectible accounts in each age category are as follows: Percent Age Class Balance Uncollectible Not past due $782,000 1/2 % 1-30 days past due 86,000 4 31-60 days past due 39,100 7 61-90 days past due 28,200 18 91-180 days past due 20,300 41 Over 180 days past due 14,900 80 $970,500 Estimate what the proper balance of the allowance for doubtful accounts should be as of December 31. Percent Estimated Uncollectible Age Class Balance Uncollectible Accounts Amount Not past due $782,000 1/2% 1-30 days past due 86,000 4 31-60 days past due 39,100 7arrow_forward

- Entry for Uncollectible Accounts Outlaw Bike Co. is a wholesaler of motorcycle supplies. An aging of the company's accounts receivable on December 31 and a historical analysis of the percentage of uncollectible accounts in each age category are given below. Age Interval Balance Estimated UncollectibleAccounts Percent Estimated UncollectibleAccounts Amount Not past due $902,000 3/4 % $6,765 1-30 days past due 99,200 2 1,984 31-60 days past due 45,100 6 2,706 61-90 days past due 32,500 18 5,850 91-180 days past due 23,500 42 9,870 Over 180 days past due 17,100 65 11,115 Total $1,119,400 $38,290 Assume that the allowance for doubtful accounts for Outlaw Bike Co. had a debit balance of $6,890 as of December 31. Journalize the adjusting entry for uncollectible accounts as of December 31. Dec. 31 - Select - - Select -arrow_forwardplease avoid solutions in image format thank youarrow_forwardEntry for Uncollectible Accounts Outlaw Bike Co. is a wholesaler of motorcycle supplies. An aging of the company's accounts receivable on December 31 and a historical analysis of the percentage of uncollectible accounts in each age category are given below. Age Interval Balance Estimated UncollectibleAccounts Percent Estimated UncollectibleAccounts Amount Not past due $878,000 3/4 % $6,585 1-30 days past due 96,600 2 1,932 31-60 days past due 43,900 8 3,512 61-90 days past due 31,600 14 4,424 91-180 days past due 22,800 38 8,664 Over 180 days past due 16,700 75 12,525 Total $1,089,600 $37,642 Assume that the allowance for doubtful accounts for Outlaw Bike Co. had a debit balance of $6,775 as of December 31. Journalize the adjusting entry for uncollectible accounts as of December 31. If an amount box does not require an entry, leave it blank. Dec. 31 - Select - - Select - - Select - - Select -arrow_forward

- 8.2arrow_forwardLinda Co. sells Christmas angels. Linda determines that at the end of December, they have the following aging schedule of Accounts Receivable: Customer K. Brant D. Eaton S Klein C. Sheen % Uncollectible Total Number of Days Past Due Not yet due $900 300 180 600 ? 200 600 800 1 % 1-30 $300 Total estimated uncollectible accounts 300 5 % 31-60 $600 50 650 10 % 61-90 100 100 25 % Over 90 130 130 50 % Compute the total estimated uncollectible accounts based on the above information at the end of December.arrow_forwardEntries for Uncollectible Receivables, using Allowance Method Journalize the following transactions in the accounts of Zippy Interiors Company, a restaurant supply company that uses the allowance method of accounting for uncollectible receivables: May 24 Sold merchandise on account to Old Town Cafe, $19,100. The cost of goods sold was $13,800. Sept. 30 Received $4,400 from Old Town Cafe and wrote off the remainder owed on the sale of May 24 as uncollectible. Dec. 7 Reinstated the account of Old Town Cafe that had been written off on September 30 and received $14,700 cash in full payment. May 24-sale Accounts receivable-old town cafe sales May 24-cost Cost of goods sold Inventoru Sep 30 Cash Allowance for doubtful accounts accounts receivable old town cafe Dec 7-reinstate Accounts receivable old town cafe Allowance for doubtful accounts Dec 7-collection cash accounts receivable old town cafearrow_forward

- don't give answer in image formatarrow_forwardNote:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardJournalize the following transactions in the accounts of BBH inc., a wholesaler of arcade cabinets that uses the allowance method of accounting for uncollectible receivables: May 24 - Sold merchandise on account to Big Castle $18,450. The cost of goods sold was $11,000. 30 - Received $6,000 from Big Castle and wrote off the remainder owed on the sale of May 24 as uncollectible. Dec. 7 - Reinstated the account of Big Castle that had been written off on September 30 and received $12,450 cash in full paymentarrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education