Quickbooks Online Accounting

3rd Edition

ISBN: 9780357391693

Author: Owen

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

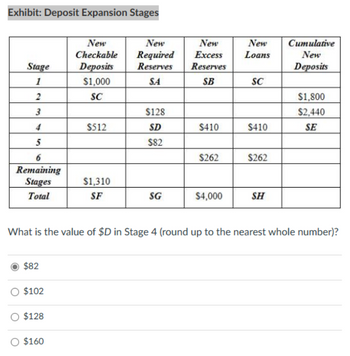

Transcribed Image Text:Exhibit: Deposit Expansion Stages

New

New

New

New

Cumulative

Checkable

Required

Excess

Loans

New

Stage

Deposits

Reserves

Reserves

Deposits

1

$1,000

SA

SB

SC

2

SC

$1,800

3

$128

$2,440

4

$512

SD

$410

$410

SE

5

$82

6

$262

$262

Remaining

Stages

$1,310

Total

SF

SG

$4,000

SH

What is the value of $D in Stage 4 (round up to the nearest whole number)?

$82

$102

$128

$160

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Question 7.17 please explained in detail.arrow_forwardClass Collaborate-AC-163-44 P x CengageNOWv2| Online teachin X + 2.cengagenow.com/ilmn/takeAssignment/takeAssignmentMain.do?invoker-assignments&takeAssignments... A Determine the following measures for 2018. Round ratio values to one decimal place and dollar amounts to the nearest cent. For number of days' sales in receivables and number of days' sales in inventory, round intermediate calculations to the nearest whole dollar and final amounts to one decimal place. Assume there are 365 days in the year. 1. Working capital Г 2,790,000 2. Current ratio 4.1 3. Quick ratio 2.5 4. Accounts receivable turnover 16 5. Days' sales in receivables 22.8 days 6. Inventory turnover 7. Days sales in inventory 8. Debt ratio days % 9. Ratio of liabilities to stockholders' equity 10. Ratio of fixed assets to long-term liabilities 11. Times interest earned times times 12. Times preferred dividends earned Check My Work 8 144 0 P Previous Email Instructor Save and Exr Submit Assignment for Grading pri se…arrow_forwardg In | Federa x M UMassD Logor X EQuickLaunch -x K myCourses Da: x Univ of Mass - X * Cengage Die education.com mework i Saved View transaction list Journal entry worksheet 1 4 6 7 8 9. 10 cearch 近arrow_forward

- What are two kinds of paid-in capital accounts?arrow_forwardOn November 1, 2022, the account balances of Blue Spruce Corp. were as follows. No. Debits No. Credits 101 Cash $2,880 154 Accumulated Depreciation-Equipment $2,400 112 Accounts Receivable 5,100 201 Accounts Payable 3,120 126 Supplies 2,160 209 Unearned Service Revenue 1,440 153 Equipment 14,400 212 Salaries and Wages Payable 840 311 Common Stock 12,000 320 Retained Earnings 4,740 $24,540 $24,540 During November, the following summary transactions were completed. Nov. 8 Paid $2,040 for salaries due employees, of which $840 is for October salarles. 10 Received $4.096 cash from customers on account. 12 Received $3,720 cash for services performed in November. 15 Purchased equipment on account $2,400. 17 Purchased supplies on account $840. 20 Paid creditors on account $3,240. 22 Paid November rent $480. 25 Paid salaries $2,040. 27 Performed services on account and billed customers $2,280 for these services. 29 Recelved $720 from customers for future service.arrow_forwardissis.com/FEL X - Unit Activity: Mathematical Mo x + lelivery//ua/69158/45467532/aHR0cHM6Ly9mMS5hcHAUZWRtZW50dW0uY29tL2xlYXJuZXItdWkvc2Vjb25kYXJ5L3VzZXIt nit Activity: Mathematical Models and Consumer Finance Task 7 Financing Transportation Respond to each question below in two to three complete sentences. Each question is worth four points. Space used (includes formatting): 0/15000 Part A Lydia makes a down payment of $1,600 on a $11,000 car loan. How much of the purchase price will the interest be calculated on? Explain how you arrived at the final answer. BIUX² X₂ 15px Part B AV king a down payment on a car loan help a car buyer? 11 of 12 = Print 11:58 O PI ☐ Save &arrow_forward

- What is the amount of the total paid-in capital? What makes up this amount?arrow_forwardContent Question 7 of 8 com/was/ui/v2/assessment-player/index.html?launchId=822123d0-f06e-40f1-aecf-7add80e089e1#/question/6 X WP NWP Assessment Builder Ul App X View Policies Current Attempt in Progress The following are a series of unrelated situations. Accounts receivable A Net sales Answer the questions relating to each of the five independent situations as requested. 1. Skysong Company's unadjusted trial balance at December 31, 2025, included the following accounts. Allowance for doubtful accounts Debit Bad debt expense for 2025 $ $54,800 6,910 WP NWP Assessment Player Ul Appli X Credit $1,267,000 + -/4 = : Skysong Company estimates its bad debt expense to be 7% of gross accounts receivable. Determine its bad debt expense for 2025.arrow_forwardCome * CengageNOowv2 | Online teach x Update akeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator%3&inprogress%-false Amortize Premium by Interest Method Shunda Corporation wholesales parts to appliance manufacturers. On January 1, Shunda issued $30,000,000 of five-year, 10% bonds at a market (effective) interest rate of 8%, receiving cash of $32,433,150. Interest is payable semiannually. Shunda's fiscal year begins on January 1. The company uses the Interest method. a. Journalize the entries to record the following: 1. Sale of the bonds. Round to the nearest dollar. If an armount box does not require an entry, leave it blank. the nearest dollar. If an amount box does not require an entry, leave it blank. 2. First semiannual interest payment, including amortization of premium. Round 3. Second semiannual interest payment, including amortization of premium. Round to the nearest dollar. If an amount box does not require an entry, leave it blank. b. Determine the bond…arrow_forward

- Print Item From the data below for Wong Company, prepare the closing entries for the year ended December 31. Cash dividends $47,000 Sales 982,600 Sales returns and allowances 3,960 Interest revenue 10,521 Factory overhead (debit) 210,620 Factory overhead (credit) 210,620 Cost of goods sold 726,820 Wages expense 130,745 Supplies expense 9,900 Depreciation expense-office equipment 6,900 Utilities expense 5,840 Bad debt expense 1,680 Advertising expense 11,120 Interest expense 9,860 Income tax expense 32,050 If an amount box does not require an entry, leave it blank. Page: 1 POST. DATE DESCRIPTION DEBIT CREDITarrow_forwardMC Qu. 12-127 The purchase of.. The purchase of $112,000 of equipment by Issulng a note would be reported: Multiple Choice In a supplementary schedule. as a $112,000 operating Inflow, and a $112,000 financing outflow. as a $112,000 Investing outflow, and a $112,000 financing Inflow. as a $112.000 investing Inflow, and a $112,000 financing outflow.arrow_forwardOnline Test Window-Google Chrome tests.mettl.com/test-window/f55ac827#/testWindow/0/20/1 EY Accounting Assessment Total 00:54:23 Finish Test Section 1 of 1 Section #1 v 15 16 17 18 19 20 21 23 24 22 25 21 of 45 All 2 43 Question # 21 G Revisit Choose the best option Under the accrual basis of accounting, if cash is received prior to the sale, then. Revenue is recognized when cash is received O A liability is recognized when cash is received O A liability is removed from the system when the cash is received O Revenue is removed from the system when the services have been performed or the goods have been delivered. Next Question Prev Question +91-82878-03040 Zaineh | Support +1-650-924-9221 4:14 PM meti gRへコ伝り) A 1/16/2021 Tyne here to searcharrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Business/Professional Ethics Directors/Executives...AccountingISBN:9781337485913Author:BROOKSPublisher:Cengage

Business/Professional Ethics Directors/Executives...

Accounting

ISBN:9781337485913

Author:BROOKS

Publisher:Cengage