Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

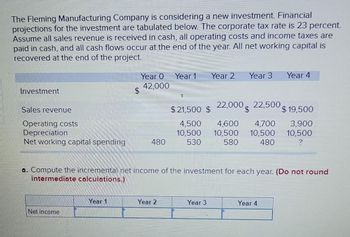

Transcribed Image Text:The Fleming Manufacturing Company is considering a new investment. Financial

projections for the investment are tabulated below. The corporate tax rate is 23 percent.

Assume all sales revenue is received in cash, all operating costs and income taxes are

paid in cash, and all cash flows occur at the end of the year. All net working capital is

recovered at the end of the project.

Investment

Sales revenue

Operating costs

Depreciation

Net working capital spending

Net income

$

Year 1

Year O

42,000

480

Year 1 Year 2 Year 3

Year 2

22,500,

$21,500 $ 22,000$

4,500 4,600 4,700

10,500 10,500 10,500

530 580

480

a. Compute the incremental net income of the investment for each year. (Do not round

intermediate calculations.)

Year 3

Year 4

Year 4

$19,500

3,900

10,500

?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 4 images

Knowledge Booster

Similar questions

- You need to estimate the value of Laputa Aviation. You have the following forecasts (in millions of dollars) of its profits and of its future investments in new plant and working capital: Earnings before interest, taxes, depreciation, and amortization (EBITDA) Depreciation Pretax profit Tax at 30% Investment 1 $ 78 38 40 12 14 Year a. Total value b. Laputa's equity 2 $ 98 48 50 15 17 3 $ 113 53 60 18 20 4 $ 118 58 60 18 22 From year 5 onward, EBITDA, depreciation, and investment are expected to remain unchanged at year-4 levels. Laputa is financed 40% by equity and 60% by debt. Its cost of equity is 13%, its debt yields 9%, and it pays corporate tax at 30%. a. Estimate the company's total value. Note: Do not round intermediate calculations. Enter your answer in millions rounded to the nearest whole amount. b. What is the value of Laputa's equity? Note: Do not round intermediate calculations. Enter your answer in millions rounded to the nearest whole amount.arrow_forwardprovide answer pleasearrow_forwardA company is considering a $166,000 investment in machinery with the following net cash flows. The company requires a 10% return on its investments. (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided.) Year 1 Year 2 Year 3 Year 4 Year 5 Net Cash Flow $10,000 $28,000 $55,000 $42,000 $111,000 (a) Compute the net present value of this investment.(b) Should the machinery be purchased?arrow_forward

- Sa. A large profitable corporation is considering a capital investment of $50,000. The equipment has a projected salvage value of $0 at the end of the two-year project period. The annual gross income each of the next two years is projected to be $44,000 and expenses are projected to be $14,000 annually. The depreciation amount will be $25,000 annually. This profitable corporation has an incremental income tax rate of 25% and the MARR is 10%. Determine the before-tax CF for Year 2 (only – not a total).arrow_forward3. Solar Solutions has purchased new manufacturing equipment that cost $400,000. Calculate the yearly tax savings from the CCA tax shield for the next three years. Assume that the income tax rate is 30%, the CCA rate is 30%, and the weighted-average cost of capital (WACC) is 12%. Assume that CCA in the first year is subject to the accelerated depreciation method for the year of acquisition. (Hint. Use Microsoft Excel to calculate the discount factor(s).) (Do not round your intermediate calculations. Round your final answers to 2 decimal places.) X Answer is complete but not entirely correct. Year 1 2 3 $ $ $ PV of Tax Savings 91,071.43 x 56,919.64 X 35,574.78 Xarrow_forwardAs assistant to the CFO of Boulder Inc., you must estimate the Year 1 cash flow for a project with the following data. What is the Year 1 cash flow? Do not round the intermediate calculations and round the final answer to the nearest whole number. Sales revenues $11,900 Operating costs $5,430 Tax rate 20.0%arrow_forward

- A firm has invested $50,000 in equipment with a 5-year useful life. The machinery will have a salvage value of $5,000. The annual benefits from the machinery are $13,000 for the first year and increase by $2,000 per year. Assume a combined 30% income tax rate, and the firm uses the SOYD depreciation. Calculate the before-tax IRR. Calculate the after-tax IRR.arrow_forwardjjjarrow_forwardC) a decrease of $12 D) an increase of $60,000 20. In a particular year a certain investment project generated revenue of $200,000. Other expenses (excluding depreciation and interest expense) totaled $100,000. Depreciation expense was $50,000 and interest expense was $10,000. The firm faces a tax rate of 21%. What is the project's after-tax operating cash flow in this year? A) $89,500 B) $81,600 C) $129,000 D) $79,000 ting decision and mustarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education