Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

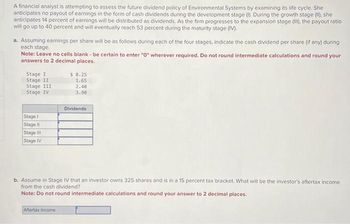

Transcribed Image Text:A financial analyst is attempting to assess the future dividend policy of Environmental Systems by examining its life cycle. She

anticipates no payout of earnings in the form of cash dividends during the development stage (1). During the growth stage (II), she

anticipates 14 percent of earnings will be distributed as dividends. As the firm progresses to the expansion stage (III), the payout ratio

will go up to 40 percent and will eventually reach 53 percent during the maturity stage (IV).

a. Assuming earnings per share will be as follows during each of the four stages, indicate the cash dividend per share (if any) during

each stage.

Note: Leave no cells blank - be certain to enter "O" wherever required. Do not round intermediate calculations and round your

answers to 2 decimal places.

Stage I

Stage II

Stage III

$ 0.25

1.65

2.40

Stage IV

3.90

Dividends

Stage I

Stage II

Stage III

Stage IV

b. Assume in Stage IV that an investor owns 325 shares and is in a 15 percent tax bracket. What will be the investor's aftertax income

from the cash dividend?

Note: Do not round intermediate calculations and round your answer to 2 decimal places.

Aftertax income

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- You are a consultant to a firm evaluating an expansion of its current business. The cash-flow forecasts (in millions of dollars) for the project are as follows: Years Cash Flow 0 – 100 1-10 + 17 On the basis of the behavior of the firm’s stock, you believe that the beta of the firm is 1.44. Assuming that the rate of return available on risk-free investments is 5% and that the expected rate of return on the market portfolio is 11%, what is the net present value of the project?arrow_forwardSuppose MMC Industries has calculated its external funds needed (EFN) to be $23,000,000, but now management is considering raising the previously assumed dividend payout ratio from 35% to 40%. If the payout ratio is increased, what will happen to EFN?arrow_forwardYou are a consultant to a firm evaluating an expansion of its current business. The cash-flow forecasts (in millions of dollars) for the project are as follows: Years Cash Flow 100 1-10 14 On the basis of the behavior of the firm's stock, you believe that the beta of the firm is 1.41. Assuming that the rate of return available on risk-free investments is 5% and that the expected rate of return on the market portfolio is 13%, what is the net present value of the project? (Negative amount should be indicated by a minus sign. Do not round intermediate calculations. Enter your answer in millions of dollars rounded to 2 decimal places.) Net present value millionarrow_forward

- For this question, use the American Eagle Outfitters 2016 10Ks and 2017 Q1 10Q from the previous questions. Your Managing Director asks you to include valuations based on Comparable Forward PE multiples given that peer capital structures have been relatively similar. She asks you to assume a 14x PE multiple on forward diluted EPS, and a 10% growth rate over LTM diluted EPS to calculate forward EPS, which is being assumed by industry analysts. Using the aforementioned assumptions for Comparable Transactions’ PE multiples, what is the implied AEO share price based on the latest data provided to you from its Corporate filings as of June 2017? 15.12 16.63 16.79 17.86arrow_forwardBeagle Beauties engages in the development, manufacture, and sale of a line of cosmetics designed to make your dog look glamorous. Below you will find selected information necessary to compute some valuation estimates for the firm. Assume the values provided are from year-end 2021. Also assume that the firm's equity beta is 1.40, the risk-free rate is 2.35 percent, and the market risk premium is 6.0 percent. Dividends per share Return on equity Book value per share 2021 value per share Average price multiple Forecasted growth rate $2.34 8.50% $ 19.30 Share price Earnings Cash Flow $5.00 13.10 13.63% $6.30 9.57 11.26% Sales $ 25.65 2.51 7.24% The sustainable growth rate is 4.522 percent, and the required return is 10.75 percent. Use the clean surplus relationship to calculate the share price for Beagle Beauties with the residual income model. Note: Do not round intermediate calculations. Round your answer to 2 decimal places.arrow_forwardAdobe Systems has come out with a new and improved product. As a result, the firm projects an ROE of 22.5%, and it will maintain a plowback ratio of .50. Its projected earnings are $3.75 per share. Investors expect an 18% rate of return on the stock. At what price and P/E ratio would you expect the firm to sell and what is the preset value of growth opportunities?arrow_forward

- A manager believes his firm will earn a return of 12.50 percent next year. His firm has a beta of 1.40, the expected return on the market is 10.50 percent, and the risk-free rate is 3.50 percent. Compute the return the firm should earn given its level of risk. (Round your answer to 2 decimal places.) Required return % Determine whether the manager is saying the firm is undervalued or overvalued. O overvalued O undervaluedarrow_forwardAs companies evolve, certain factors can drive sudden growth. This may lead to a period of nonconstant, or variable, growth. This would cause the expected growth rate to increase or decrease, thereby affecting the valuation model. For companies in such situations, you would refer to the variable, or nonconstant, growth model for the valuation of the company's stock. Consider the case of Portman Industries: Portman Industries just paid a dividend of $2.40 per share. The company expects the coming year to be very profitable, and its dividend is expected to grow by 12.00% over the next year. After the next year, though, Portman's dividend is expected to grow at a constant rate of 2.40% per year. Assuming that the market is in equilibrium, use the information just given to complete the table. Term Dividends one year from now (D1) Horizon value (P1) Intrinsic value of Portman's stock Value The risk-free rate (TRF) is 3.00%, the market risk premium (RPM) is 3.60%, and Portman's beta is 1.70.…arrow_forwardYou are trying to value the stocks of Imaginary Inc. The company is currently involved ina very risky, but potentially very profitable project. In the preceding year, the companyhad earnings of $10 per share. You expect the earnings per share to grow to $15, $20, and$25 in the next three years, after which you expect a growth rate of 2%. The companyalways applies a plowback ratio of 60%. You estimate that a risk-adjusted discount rateof 10% is appropriate.a). What are the expected dividends per share in the next three years?b). What is the expected price per share three years from now?c). What is the fair stock price per share today?arrow_forward

- You are now an equity analyst. We now find that the actual valuation of Company X is 130. Your manager suggests basing the price on a discounted dividend model and a discounted free cash flow valuation method. However, these two methods may produce very different estimates when applied to actual data. The discounted dividend model works out to a price of 60, while the discounted free cash flow valuation method works out to a price of 10. Question: Explain to your management why the two valuation methodologies provide different estimations. Specifically, discuss the assumptions implicit in the two methodologies, as well as the assumptions you made when doing your analysis. Why do these projections differ from Company X's current stock price?arrow_forward1. A credit portfolio manager is expecting corporate credit spreads to widen over the next several months. What are two ways that she can take advantage of the excess return (+coupon payments) relative to risk-free assets (i.e. treasuries) but limit the impact of the expected moves?arrow_forward31. CAPM and Valuation. You are a consultant to a firm evaluating an expansion of its current business. The cash-flow forecasts (in millions of dollars) for the project are as follows: Years Cash Flow -100 1-10 +15 On the basis of the behavior of the firm's stock, you believe that the beta of the firm is 1.4. Assuming that the rate of return available on risk-free investments is 4% and that the expected rate of return on the market portfolio is 12%, what is the net present value of the project? (LO12-3)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education