Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

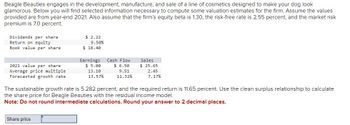

Transcribed Image Text:Beagle Beauties engages in the development, manufacture, and sale of a line of cosmetics designed to make your dog look

glamorous. Below you will find selected information necessary to compute some valuation estimates for the firm. Assume the values

provided are from year-end 2021. Also assume that the firm's equity beta is 1.30, the risk-free rate is 2.55 percent, and the market risk

premium is 7.0 percent.

Dividends per share.

Return on equity

Book value per share

2021 value per share.

Average price multiple

Forecasted growth rate

$ 2.22

9.50%

$18.40

Share price

Earnings

$ 5.00

13.10

13.57%

Cash Flow

$ 6.50

9.51

11.32%

Sales

$25.65

2.45

7.17%

The sustainable growth rate is 5.282 percent, and the required return is 11.65 percent. Use the clean surplus relationship to calculate

the share price for Beagle Beauties with the residual income model.

Note: Do not round intermediate calculations. Round your answer to 2 decimal places.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 1 images

Knowledge Booster

Similar questions

- Beagle Beauties engages in the development, manufacture, and sale of a line of cosmetics designed to make your dog look glamorous. Below you will find selected information necessary to compute some valuation estimates for the firm. Assume the values provided are from year-end 2021. Also assume that the firm's equity beta is 1.40, the risk-free rate is 2.35 percent, and the market risk premium is 6.0 percent. Dividends per share Return on equity Book value per share 2021 value per share Average price multiple Forecasted growth rate $2.34 8.50% $ 19.30 Share price Earnings Cash Flow $5.00 13.10 13.63% $6.30 9.57 11.26% Sales $ 25.65 2.51 7.24% The sustainable growth rate is 4.522 percent, and the required return is 10.75 percent. Use the clean surplus relationship to calculate the share price for Beagle Beauties with the residual income model. Note: Do not round intermediate calculations. Round your answer to 2 decimal places.arrow_forwardProcter and Gamble (PG) paid an annual dividend of $2.79 in 2018. You expect PG to increase its dividends by 7.9% per year for the next five years (through 2023), and thereafter by 2.7% per year. If the appropriate equity cost of capital for Procter and Gamble is 8.9% per year, use the dividend-discount model to estimate its value per share at the end of 2018.arrow_forwardBeagle Beauties engages in the development, manufacture, and sale of a line of cosmetics designed to make your dog look glamorous. Below you will find selected information necessary to compute some valuation estimates for the firm. Assume the values provided are from year - end 2021. Also assume that the firm's equity beta is 1.40, the risk - free rate is 2.60 percent, and the market risk premium is 8.0 percent. Dividends per share $ 2.44 Return on equity 10.50% Book value per share $ 20.05 Earnings Cash Flow Sales 2021 value per share $ 5.00 $ 6.40 $ 25.65 Average price multiple 13.10 9.62 2.56 Forecasted growth rate 13.68% 11.21% 7.39% Using the PE, P/CF, and P/S ratios, estimate the 2022 share price for Beagle Beauties. Note: Do not round intermediate calculations. Round your answers to 2 decimal places. DO NOT USE EXCEL please leave a key for the formula thank youarrow_forward

- A firm has a net return on equity of 10% over the fiscal year 2019-2020. Over the same year its three closest rivals have returns of 16%, 14% and 9% respectively. Its opportunity cost of capital is equal to: 13 10 16 14arrow_forwardplease read the instructions and use the data to help.arrow_forwardLifecycle Motorcycle Company is expected to pay a dividend in year 1 of $2.00, a dividend in year 2 of $3.00, and a dividend in year 3 of $4.00. After year 3, dividends are expected to grow at the rate of 4% per year. An appropriate required return for the stock is 13%. Using the multistage DDM, the stock should be worth_______arrow_forward

- Formulate a system of equations for the situation below and solve. A private investment club has $600,000 earmarked for investment in stocks. To arrive at an acceptable overall level of risk, the stocks that management is considering have been classified into three categories: high-risk, medium-risk, and low-risk. Management estimates that high-risk stocks will have a rate of return of 15% / year; medium-risk stocks, 10%/year; and low-risk stocks, 7%/year. The members have decided that the investment in low-risk stocks should be equal to the sum of the investments in the stocks of the other two categories. Determine how much the club should invest in each type of stock if the investment goal is to have a return of $60,000/year on the total investment. (Assume that all the money available for investment is invested.) high-risk stocks $ 24000 X medium-risk stocks low-risk stocks LA LAarrow_forwardBeagle Beauties engages in the development, manufacture, and sale of a line of cosmetics designed to make your dog look glamorous. Below you will find selected information necessary to compute some valuation estimates for the firm. Assume the values provided are from year-end 2021. Also assume that the firm's equity beta is 1.20, the risk-free rate is 2.65 percent, and the market risk premium is 7.0 percent. Dividends per share Return on equity Book value per share 2021 value per share Average price multiple Forecasted growth rate $ 2.26 9.50% $ 18.70 Earnings $ 5.00 Cash Flow Sales $ 6.30 $ 25.65 13.10 9.53 2.47 13.59% 11.30% 7.23% Using the PE, P/CF, and P/S ratios, estimate the 2022 share price for Beagle Beauties. Note: Do not round intermediate calculations. Round your answers to 2 decimal places. Using PE ratio Using P/CF ratio Using P/S ratio Share Pricearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education