Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

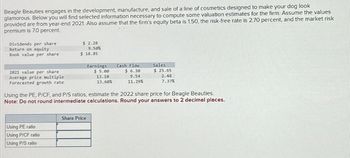

Transcribed Image Text:Beagle Beauties engages in the development, manufacture, and sale of a line of cosmetics designed to make your dog look

glamorous. Below you will find selected information necessary to compute some valuation estimates for the firm. Assume the values

provided are from year-end 2021. Also assume that the firm's equity beta is 1.50, the risk-free rate is 2.70 percent, and the market risk

premium is 7.0 percent.

Dividends per share

Return on equity

Book value per share

2021 value per share

Average price multiple

Forecasted growth rate

$ 2.28

9.50%

$18.85

Using PE ratio

Using P/CF ratio

Using P/S ratio

Earnings

$5.00

13.10

13.60%

Share Price

Cash Flow

$6.30

9.54

11.29%

Using the PE, P/CF, and P/S ratios, estimate the 2022 share price for Beagle Beauties.

Note: Do not round intermediate calculations. Round your answers to 2 decimal places.

Sales

$25.65

2.48

7.37%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- Given the following information for the stock of Foster Company, calculate the risk premium on its common stock. Current price per share of common stock $47.02 Expected dividend per share next year $2.46 Constant annual dividend growth rate 5.9% Risk-free rate of return 3.9% The risk premium on Foster stock is ___%arrow_forwardPlease solve b and c.arrow_forwardNikularrow_forward

- Beagle Beauties engages in the development, manufacture, and sale of a line of cosmetics designed to make your dog look glamorous. Below you will find selected information necessary to compute some valuation estimates for the firm. Assume the values provided are from year-end 2021. Also assume that the firm's equity beta is 1.30, the risk-free rate is 2.55 percent, and the market risk premium is 7.0 percent. Dividends per share. Return on equity Book value per share 2021 value per share. Average price multiple Forecasted growth rate $ 2.22 9.50% $18.40 Share price Earnings $ 5.00 13.10 13.57% Cash Flow $ 6.50 9.51 11.32% Sales $25.65 2.45 7.17% The sustainable growth rate is 5.282 percent, and the required return is 11.65 percent. Use the clean surplus relationship to calculate the share price for Beagle Beauties with the residual income model. Note: Do not round intermediate calculations. Round your answer to 2 decimal places.arrow_forwardUse the dividend discount model to value a share of Toyota’s stock (ticker symbol: TM) as of December 31, 2021. In your application of this model, use the data provided on the most recent Toyota Value Line report to estimate the necessary dividend payment and the firm’s equity beta. Assume, that the expected growth rate of dividends in perpetuity (g) ranges from 2.5% to 3.5%/year.arrow_forwardAn analyst produces the following series of annual dividend forecasts for company D: Expected dividend (end of) year t+1 = 10 euros; Expected dividend (end of) year t+2 = 20 euros; Expected dividend (end of) year t+3 = 10 euros. The analyst further expects that company D dividend will grow indefinitely at a rate of 2 percent after year t+3. Company D cost of equity equals 10 percent. Under these assumptions, calculate the analysts estimate of company D equity value at the end of year t.arrow_forward

- Given the following information for the stock of Foster Company, calculate the risk premium on its common stock. Current price per share of common stock $37.01 Expected dividend per share next year $1.39 Constant annual dividend growth rate 8.4% Risk-free rate of return 5.2%arrow_forwardYou are considering purchasing a share of preferred stock with the following characteristics: par value = $100 dividend rate = 12% per year payment schedule = quarterly maturity date = required rate of return = 6% per year current market price = $135 per share Based on this information, answer the following: A. What is the dollar amount of the quarterly dividend on this stock? B. Using the Discounted Cash Flow Method, what is the dollar value of this stock? C. Using the Discounted Cash Flow Method, what is the annual expected return for this stock? D. Based on your answer to part B, should you invest in the stock? Why or why not? E.…arrow_forwardFor this question, use the American Eagle Outfitters 2016 10Ks and 2017 Q1 10Q from the previous questions. Your Managing Director asks you to include valuations based on Comparable Forward PE multiples given that peer capital structures have been relatively similar. She asks you to assume a 14x PE multiple on forward diluted EPS, and a 10% growth rate over LTM diluted EPS to calculate forward EPS, which is being assumed by industry analysts. Using the aforementioned assumptions for Comparable Transactions’ PE multiples, what is the implied AEO share price based on the latest data provided to you from its Corporate filings as of June 2017? 15.12 16.63 16.79 17.86arrow_forward

- a company has a stock of 1.40, risk free 4.25%, market risk of 5.50%. what is the future return growth rate?arrow_forwardBeagle Beauties engages in the development, manufacture, and sale of a line of cosmetics designed to make your dog look glamorous. Below you will find selected information necessary to compute some valuation estimates for the firm. Assume the values provided are from year-end 2021. Also assume that the firm's equity beta is 1.40, the risk-free rate is 2.35 percent, and the market risk premium is 6.0 percent. Dividends per share Return on equity Book value per share 2021 value per share Average price multiple Forecasted growth rate $2.34 8.50% $ 19.30 Share price Earnings Cash Flow $5.00 13.10 13.63% $6.30 9.57 11.26% Sales $ 25.65 2.51 7.24% The sustainable growth rate is 4.522 percent, and the required return is 10.75 percent. Use the clean surplus relationship to calculate the share price for Beagle Beauties with the residual income model. Note: Do not round intermediate calculations. Round your answer to 2 decimal places.arrow_forwardThe analysis of risk and the search for yield in companies is determinant for financial success. In this case, consider the stock price and dividends of the companies Power Electric Industries, Riviera Power Inc. and Nature Energy Corp. for the period from 2014 to 2019. Power Electric Industries Power Electric Industries Riviera Power Inc. Riviera Power Inc. Nature Energy Corp. Nature Energy Corp. year Year Stock price Dividends Year Stock price Dividends Year Stock price Dividends 2019 $18.5 $1.50 $38.5 $4.50 $58.5 $3.50 2018 $15.93 $1.10 $40.93 $3.10 $50.93 $2.10 2017 $10.20 $1.00 $43.20 $3.00 $53.20 $3.00 2016 $9.80 $0.90 $50.80 $2.90 $50.80 $2.90 2015 $8.50 $0.85 $48.50 $2.85 $48.50 $2.75 2014 $8.00 $0.80 $45.00 $2.80 $45.00 $2.60 1. Consider the companies' data to calculate annual rates of return. Determine the average return for each figure over the 5-year period. (You…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education