FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

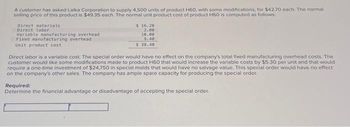

Transcribed Image Text:A customer has asked Lalka Corporation to supply 4,500 units of product H60, with some modifications, for $42.70 each. The normal

selling price of this product is $49.35 each. The normal unit product cost of product H60 is computed as follows:

Direct materials

Direct labor

Variable manufacturing overhead

Fixed manufacturing overhead

Unit product cost

$ 16.20

2.80

10.00

9,40

$ 38.40

Direct labor is a variable cost. The special order would have no effect on the company's total fixed manufacturing overhead costs. The

customer would like some modifications made to product H60 that would increase the variable costs by $5.30 per unit and that would

require a one-time investment of $24,750 in special molds that would have no salvage value. This special order would have no effect

on the company's other sales. The company has ample spare capacity for producing the special order.

Required:

Determine the financial advantage or disadvantage of accepting the special order.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Oat Treats manufactures various types of cereal bars featuring oats. Simmons Cereal Company has approached Oat Treats with a proposal to sell the company its top selling oat cereal bar at a price of $27,500 for 20,000 bars. The costs shown are associated with production of 20,000 oat bars currently: Direct material Direct labor Manufacturing overhead Total The manufacturing overhead consists of $3,000 of variable costs with the balance being allocated to fixed costs. PLEASE NOTE: Costs per unit are rounded to two decimal places and shown with "$" and commas as needed (i.e. $1,234.56). All other dollar amounts are rounded to whole dollars and shown with "$" and commas as needed (i.e. $12,345). 1. What is Oat Treats' relevant cost? $14,000 6,000 8,000 $28,000 2. What does Simmons Cereal's offer cost? 3. If Oat Treats accepts the offer, what will the effect on profit be? o Incremental dollar amount = o Increase or Decrease? no quotes. Please note: Your answer is either "Increase" or…arrow_forwardGallerani Corporation has received a request for a special order of 5,600 units of product A90 for $27.50 each. Product A90's unit product cost is $27.25, determined as follows: $ 2.85 8.15 Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead 7.25 9.00 Unit product cost $27.25 Assume that direct labor is a variable cost. The special order would have no effect on the company's total fixed manufacturing overhead costs. The customer would like modifications made to product A90 that would increase the variable costs by $3.90 per unit and that would require an investment of $28,000 in special molds that would have no salvage value. This special order would have no effect on the company's other sales. The company has ample spare capacity for producing the special order. The annual financial advantage (disadvantage) for the company as a result of accepting this special order should be: Multiple Cholce ($48,440) $1.960 $1.400 ($85.960)arrow_forwardRooney Electronics currently produces the shipping containers it uses to deliver the electronics products it sells. The monthly cost of producing 9,100 containers follows. Unit-level materials Unit-level labor Unit-level overhead Product-level costs* $ 5,200 6,500 3,600 9,300 26,600 Allocated facility-level costs *One-third of these costs can be avoided by purchasing the containers. Russo Container Company has offered to sell comparable containers to Rooney for $2.70 each. Required a. Calculate the total relevant cost. Should Rooney continue to make the containers? b. Rooney could lease the space it currently uses in the manufacturing process. If leasing would produce $11,500 per month, calculate the total avoidable costs. Should Rooney continue to make the containers? a. Total relevant cost Should Rooney continue to make the containers? b. Total avoidable cost Should Rooney continue to make the containers?arrow_forward

- Werner Company produces and sells disposable foil baking pans to retailers for $2.65 per pan. The variable cost per pan is as follows: Direct materials Direct labor Variable factory overhead Variable selling expense Fixed manufacturing cost totals $143,704 per year. Administrative cost (all fixed) totals $19,596. Required: $0.27 0.51 0.69 0.18 Compute the number of pans that must be sold for Werner to break even. pans Conceptual Connection: What is the unit variable cost? What is the unit variable manufacturing cost? Round your answers to the nearest cent. Unit variable cost Unit variable manufacturing cost Which is used in cost-volume-profit analysis? Unit variable cost ✓ How many pans must be sold for Werner to earn operating income of $7,000? pans How much sales revenue must Werner have to earn operating income of $7,000?arrow_forwardGadubhaiarrow_forwardSheridan, Inc. currently manufactures a wicket as its main product. Costs per unit are as follows: Direct materials and direct labor $11 Variable overhead Fixed overhead Total 7 9 $27 Saran Company has contacted Sheridan with an offer to sell it 5400 wickets for $21 each. Of Sheridan's $9 per unit fixed cost, $5 per unit is unavoidable. Should Sheridan make or buy the wickets and why? O Make because the cost savings is $16200 O Make because the cost savings is $5400 O Buy because the cost savings is $10800 O Buy because the cost savings is $5400arrow_forward

- Thornton Electronics currently produces the shipping containers It uses to deliver the electronics products It sells. The monthly cost of producing 9,100 containers follows. Unit-level materials Unit-level labor Unit-level overhead Product-level costs* Allocated facility-level costs $ 5,100 6,400 3,300 9,900 28,000 *One-third of these costs can be avoided by purchasing the containers. Russo Container Company has offered to sell comparable containers to Thornton for $2.60 each. Required a. Calculate the total relevant cost. Should Thornton continue to make the containers? b. Thornton could lease the space it currently uses in the manufacturing process. If leasing would produce $12,100 per month, calculate the total avoidable costs. Should Thornton continue to make the containers? a. Total relevant cost a. Should Thornton continue to make the containers? b. Total avoidable cost b. Should Thornton continue to make the containers?arrow_forwardVishnuarrow_forwardplease step by step solution.arrow_forward

- Dewey Manufacturing has been approached by a new customer with an offer to purchase 500 units of its hands-free automotive model SMAK at a price of $15,000 per unit. Existing sales would not be affected, and Dewey has sufficient capacity to produce the special order. Fixed overhead will not change if Dewey accepts the order or not. Unit cost data is: Per Unit: Direct Materials $6,000 Direct Labor $2,500 Variable OVHD $3,500 Fixed OVHD $10,000 $22,000 Normal sales price is $27,000. Assume Dewey decides to accept the order. How much will their operating income change? Should they have accepted the orderarrow_forwardRedhead Equipment Inc. manufactures three products. Information about the selling prices and unit costs for the three products is below: Product A Selling price $90.00 $60.00 $110.00 Variable costs $52.00 $24.00 $63.00 Fixed costs $22.00 $8.00 $25.00 Compression machine time 11 min. 6 min. 13 min. Fixed costs are applied based on direct labour hours. Demand for the three products exceeds the company's current production capacity. The compression machine is the constraint, with just 2,500 minutes of compression machine time available this week. Required: a. Given the compression machine constraint, which product should be emphasized? Be sure to show your calculations to support your recommendation Activa Go to Parrow_forwardWehrs Corporation has received a request for a special order of 9,800 units of product K19 for $47.50 each. The normal selling price of this product is $52.60 each, but the units would need to be modified slightly for the customer. The normal unit product cost of product K19 is computed as follows: Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Unit product.cost $ 18.30 7.60 4.80 7.70 $ 38.40 Direct labor is a varlable cost. The special order would have no effect on the company's total fixed manufacturing overhead costs. The customer would like some modifications made to product K19 that would increase the variable costs by $7.20 per unit and that would require a one-time investment of $47,000 in special molds that would have no salvage value. This special order would have no effect on the company's other sales. The company has ample spare capacity for producing the special order. Required: Determine the effect on the company's total net…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education