FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

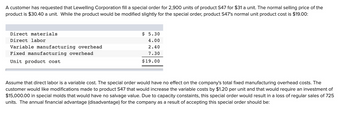

Transcribed Image Text:A customer has requested that Lewelling Corporation fill a special order for 2,900 units of product S47 for $31 a unit. The normal selling price of the

product is $30.40 a unit. While the product would be modified slightly for the special order, product S47's normal unit product cost is $19.00:

Direct materials

Direct labor

Variable manufacturing overhead

Fixed manufacturing overhead

Unit product cost

$ 5.30

4.00

2.40

7.30

$19.00

Assume that direct labor is a variable cost. The special order would have no effect on the company's total fixed manufacturing overhead costs. The

customer would like modifications made to product S47 that would increase the variable costs by $1.20 per unit and that would require an investment of

$15,000.00 in special molds that would have no salvage value. Due to capacity constaints, this special order would result in a loss of regular sales of 725

units. The annual financial advantage (disadvantage) for the company as a result of accepting this special order should be:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Novak Productions Limited manufactures and sells three different products of different qualities. They are referred to as: Normal, High, and Superior. The accounting department provides the following information on these products: Normal High Superior Selling price per unit $ 35.00 $ 47.00 $ 54.00 Variable costs per unit $ 30.17 $ 40.00 $ 50.00 Contribution margin per unit $ 4.83 $ 7.00 $ 4.00 Machine hours required 0.02 0.04 0.08 (a) Determine the contribution margin per machine hour. Contribution Margin Normal $ per machine hour High $ per machine hour Superior $ per machine hourarrow_forwardAlibaba Manufacturing manufactures widgets for distribution. The standard costs for the manufacture of widgets follow: Standard Costs Actual CostsDirect materials 3 lbs. per widget at 31,000 lbs. at $34 $35 per pound per poundDirect labor 2.5 hours per widget 22,500 hours at at $11 per hour $11.80 per hourFactory overhead Variable cost, $24/widget $241,500 variable cost Fixed cost, $40/widget $381,250 fixed cost Budgeted factory overhead was $640,000. Overhead applied is based on widgets produced. The company estimated that 10,000 widgets would be produced; however, only 9,600 were produced. InstructionsCalculate the following amounts.1. Rate at which total factory overhead is applied2. Materials price…arrow_forwardPlease do not give solution in image format thankuarrow_forward

- Therapeutic Systems sells its products for $23 per unit. It has the following costs Rent Factory labor Executives under contract Raw material $ 195,000 $9.00 per unit $365,500 $ 2.20 per unit Separate the expenses between fixed and variable costs per unit. Using this information and the sales price per unit of $23, compute the break-even point. Note: Do not round intermediate calculations. Break-even point hitsarrow_forwardFollowing costs and revenue are incurred/earned by Toy inc. on each unit of teddy bear: Selling price Materials $49 $12 Labour $15 Variable overhead Fixed overhead $7 $6 Toy Inc. has received an offer from a customer. The customer is ready to buy 1,500 unitsat $37 each. However, the customer is asking for customized colouring on the teddy bear'spocket, which will require additional $1 per teddy bear. Should the offer from customer be accepted by Toy Inc.? Accept due to Incremental profit of $3,300. Reject due to Incremental loss of $3,000. Accept due to Incremental profit of $3,000 Reject due to incremental loss of $3,300arrow_forwardGadubhaiarrow_forward

- Epsilon Company can produce a unit of product for the following costs: Direct material $ 8.10 Direct labor 24.10 Overhead 40.50 Total product costs per unit $ 72.70 An outside supplier offers to provide Epsilon with all the units it needs at $64.55 per unit. If Epsilon buys from the supplier, the company will still incur 30% of its overhead. Epsilon should choose to:arrow_forwardCollins Co. produces a part used in the manufacture of one of its products. The unit product cost is $40, computed as follows: Direct materials, direct labor, and variable overhead $24 Fixed overhead $16 Total $40 An outside supplier has offered to provide the parts for only $30 each. If the parts are purchased from the outside supplier, (1) the company estimates that 25% of the fixed overhead cost above could be eliminated; (2) the company can use the freed capacity to launch a new product, earning a contribution margin of $5 per unit. Based on these data, the per-unit dollar financial advantage or disadvantage of purchasing from the outside supplier would be: Multiple Choice a)$7 financial disadvantage b)$8 financial advantage c)$2 financial disadvantage d)$3 financial advantagearrow_forwardPlz . without plagiarism pleasearrow_forward

- Please only answer the total amount of fixed manufacturing overhead.arrow_forwardThe Salsa Division of the Spicy Foods Company has provided you with the following information at a volume of 40,000 bottles: Cost Per unit Direct material $8.00 Direct labor $4.00 Variable overhead $3.00 Fixed overhead - Traceable $6.00 Fixed overhead - Allocated $5.00 Total $26.00 An outside vendor has approached Salsa and offered to produce 30,000 bottles of salsa at a price of $22.00 per unit. By outsourcing, the company could begin operating a new line of Hot Sauce that is expected to generate sales of $500,000. Outsourcing will also allow Salsa to eliminate 30% of the division's traceable fixed overhead. NOTE: The contribution margin ratio for Hot Sauce = 40%. Determine the impact on income if Salsa accepts the outside supplier's offer.arrow_forwardSheffield Corp. incurs the following costs to produce 10500 units of a subcomponent: Direct materials Direct labor Variable overhead Fixed overhead $(3600). $9200 Ⓒ$8150. $950. $(950). 11750 13000 An outside supplier has offered to sell Sheffield the subcomponent for $2.80 a unit. No fixed costs are avoidable. If Sheffield accepts the offer, it could use the production capacity to produce another product that would generate additional income of $3600. The increase (decrease) in net income from accepting the offer would be 20800arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education