Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN: 9781337115773

Author: Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Financial Accounting Question provide answer

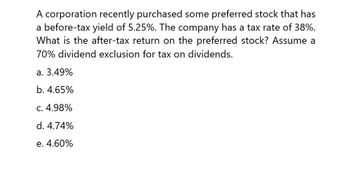

Transcribed Image Text:A corporation recently purchased some preferred stock that has

a before-tax yield of 5.25%. The company has a tax rate of 38%.

What is the after-tax return on the preferred stock? Assume a

70% dividend exclusion for tax on dividends.

a. 3.49%

b. 4.65%

c. 4.98%

d. 4.74%

e. 4.60%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The Castle Company recently reported net profits after taxes of $15.8 million. It has 2.5 million shares of common stock outstanding and pays preferred dividends of $1 million a year. The company’s stock currently trades at $60 per share. Compute the stock’s earnings per share (EPS). What is the stock’s P/E ratio? Determine what the stock’s dividend yield would be if it paid $1.75 per share to common stockholders.arrow_forwardRatio Analysis MJO Inc. has the following stockholders equity section of the balance sheet: On the balance sheet date, MJOs stock was selling for S25 per share. Required: Assuming MJOs dividend yield is 1%, what are the dividends per common share? Assuming MJOs dividend yield is 1% and its dividend payout is 20%, what is MJOs net income?arrow_forwardPlease provide answer the accounting questionarrow_forward

- ___ is the after tax return?arrow_forwardThe expected pretax return on three stocks is divided between dividends and capital gains in the following way: Stock Expected Dividend Expected Capital Gain A $0 $10 B 5 5 C 10 0 Required: a. If each stock is priced at $165, what are the expected net percentage returns on each stock to (i) a pension fund that does not pay taxes, (ii) a corporation paying tax at 21% (the effective tax rate on dividends received by corporations is 6.3%), and (iii) an individual with an effective tax rate of 10% on dividends and 5% on capital gains? b. Suppose that investors pay 40% tax on dividends and 10% tax on capital gains. If stocks are priced to yield an after-tax return of 10%, what would A, B, and C each sell for? Assume the expected dividend is a level perpetuity.arrow_forwardThe expected pretax return on three stocks is divided between dividends and capital gains in the following way: Stock Expected Dividend Expected Capital Gain A $0 $10 B 5 5 C 10 0 Required: a. If each stock is priced at $115, what are the expected net percentage returns on each stock to (i) a pension fund that does not pay taxes, (ii) a corporation paying tax at 21% (the effective tax rate on dividends received by corporations is 6.3%), and (iii) an individual with an effective tax rate of 10% on dividends and 5% on capital gains? Stock Pension investor corporation Individual A 8.70 % 6.86 % __________% B 8.70 % ___________% ___________% C 8.70 % __________% __________% b. Suppose that investors pay 40% tax on dividends and 10% tax on capital gains. If stocks…arrow_forward

- The expected pretax return on three stocks is divided between dividends and capital gains in the following way: Stock Expected Dividend Expected Capital Gain A $0 $10 B 5 5 C 10 0 Required: a. If each stock is priced at $110, what are the expected net percentage returns on each stock to (i) a pension fund that does not pay taxes, (ii) a corporation paying tax at 21% (the effective tax rate on dividends received by corporations is 6.3%), and (iii) an individual with an effective tax rate of 15% on dividends and 10% on capital gains? b. Suppose that investors pay 50% tax on dividends and 20% tax on capital gains. If stocks are priced to yield an after-tax return of 8%, what would A, B, and C each sell for? Assume the expected dividend is a level perpetuity. Req A Req B If each stock is priced at $110, what are the expected net percentage returns on each stock to (i) a pension fund that does not pay taxes, (ii) a corporation paying tax at 21% (the effective…arrow_forwardThe expected pretax return on three stocks is divided between dividends and capital gains in the following way: Stock Expected Dividend Expected Capital Gain A $0 $10 B 5 5 C 10 0 Required: a. If each stock is priced at $140, what are the expected net percentage returns on each stock to (i) a pension fund that does not pay taxes, (ii) a corporation paying tax at 21% (the effective tax rate on dividends received by corporations is 6.3%), and (iii) an individual with an effective tax rate of 15% on dividends and 10% on capital gains? b. Suppose that investors pay 50% tax on dividends and 20% tax on capital gains. If stocks are priced to yield an after-tax return of 8%, what would A, B, and C each sell for? Assume the expected dividend is a level perpetuity. If each stock is priced at $1.40, what are the expected net percentage on each stock to (i) a pension fund that does not pay taxes, (ii) a corporation paying taxes at 21% (the effective tax rate on dividends…arrow_forwardThe expected pretax return on three stocks is divided between dividends and capital gains in the following way: Stock Expected Dividend Expected Capital Gain A $0 $10 B 5 5 C 10 0 A. If each stock is priced at $160, what are the expected net percentage returns on each stock to (i) a pension fund that does not pay taxes, (ii) a corporation paying tax at 21% (the effective tax rate on dividends received by corporations is 6.3%), and (iii) an individual with an effective tax rate of 15% on dividends and 10% on capital gains? Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places.) B. Suppose that investors pay 50% tax on dividends and 20% tax on capital gains. If stocks are priced to yield an after-tax return of 8%, what would A, B, and C each sell for? Assume the expected dividend is a level perpetuity. (Do not round intermediate calculations. Round your answers to 2 decimal places.)arrow_forward

- a) Ex-Dividend Price Company A has declared a dividend of $2.60 per share. Suppose capital gains are not taxed but dividends are taxed at 15 percent. New IRS regulations require that taxes be withheld at the time the dividend is paid. The stock closed at $36.80 per share today and the stock goes ex dividend tomorrow. What will be the ex-dividend price? b) Market value and homemade dividends An investor own 100 shares of Firm X. The company will pay 0.50 per share this year and final liquating dividend of $42 per share next year. The required return of this stock is 14%. Ignoring taxes, what is the current market value of one share of this stock? What will the investor's homemade dividend per share be next year if they do not want any dividend this year? (hint: buy shares with the dividends this year)arrow_forwardThe expected pretax return on three stocks is divided between dividends and capital gains in the following way: Expected Dividend Stock A $ 0 Expected Capital Gain $ 10 B C 3C 5 10 5 0 Required: a. If each stock is priced at $110, what are the expected net percentage returns on each stock to (i) a pension fund that does n pay taxes, (ii) a corporation paying tax at 21% (the effective tax rate on dividends received by corporations is 6.3%), and (iii) a individual with an effective tax rate of 15% on dividends and 10% on capital gains? b. Suppose that investors pay 50% tax on dividends and 20% tax on capital gains. If stocks are priced to yield an after-tax retur 8%, what would A, B, and C each sell for? Assume the expected dividend is a level perpetuity. Complete this question by entering your answers in the tabs below. Required A Required B If each stock is priced at $110, what are the expected net percentage returns on each stock to (i) a pension fund that does not pay taxes, (ii) a…arrow_forwardAn S corporation earns $6.30 per share before taxes. The corporate tax rate is 35%, the personal tax rate on dividends is 20%, and the personal tax rate on non-dividend income is 39%. What is the total amount of taxes paid if the company pays a $3.00 dividend? A. $1.97 B. $2.95 C. $3.44 D. $2.46 OCarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Pfin (with Mindtap, 1 Term Printed Access Card) (...

Finance

ISBN:9780357033609

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...

Finance

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning