Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

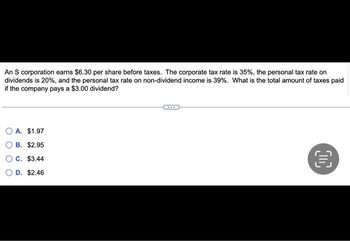

Transcribed Image Text:An S corporation earns $6.30 per share before taxes. The corporate tax rate is 35%, the personal tax rate on

dividends is 20%, and the personal tax rate on non-dividend income is 39%. What is the total amount of taxes paid

if the company pays a $3.00 dividend?

A. $1.97

B. $2.95

C. $3.44

D. $2.46

OC

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Franklin Corporation just paid taxes of $152,000 on taxable income of... Franklin Corporation just paid taxes of $152,000 on taxable income of $512,000. The marginal tax rate is 35% for the company. What is the average tax rate for the Franklin Corporation?arrow_forwardCompany R generates $2,400 net income. Assume that the company pays $2,000 interests on its debts and 40% taxes on earnings before taxes. What is the Times-Interest-Earned (TIE) Ratio of Company R?.arrow_forwardHaricot Corporation and Pinto Corporation both have operating profits of $155 million. Haricot is financed solely by equity, while Pinto has issued $205 million of 5% debt. If the corporate tax rate is 21%:Required:How much tax does each company pay? What is the total payout to investors (debtholders plus shareholders) of each company?arrow_forward

- Thompson Inc. has just paid $2.50 in dividends. Determine the after tax dividend received and the average tax rate given the following tax information: 25% gross up; federal tax rate is 29%; 14% federal tax credit ; 16% provincial tax rate; 6% provincial tax creditarrow_forwardQUESTION 1 "Consider a C corporation. The corporation earns $4 per share before taxes. After the corporation has paid its corresponding taxes, it will distribute 50% of its earnings to its shareholders as a dividend. The corporate tax rate is 30%, the tax rate on dividend income is 20%, and the personal income tax rate is set at 28%. What are the shareholder's earnings from the corporation after all corresponding taxes are paid? Note: Express your answers in strictly numerical terms. For example, if the answer is 5%, enter 0.05 as an answer; or if the answer is $500, write enter 500 as an answer."arrow_forward1. Tommy’s Woodworking had sales of $4 million this past year. Its COGS was $2.75 million and its operating expenses were $800,000. Interest expenses on outstanding debt were $200,000 and the company paid $40,000 in stock dividends. Its tax rate is 35%. What was the company’s taxable income (EBT) and tax liability (tax expense)?arrow_forward

- The tax rates are as shown below: Taxable Income Tax Rate $ 0 - 50,000 15 % 50,001 - 75,000 25 % 75,001 - 100,000 34 % 100,001 - 335, 000 39 % Your firm currently has taxable income of $81,600. How much additional tax will you owe if you increase your taxable income by $22, 800 ?arrow_forward8. What is the after-tax return to a corporation that buys a share of preferred stock at $45, sells it at year-end at $45, and receives a $5 year-end dividend? The firm is in the 20% tax bracket. Revenue = $5 For a company, taxable = $5 * 30% = $1.5 Tax = $1.5* 20% = $0.3 After tax income = $5 - $0.3= $4.7 Return $4.7/$45= 10.44%arrow_forward6arrow_forward

- what is total tax paid by firm and owner, when corporation has$790 in profits and a 34.2% tax rate (individual tax rate is 12.13%arrow_forward↑ You are a shareholder in a C corporation. The corporation earns $2.05 per share before taxes. Once it has paid taxes it will distribute the rest of its earnings to you as a dividend Assume the corporate tax rate is 25% and the personal tax rate on all income is 20% How much is left for you after all taxes are paid? The amount that remains is $ per share. (Round to the nearest cent.)arrow_forwardSubject Financearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education